Is F5 Stock A Better Pick Over Abercrombie After Its Recent 20% Rise?

Given its better prospects, we believe F5 stock (NASDAQ: FFIV), an application security provider, is a better pick than Abercrombie & Fitch (NYSE: ANF), a specialty retailer selling casual clothing and footwear. ANF stock saw a stellar 24% rise on Wednesday, May 29 after the company reported an upbeat Q1 and raised its full-year outlook. After its recent rise, ANF stock is now up 2x year-to-date. In contrast, FFIV stock is down 5%.

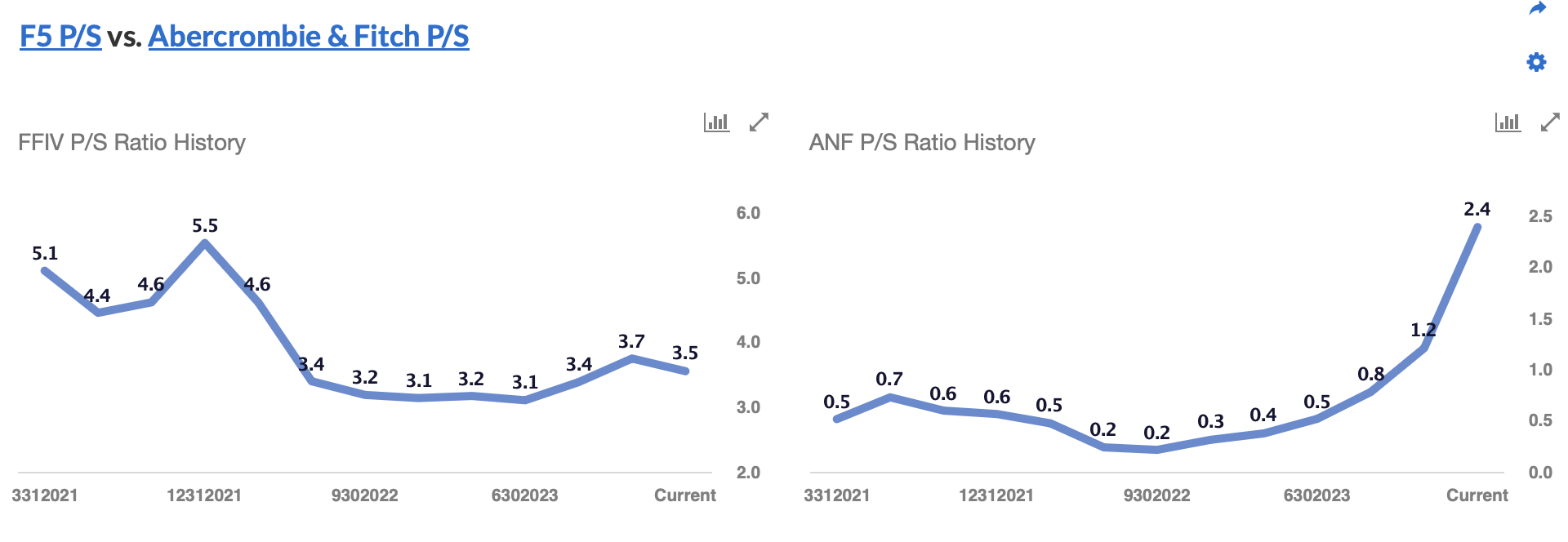

Although these companies are from different sectors, we compare them because of their similar market capitalization of around $10 billion. Investors have assigned a higher valuation multiple of 3.5x revenues for F5, compared to 2.4x revenues for Abercrombie, due to F5’s superior profitability and solid financial position. In the sections below, we discuss why we believe that F5 will offer better returns than Abercrombie in the next three years. In this note, we compare a slew of factors, such as historical revenue growth, stock returns, and valuation.

1. ANF Stock Has Fared Much Better Than FFIV

FFIV stock has seen little change, moving slightly from levels of $175 in early January 2021 to around $170 now, while ANF stock has seen extremely strong gains of 850% from $20 to $190 over the same period. This compares with an increase of about 40% for the S&P 500 over this roughly three-year period.

Overall, the performance of FFIV and ANF stock with respect to the index has been far from consistent. Returns for FFIV stock were 39% in 2021, -41% in 2022, and 25% in 2023, while ANF stock returns were 71%, -34%, and 285% during the same years, respectively. In comparison, returns for the S&P 500 have been 27% in 2021, -19% in 2022, and 24% in 2023 — indicating that FFIV and ANF underperformed the S&P in 2022.

In contrast, the Trefis High Quality (HQ) Portfolio, with a collection of 30 stocks, has outperformed the S&P 500 each year over the same period. Why is that? As a group, HQ Portfolio stocks provided better returns with less risk versus the benchmark index; less of a roller-coaster ride, as evident in HQ Portfolio performance metrics.

Given the current uncertain macroeconomic environment with high oil prices and elevated interest rates, could FFIV and ANF face a similar situation as they did in 2022 and underperform the S&P over the next 12 months — or will they see a strong jump? We think FFIV stock will fare better than ANF, especially now that ANF has already seen a sharp rally.

2. Abercrombie’s Revenue Growth Is Much Better

F5’s revenue has risen at a 6.2% average annual growth rate in the last three years, compared to 11.4% for Abercrombie. F5’s revenues rose from $2.4 billion in fiscal 2020 (fiscal ends in September) to $2.8 billion in 2023, led by services and product revenue growth due to increasing demand and entry into new markets.

For Abercrombie, revenue increased from $3.1 billion in fiscal 2021 (fiscal ends in January) to $4.3 billion in 2024, driven by its Abercrombie brand, which benefited from strong student demographics and solid growth in its women’s business. The Hollister brand has also being doing well lately. Inventory discipline is also one of the factors aiding Abercrombie’s growth. The company recently reported its Q1 results, with revenue of $1.02 billion and adjusted earnings per share of $2.14, compared to the consensus estimates of $963 million and $1.74, respectively. Not only did the company post an upbeat Q1, it raised its full-year outlook to 10% sales growth, higher than its prior guidance of 4% to 6% growth, and above the 7% growth per the consensus estimate.

Our F5 Revenue Comparison and Abercrombie & Fitch Revenue Comparison dashboards provide more insight into the companies’ sales. Looking forward, we expect F5 to see slower sales growth than Abercrombie. F5’s top-line is likely to expand at a CAGR of 3% to $3 billion in three years, while Abercrombie will likely see its sales rise at a mid-single-digit average annual growth rate to over $5 billion over this period.

3. F5 Is More Profitable

F5’s operating margin improved from 17.1% in 2020 to 19.1% in 2023, while Abercrombie’s operating margin expanded from 1.7% in 2021 to 11.3% in 2024. F5’s margin metric has been weighed down lately due to a rise in component costs. Still, it fares better than Abercrombie.

Looking at financial risk, both are comparable. F5’s 3% debt as a percentage of equity is lower than 10% for Abercrombie. However, Abercrombie’s 30% cash as a percentage of assets is slightly higher than 26% for F5, implying that F5 has a better debt position and Abercrombie has more cash cushion.

4. The Net of It All

We see that Abercrombie has seen better revenue growth and has more cash cushion. On the other hand, F5 is more profitable and has a better debt position. Now, looking at prospects using P/S as a base, due to high fluctuations in P/E and P/EBIT, we believe F5 will offer higher returns in the next three years. If we compare the current valuation multiples to the historical averages, F5 fares better. F5 stock is trading at 3.7x revenues, compared to its last five-year average of 4.1x. In contrast, ANF stock trades at 2.4x revenues, vs. the last five-year average of 0.5x. Overall, the positives for Abercrombie appear to be priced in, and it’s trading at a much higher valuation multiple compared to its own historical average, making F5 a comparatively better pick, in our view.

While FFIV stock may outperform ANF, it is helpful to see how F5’s peers fare on metrics that matter. You will find other valuable comparisons for companies across industries at Peer Comparisons.

| Returns | May 2024 MTD [1] |

2024 YTD [1] |

2017-24 Total [2] |

| FFIV Return | 2% | -6% | 16% |

| ANF Return | 56% | 115% | 1479% |

| S&P 500 Return | 5% | 10% | 135% |

| Trefis Reinforced Value Portfolio | 6% | 5% | 649% |

[1] Returns as of 5/30/2024

[2] Cumulative total returns since the end of 2016

Invest with Trefis Market-Beating Portfolios

See all Trefis Price Estimates