Up 11% This Year, Where is Ralph Lauren Stock Headed Post Q1 Results?

Note: Ralph Lauren’s FY’24 ended March 30, 2024

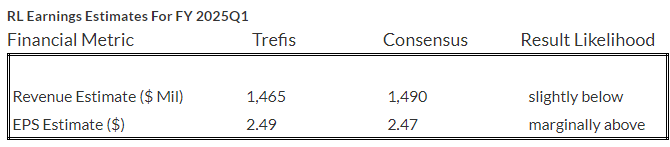

Ralph Lauren (NYSE: RL), a company engaged in the design, marketing, and distribution of premium lifestyle products, including apparel, accessories, fragrances, and home furnishings, is scheduled to report its fiscal first-quarter results on Wednesday, August 7. We expect Ralph Lauren stock to likely trade sideways due to mixed results with revenues coming below but earnings beating expectations marginally. For the fiscal 2025, Ralph Lauren expects revenue to increase at a low single-digit pace on a constant currency basis, centering on about 2% to 3%. Based on current exchange rates, foreign currency is expected to negatively impact revenue growth by approximately 90 basis points in FY’25. The company also set long-term sales and margin growth and presented a strategic growth plan titled “Next Great Chapter: Accelerate.” The company’s three-year financial outlook projects mid-to-high single-digit revenue compounded annual growth.

In fact, consistently beating the S&P 500 – in good times and bad – has been difficult over recent years for individual stocks; for heavyweights in the Consumer Discretionary sector including AMZN, TSLA, and HD, and even for the megacap stars GOOG, MSFT, and AAPL. In contrast, the Trefis High Quality (HQ) Portfolio, with a collection of 30 stocks, has outperformed the S&P 500 each year over the same period. Why is that? As a group, HQ Portfolio stocks provided better returns with less risk versus the benchmark index; less of a roller-coaster ride as evident in HQ Portfolio performance metrics. Given the current uncertain macroeconomic environment with high oil prices and elevated interest rates, could RL face a similar situation as it did in 2021 and underperform the S&P over the next 12 months – or will it see a strong jump?

Our forecast indicates that RL’s valuation is $167 per share, which is almost in line with the current market price. Look at our interactive dashboard analysis on RL Earnings Preview: What To Expect in Q1 for more details.

- Gaining 16% This Year, Will Ralph Lauren Stock Rally Further After Q4 Results?

- What To Expect From Ralph Lauren’s Fiscal Q2 After Stock Up 9% This Year?

- What’s Next For Ralph Lauren Stock?

- Will Ralph Lauren Stock Trade Lower Post Fiscal Q3?

- Ralph Lauren Q2 Preview: What Are We Watching?

- Ralph Lauren Stock To Trade Lower After FY Q4 Results?

(1) Revenues to likely come in below the consensus estimates

Trefis estimates RL’s Q1 2025 revenues to be around $1.5 Bil, slightly below the consensus estimate. For its fiscal 2024 fourth quarter, the luxury retailer saw revenue grow 2% year-over-year (y-o-y) to $1.6 billion, driven by a 7% growth in Asia sales alongside a 2% rise in both European and North American sales. The company benefited from continued strength in DTC and better-than-expected sequential improvement in wholesale business. It should be noted that RL’s inventory was down 16% from the prior year period to $902 million in Q4. On the balance sheet, RL ended Q4 with roughly $1.8 billion in cash and short-term investments and around $1.1 billion in long-term debt. We now forecast Ralph Lauren’s Revenues to be $6.8 billion for the full year 2025, up 3% y-o-y.

2) EPS expected to be marginally above consensus estimates

RL’s Q1 2025 earnings per share (EPS) is expected to be $2.49 per Trefis analysis, slightly above the consensus estimate. In Q4, the retailer reported earnings of $1.71 per share compared to $0.90 per share a year ago. Its adjusted gross margin improved 480 basis points from a year ago to land at 66.6% of sales in Q4 2024. The company’s margins were driven higher by strong average unit retail growth across all regions, lower freight, and favorable channel and geographic mix shifts, more than offsetting continued pressure from raw material costs.

(3) Stock price estimate aligns with the current market price

Going by our Ralph Lauren’s Valuation, with an EPS estimate of around $11.14 and a P/E multiple of 15.0x in fiscal 2024, this translates into a price of $167, which is almost in line with the current market price.

It is helpful to see how its peers stack up. RL Peers shows how Ralph Lauren compares against peers on metrics that matter. You will find other useful comparisons for companies across industries at Peer Comparisons.

| Returns | Aug 2024 MTD [1] |

2024 YTD [1] |

2017-24 Total [2] |

| RL Return | -9% | 11% | 77% |

| S&P 500 Return | -3% | 12% | 139% |

| Trefis Reinforced Value Portfolio | -6% | 1% | 650% |

[1] Returns as of 8/6/2024

[2] Cumulative total returns since the end of 2016

Invest with Trefis Market-Beating Portfolios