Why Wal-Mart Is Looking To Exit From Japan

Wal-Mart (NYSE:WMT) is reportedly looking to sell Japanese supermarket chain Seiyu. The company has approached other major retailers and private equity funds for a possible sale that could amount to 300 to 500 billion yen ($2.7 billion to $4.5 billion). This implies that Wal-Mart is further retreating from lower growth markets to invest in developing economies such as China and India. The company recently sold an 80% stake in its Brazilian operations to private equity firm Advent International, and announced plans to partially exit its stake in British grocer Asda by merging the business with J Sainsbury – indicating that the world’s largest retailer is seeking to overhaul its overseas business.

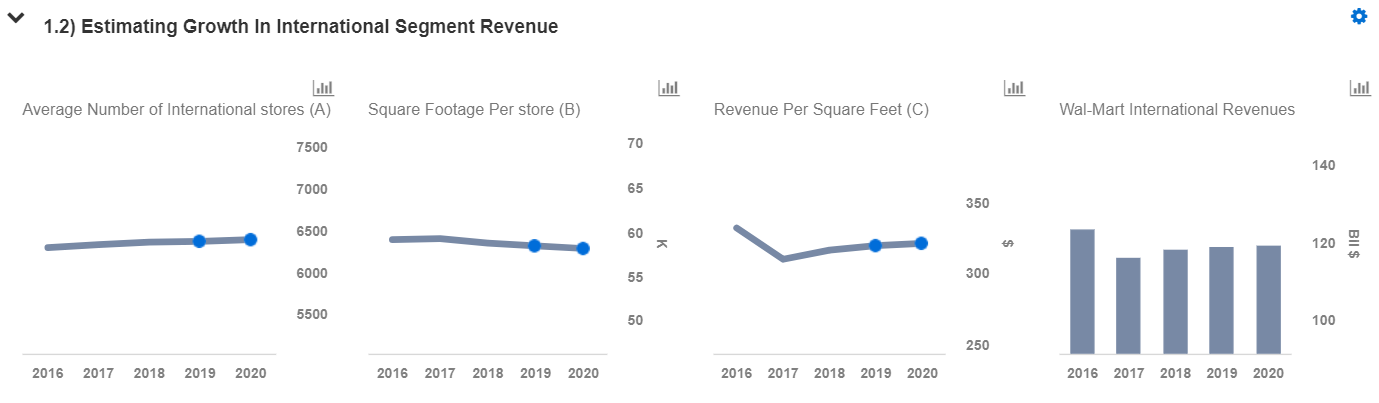

Accordingly, we expect Wal-Mart’s revenue to grow by nearly $22 billion (2% CAGR) through fiscal 2020. To arrive at our fiscal 2020 net revenue estimates for Wal-Mart, we have broken down the revenues and estimated separately. We have also created an interactive dashboard analysis which provides detailed steps of how we arrived at this growth number. You can make changes to these variables to arrive at your own revenue estimates for the company. We expect Wal-Mart to generate around $523 billion in revenues in fiscal 2020, and earnings of almost $15 billion. Of the total expected revenues in fiscal 2020, we estimate $339 billion in the Wal-Mart U.S. business, almost $120 billion for the Wal-Mart International business, and nearly $60 billion for Sam’s Club. We have a $94 price estimate for Wal-Mart, which is almost 10% ahead of the current market price.

Japanese Supermarket Industry Has Proved Difficult For Foreign Retailers

- Up 32% Since Beginning of This Year, Will Walmart’s Strong Run Continue Following Q2 Results?

- Up 15% This Year, Will Walmart Stock Rally Further After Q1 Results?

- Where Is Walmart Stock Headed Post Stock Split?

- Up 7% Already This Year , Where Is Walmart Stock Headed Post Q4 Results?

- Up 18% This Year, Will Walmart Stock Continue To Grow Past Q3?

- Can Walmart’s Stock Trade Lower Post Q2?

The dominance of Wal-Mart in the U.S. is well established, but the retail giant has had more difficulty in many foreign markets. To that end, Japan’s supermarket industry has proved challenging for many foreign retail giants, primarily due to stiff competition from online retailers such as Amazon, in addition to sluggish consumer spending driven by 15 years of deflation. Wal-Mart, in particular, has struggled to replicate the success of its low-price model with Seiyu despite its frequent discount offers. In fact, other retail giants, including Carrefour and Tesco, also exited Japan in 2005 and 2011, respectively. It makes sense for Wal-Mart to invest in emerging economies with growth potential to increase its international revenues going forward. Markets such as China and India constitute around 35% of the world’s population, and both countries have substantial scope for improvement in supply chain operations, and also offer an opportunity for growth in discount retailing because of the relatively lower (but growing) average disposable incomes, lifestyle changes in the middle class and increased digital connectivity.

We have calculated Wal-Mart’s total revenue by estimating the revenues from the company’s domestic sales, international sales, Sam’s Club sales and other income. Further, we have calculated the retailer’s divisional revenues by estimating the number of stores, square footage per store and revenue per square foot. We expect close to 6390 stores in international markets with an average square footage per store of 58k and revenue per square foot of $321, translating into $119 billion (+1% y-o-y) in international revenues in fiscal 2020.

Wal-Mart saw its stock gain nearly 50% in 2017, but it is now down close to 15% year-to-date as of July 12. Much of the stock decline was due to the slowdown in the company’s e-commerce growth in the fourth quarter to 23% y-o-y from levels of 60%+ in the first quarter of 2017. However, the company’s e-commerce growth in the recent Q1 accelerated to 33% y-o-y. Going forward, we expect Wal-Mart to grow, albeit at a slower pace than in 2017, as it continues to invest in its people and technology. The value addition of Wal-Mart’s expansion in places such as India and China could significantly impact the company’s financials in the long run due to the sheer size and growth potential of these markets.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.