What Lies Ahead For Tapestry’s Stock Post Q4 Results?

Note: Tapestry’s FY’24 ended July 2024.

Tapestry (NYSE: TPR), a luxury goods retailer of handbags, shoes, and accessories, is scheduled to report its fiscal fourth-quarter results on Thursday, August 15. We expect the apparel retailer’s stock to trade higher post the fiscal Q4 release with revenues and earnings beating expectations. Tapestry plans to acquire Capri Holdings, formerly known as Michael Kors, by financing the $8.5 billion deal in debt, with its own net debt reported at around $900 million, for a $9.4 billion pro forma net debt load. The deal is expected to close before the end of the 2024 calendar year. That said, the Tapestry- Capri deal will create a huge portfolio of luxury brands as Tapestry’s Coach, Kate Spade, and Stuart Weitzman brands will be combined with Capri’s Versace, Jimmy Choo, and Michael Kors brands.

In Q3, the Coach business saw flat year-over-year (y-o-y) sales at $1.15 billion. But sales at Kate Spade were down 6% y-o-y to $281 million and Stuart Weitzman sales fell 18% to $56 million. The Coach brand accounts for roughly 75% of the company’s revenues. Geographically, sales in the U.S. fell 3% y-o-y and international sales grew 3% y-o-y at constant currency (driven largely by 19% growth in Europe and 15% growth in Asia excluding China). The company’s international revenue growth was dampened by a weakness of 2% in Greater China. Coach has a significant physical presence in China – where the luxury market is recovering from the pandemic with greater strength and resilience. It is expected to reach around $112 billion by 2025, or approximately 25% of the total global spending.

Our forecast indicates that Tapestry’s valuation is around $46 a share, which is 23% higher than the current market price. Look at our interactive dashboard analysis on Tapestry’s Earnings Preview: What To Expect in Fiscal Q4? for more details.

- What’s Next For Tapestry’s Stock After A Solid Q2?

- Up 6% Year To Date, What Lies Ahead For Tapestry Stock Post Q3 Results?

- Up 8% This Year, How Will Tapestry Stock Trend Post Q2 Results?

- Down 28% This Year, Where Is Tapestry’s Stock Headed Post Fiscal Q1?

- Tapestry Stock Could Rise 80% If It Recovers To Pre-Inflation Shock Highs

- Tapestry’s Stock Down 27% This Year, What’s Next?

(1) Revenues expected to be above consensus estimates

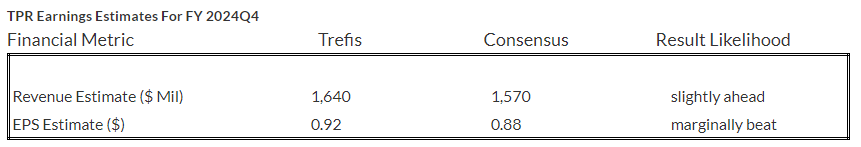

Trefis estimates TPR’s Q4 2024 revenues to be around $1.6 Bil, slightly above the consensus estimate. In Q3 2024, TPR reported sales of $1.5 billion – down 2% y-o-y. Excluding a currency headwind of approximately 160 basis points, revenue was approximately even with the prior year. Looking ahead, Tapestry expects full-year revenue of $6.6 billion and sees EPS of $4.20 to $4.25 (up almost 8-9% y-o-y).

2) EPS likely to beat the consensus estimates

TPR’s Q4 2024 earnings per share (EPS) is expected to be 92 cents per Trefis analysis, marginally above the consensus estimate. The company’s operating margin improved by 110 basis points y-o-y to 16.1% in Q3. The third quarter adjusted EPS of $0.81 beat market expectations and was positively impacted by a favorable expense timing shift worth roughly $0.06. The company’s diluted EPS fell 24% y-o-y to 60 cents.

(3) Stock price estimate higher than the current market price

Going by our Tapestry’s Valuation, with an EPS estimate of around $4.24 and a P/E multiple of close to 10.9x in fiscal 2024, this translates into a price of $46, which is 23% higher than the current market price.

It is helpful to see how its peers stack up. TPR Peers shows how Tapestry’s stock compares against peers on metrics that matter. You will find other useful comparisons for companies across industries at Peer Comparisons.

| Returns | Aug 2024 MTD [1] |

2024 YTD [1] |

2017-24 Total [2] |

| TPR Return | -5% | 5% | 36% |

| S&P 500 Return | -3% | 12% | 139% |

| Trefis Reinforced Value Portfolio | 1% | 8% | 705% |

[1] Returns as of 8/14/2024

[2] Cumulative total returns since the end of 2016

Invest with Trefis Market-Beating Portfolios