Rising 18% This Year, Will Exxon Mobil’s Run Continue Following Q2 Results?

Exxon Mobil (NYSE: XOM), a leading explorer, producer, transporter, and seller of crude oil and natural gas, and North America’s largest energy company by market cap, is scheduled to announce its fiscal second-quarter results on Friday, August 2. We expect Exxon Mobil stock to likely trade sideways due to mixed Q2 results with revenue missing but earnings beating market expectations marginally. XOM stock is up 18% year-to-date to $119. In comparison, XOM’s peer Chevron Corporation (NYSE: CVX) stock grew 7% to $161 during the same period. Exxon Mobil’s Q1 earnings disappointed market expectations, with a decline in net income and revenues compared to the same period last year. The company attributed the earnings disappointment to inventory and non-cash tax adjustments but highlighted ongoing cost savings and a strengthened balance sheet.

XOM stock has seen extremely strong gains of 200% from levels of $40 in early January 2021 to around $119 now, vs. an increase of about 45% for the S&P 500 over this roughly 3-year period. However, the increase in XOM stock has been far from consistent. Returns for the stock were 48% in 2021, 80% in 2022, and -9% in 2023. In comparison, returns for the S&P 500 have been 27% in 2021, -19% in 2022, and 24% in 2023 – indicating that XOM underperformed the S&P in 2023.

In fact, consistently beating the S&P 500 – in good times and bad – has been difficult over recent years for individual stocks; for other heavyweights in the Energy sector including CVX, COP, and BP, and even for the megacap stars GOOG, TSLA, and MSFT. In contrast, the Trefis High Quality (HQ) Portfolio, with a collection of 30 stocks, has outperformed the S&P 500 each year over the same period. Why is that? As a group, HQ Portfolio stocks provided better returns with less risk versus the benchmark index; less of a roller-coaster ride as evident in HQ Portfolio performance metrics. Given the current uncertain macroeconomic environment with high oil prices and elevated interest rates, could XOM face a similar situation as it did in 2023 and underperform the S&P over the next 12 months – or will it see a strong jump?

Our forecast indicates that Exxon Mobil’s valuation is around $112 per share, which is inline with the current market price. Look at our interactive dashboard analysis on Exxon Mobil Earnings Preview: What To Expect in Q2? for more details.

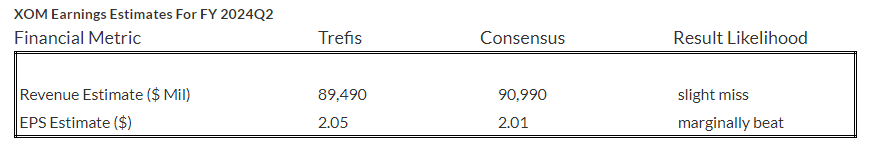

(1) Revenues expected to be slightly below the consensus estimates

Trefis estimates Exxon Mobil’s Q2 2024 revenues to be around $89.5 Bil, slightly below the consensus estimate. In Q1, XOM’s revenue fell 4% year-over-year (y-o-y) to $83.1 billion, as oil refining margins and natural gas prices fell from post-Covid peaks. Exxon offset some of the decline as oil production rose faster than expected from its Guyana venture, where output reached more than 600K barrels of oil equivalent (boe)/day after producing 440K boe/day in Q4 2023, and its refineries produced a record amount of fuel for any Q1, with throughput of 3.84B barrels (bbl)/day, down 4% yo-y. Q1 worldwide oil production rose 2.5% y-o-y to 2.55 billion bbl/day, as a 0.5% drop in the U.S. and a 5% decline in Asia was offset by a 15.2% boost in Canada and other Americas and a 1.8% gain in Africa. However, net natural gas production available for sale fell 8.2% to 7.36 billion cubic feet/day.

It should be noted that there are several high-potential projects from which XOM will benefit for many years to come. XOM plans to invest between $20 billion and $25 billion annually in the coast of Guyana through 2027 and expects Guyana (which went from zero production three years ago to 360,000 barrels per day at present) to produce close to 1 million barrels per day by the end of the decade. Exxon also made a final investment decision to develop their fifth and most expensive project on Guyana’s offshore Stabroek block (targeted for the 2026 start). The $12.7 billion Uaru project will produce around 250K barrels/day and cost 27% more than the previous project of equivalent size, reflecting rising costs. The company is also working hard to diversify into renewable energy with blue hydrogen and carbon capture technologies. The company sees carbon capture and storage becoming a $4 trillion industry by 2050.

(2) EPS likely to marginally beat the consensus estimates

Exxon Mobil’s Q2 2024 earnings per share (EPS) is expected to be $2.05 as per Trefis analysis, marginally above the consensus estimate. In Q1, the company’s net income fell to $8.22 billion, or $2.06/share, from $11.43 billion, or $2.79/share, in the year-ago quarter. Still, this was the company’s second-highest Q1 haul in the past decade.

(3) Stock price estimate inline with the current market price

Going by our XOM’s Valuation, with an EPS estimate of around $8.49 and a P/E multiple of around 13.2x in fiscal 2024, this translates into a price of nearly $112, which is almost 5% lower than the current market price. It should be noted that we use core sales revenue (which comes from the sale of hydrocarbons) figures that exclude the revenue it generates from the distribution, processing, and marketing of hydrocarbon and other sources of income.

It is helpful to see how its peers stack up. Exxon Mobil Peers shows how XOM stock compares against peers on metrics that matter. You will find other useful comparisons for companies across industries at Peer Comparisons.

| Returns | Jul 2024 MTD [1] |

2024 YTD [1] |

2017-24 Total [2] |

| XOM Return | 3% | 18% | 31% |

| S&P 500 Return | 0% | 15% | 144% |

| Trefis Reinforced Value Portfolio | -1% | 5% | 682% |

[1] Returns as of 7/31/2024

[2] Cumulative total returns since the end of 2016

Invest with Trefis Market-Beating Portfolios