How Can The Launch Of PayPay Impact Yahoo! Japan’s Valuation?

Yahoo! Japan (OTC:YAHOY) continues to benefits from its advertising business. However, the real catalyst for the company could be its foray in the payments space with PayPay. Accordingly, we estimate a substantial upside to the company’s stock price.

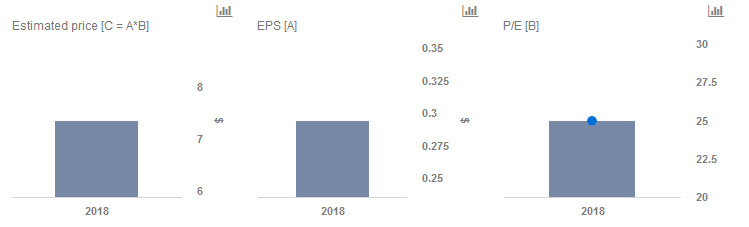

We currently have a price estimate of $7 per share for Yahoo! Japan, which significantly higher than the current market price. Our interactive dashboard on Yahoo! Japan’s Price Estimate outlines our forecasts and estimates for the company. You can modify any of the key drivers to visualize the impact of changes on its valuation.

- Strong Revenue Growth Potential Presents A Sizable Upside For Yahoo! Japan

- How Is PayPay’s Growth Likely To Impact Yahoo! Japan Post Q3?

- What To Expect From Yahoo! Japan’s Q3 Earnings

- Yahoo! Japan Earnings Preview: Media & Commerce Likely To Drive Top Line Growth

- Key Takeaways From Yahoo Japan’s Earnings, And Expectations For Fiscal 2018

- Yahoo! Japan Earnings Preview: Sustained Top Line Growth Expected From Major Segments

The company’s Q2 results saw double-digit growth in advertising revenues, with growth in advertising across the media and commerce segments. While the overall revenue also grew by 8% y-o-y, EBITDA decline by 10% y-o-y. The decline in profitability was attributable to expenses for new challenges across the media and commerce businesses, increase in SG&A expenses associated with business growth and investments in human resources and platform. The company also saw YJ Card Corporation achieve profitability and announced measures to revamp YAHUOKU through streamlining of its logistics.

One of the key announcements seemed to be the launch of PayPay (which will also have service co-ordination with Alipay), a mobile payment app. Yahoo Japan’s size and integration with Alipay gives PayPay an enviable competitive edge – the ability to offer cashless payment services to residents and foreigners alike. The other interesting aspect of PayPay is that it is likely to be the umbrella for all of Yahoo Japan’s mobile payment initiatives. Finally, PayPay has also attracted investment from the Softbank Vision Fund. Not only is Softbank investing in PayPay, but it will also be leveraging its salesforce to expand the reach of PayPay beyond national level merchants to more small businesses. PayPay’s ability to provide a fulfillment option for Yahoo Japan’s commerce business is also likely to help in continuing to enhance the take rate in advertising.

Softbank has been increasingly becoming the financier to the world’s most promising tech companies, and this could provide a boost to PayPay’s prospects. This could allow for a substantial long-term growth opportunity for Yahoo! Japan.

Do not agree with our forecast? Create your own price forecast for Yahoo! Japan by changing the base inputs (blue dots) on our interactive dashboard.

Like our charts? Explore example interactive dashboards and create your own.