How Is PayPay’s Growth Likely To Impact Yahoo! Japan Post Q3?

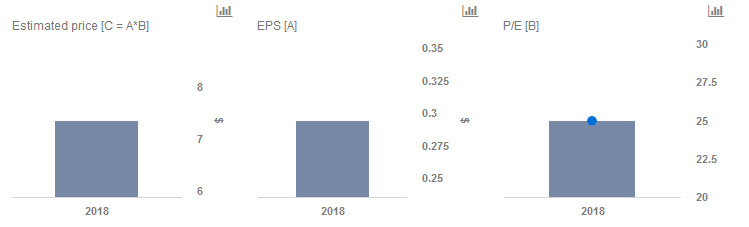

Yahoo! Japan (OTC:YAHOY) reported its Q3 earnings on February 4. The highlight of the company’s results appears to be the traction in PayPay’s subscriber base, which grew to 4 million within 4 months of launching. Additionally, the company’s management tightened its operating income guidance with the floor of the guidance moving up. Furthermore, management outlined a long-term plan towards growing revenue and profits. In view of PayPay’s rapid growth, albeit amid weakening profitability, we are maintaining our price estimate of $7 per share.

Our price estimate of $7 per share for Yahoo! Japan is 30% higher than the current market price. Our interactive dashboard on Yahoo! Japan’s Price Estimate outlines our forecasts and estimates for the company. You can modify any of the key drivers to visualize the impact of changes on its valuation.

- Strong Revenue Growth Potential Presents A Sizable Upside For Yahoo! Japan

- What To Expect From Yahoo! Japan’s Q3 Earnings

- How Can The Launch Of PayPay Impact Yahoo! Japan’s Valuation?

- Yahoo! Japan Earnings Preview: Media & Commerce Likely To Drive Top Line Growth

- Key Takeaways From Yahoo Japan’s Earnings, And Expectations For Fiscal 2018

- Yahoo! Japan Earnings Preview: Sustained Top Line Growth Expected From Major Segments

Highlights from Q3 are below:

- Media Business: Revenues grew to JPY 76 billion (+3.9% y-o-y), driven by advertising revenues (+4.9% y-o-y). The segment operating margin declined to 47.8% (-7.8% y-o-y) due to investments across cost of sales and SG&A.

- Commerce Business: Revenues grew to JPY 166 billion (+8.3% y-o-y), driven by advertising revenues (+25.1% y-o-y). The operating margin declined to 9.4% (- 40 bps y-o-y) due to investments in SG&A.

- Total revenue grew to JPY 243 (+5.1% y-o-y), driven by advertising revenues (+6.6% y-o-y). The operating margin declined to 15% (-7.8% y-o-y) due to investments in SG&A. The company also benefited from ASKUL Group’s revenue growing to JPY 98 billion (+7.4% y-o-y)..

On a longer-term basis, management has laid out a plan for FY 2018 to FY2023 to be a period of structural reform, during which operating income is likely to remain above JPY 140 billion level per year, exiting FY 2023 with operating income of JPY 225 billion. The company expects its revenue profile to evolve along with the business environment and believes that PayPay will be an important driver for to help achieve those goals.

Notwithstanding the backing from Softbank, Paypay’s user base has grown on the back of the marketing initiatives it has undertaken. Paypay is also benefiting from the involvement of India’s Paytm (which also counts Softbank and Hathaway Berkshire as investors).

While early signs from PayPay appear encouraging, we will be looking for proof of further traction.

Do not agree with our forecast? Create your own price forecast for Yahoo! Japan by changing the base inputs (blue dots) on our interactive dashboard.

Like our charts? Explore example interactive dashboards and create your own.