Can Guess Stock Reverse Its Poor Run This Year With Its Fiscal Q2 Results?

Guess (NYSE:GES), a retailer that designs, markets, distributes, and licenses apparel and accessories for men, women, and children, is scheduled to report its fiscal Q2 2025 results on Wednesday, August 28. (Guess’ FY’24 ended on Feb 3, 2024.) We expect GES stock to likely trade higher post its fiscal Q2 results with revenues and earnings beating market expectations. Notably, GES stock is down 7% this year to ~$22. In contrast, its peer Gap’s stock (NYSE: GPS) has risen 20% over the same period to $25.

For the full fiscal year 2025, Guess expects revenue to grow between 10.7-12.7%. Its GAAP and adjusted operating margins are anticipated to be in the range of 7.3-8.1% and 7.7-8.5%, respectively. In addition, the retailer expects GAAP EPS between $2.59-2.89 and adjusted EPS between $2.62-3.00 for the full fiscal year.

GES stock has seen a decline of 20% from levels of $25 in early January 2021 to around $22 now, vs. an increase of about 50% for the S&P 500 over this roughly 3-year period. However, the decrease in GES stock has been far from consistent. Returns for the stock were 5% in 2021, -13% in 2022, and 11% in 2023. In comparison, returns for the S&P 500 have been 27% in 2021, -19% in 2022, and 24% in 2023 – indicating that GES underperformed the S&P in 2021 and 2023.

In fact, consistently beating the S&P 500 – in good times and bad – has been difficult over recent years for individual stocks; for heavyweights in the Consumer Discretionary sector including AMZN, TSLA, and HD, and even for the megacap stars GOOG, MSFT, and AAPL. In contrast, the Trefis High Quality (HQ) Portfolio, with a collection of 30 stocks, has outperformed the S&P 500 each year over the same period. Why is that? As a group, HQ Portfolio stocks provided better returns with less risk versus the benchmark index; less of a roller-coaster ride as evident in HQ Portfolio performance metrics. Given the current uncertain macroeconomic environment with high oil prices and elevated interest rates, could GES face a similar situation as it did in 2021 and 2023 and underperform the S&P over the next 12 months – or will it see a recovery?

Our forecast indicates that the company’s valuation is around $25 a share, which is almost 16% higher than the current market price. Look at our interactive dashboard analysis on Guess’ Earnings Preview: What To Expect in Fiscal Q2? for more details.

- Stronger Bet Than Guess Stock: ANF Delivers More

- Why ANF Could Outperform Guess Stock

- ANF Tops Guess Stock on Price & Potential

- Why ANF May Be the Better Choice Over Guess? Stock: Cheaper and Growing Faster

- Guess Stock Skyrockets 26% As Privatization Deal Unfolds, But Is the Risk Too High?

- Market Movers | Winners: GES, SRRK, NESR | Losers: CLDX, LZB, OPEN

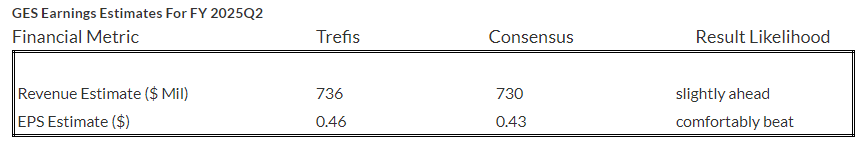

(1) Revenues expected to be slightly ahead of consensus estimates

Trefis estimates GES’ FQ2 revenues to be around $736 million, slightly ahead of market expectations. In Q1, the company’s revenue grew 4% y-o-y to around $592 million – with the Americas Wholesale, Europe, and Licensing segments performing better than expected, partially offset by lower-than-anticipated revenues in the Americas Retail segment.

Guess posted negative operating margins (-3.4% and -1.3%; adjusted for one-time expenses). The deterioration was mainly driven at the corporate expense level, with an increase of 44% y-o-y, in part driven by one-time Rag&Bone’s acquisition expenses and SG&A expenses. The only positive point in this respect is the 120 basis points y-o-y growth in gross margins to 49.1%, particularly given the challenging retail landscape.

2) EPS likely to beat consensus estimates

GES’ FQ2 earnings per share (EPS) is expected to be 46 cents per Trefis analysis, beating the consensus estimate. The company earned $0.23 per share in Q1, compared to -$0.22 in the year-ago quarter.

(3) Stock price estimate higher than the current market price

Going by our Guess’ Valuation, with an adjusted earnings per share (EPS) estimate of around $2.82 and a P/E multiple of almost 8.7x in fiscal 2025, this translates into a price of $25, which is nearly 16% higher than the current market price.

It is helpful to see how its peers stack up. GES Peers shows how Guess’ stock compares against peers on metrics that matter. You will find other useful comparisons for companies across industries at Peer Comparisons.

| Returns | Aug 2024 MTD [1] |

2024 YTD [1] |

2017-24 Total [2] |

| GES Return | -10% | -7% | 78% |

| S&P 500 Return | 1% | 17% | 149% |

| Trefis Reinforced Value Portfolio | 5% | 13% | 736% |

[1] Returns as of 8/26/2024

[2] Cumulative total returns since the end of 2016

Invest with Trefis Market-Beating Portfolios