What To Expect From Yelp’s First Quarter Earnings

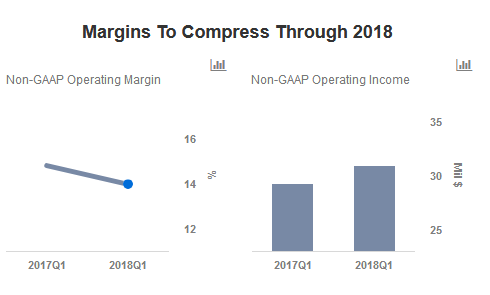

Yelp (NYSE:YELP) is scheduled to announced its first quarter results on May 10. In recent quarters, Yelp has reported steady growth in advertising revenues driven by a corresponding increase in paying advertising accounts. Additionally, claimed business locations – or businesses that are listed for free on Yelp – witnessed growth, which led local ad revenues to grow in the teens through the year. However, despite the revenue increase, the company has struggled to improve margins.

We expect this trend to continue through the March quarter. As Yelp’s advertiser base increases and mobile engagement continues to improve, we expect it to translate to ad revenue growth. We forecast ad revenues to increase 12-13% to around $200 million for the March quarter. Additionally, Yelp also continues to witness traction at its transaction services business, and these revenues are expected to be around 4-5% higher on a y-o-y basis to $18-19 million. We have created an interactive dashboard analysis that summarizes our expectation for Yelp’s first quarter earnings. You can modify the revenues from each business segment and margin expectations to see how the EPS would be affected for the first quarter.

- Down 13% This Year, What’s Happening With Yelp Stock?

- Yelp Stock Up 66% Since 2023. Does It Have More Room To Run Post Q4 Results?

- What To Expect From Yelp’s Q3 After Stock Up 50% This Year?

- Yelp Stock is Up 60% So Far. What’s Next?

- Yelp Stock Down 14% Over Six Months. What’s Next?

- Yelp Stock To Likely Trade Lower Post Q4

See our complete analysis for Yelp

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.