Forecast Of The Day: Western Digital’s Client Solutions Revenue

What?

Western Digital’s (NASDAQ:WDC) Client Solutions Revenue rose from around $3.35 billion in FY’20 to about $3.72 billion in FY’21. Trefis expects the metric to rise to about $4 billion in FY’22 and to about $4.3 billion in FY’23.

Why?

- Western Digital Stock Set To Rally Further On Higher AI Demand

- After 50% Gains This Year Will AI Demand Continue To Drive Western Digital Stock Higher?

- Should You Pick Western Digital Stock At $65 After 25% Gains This Year?

- After Rising Over 30% In 2023 Is This Casino Stock A Better Pick Over Western Digital Stock?

- Which Is A Better Pick – Western Digital Stock Or Expedia?

- Will Western Digital Stock Rebound To Its Pre-Inflation Shock Highs?

We expect growth to be driven by higher sales of flash and removable storage products such as USB flash drives, microSD cards, and external hard drives.

So What?

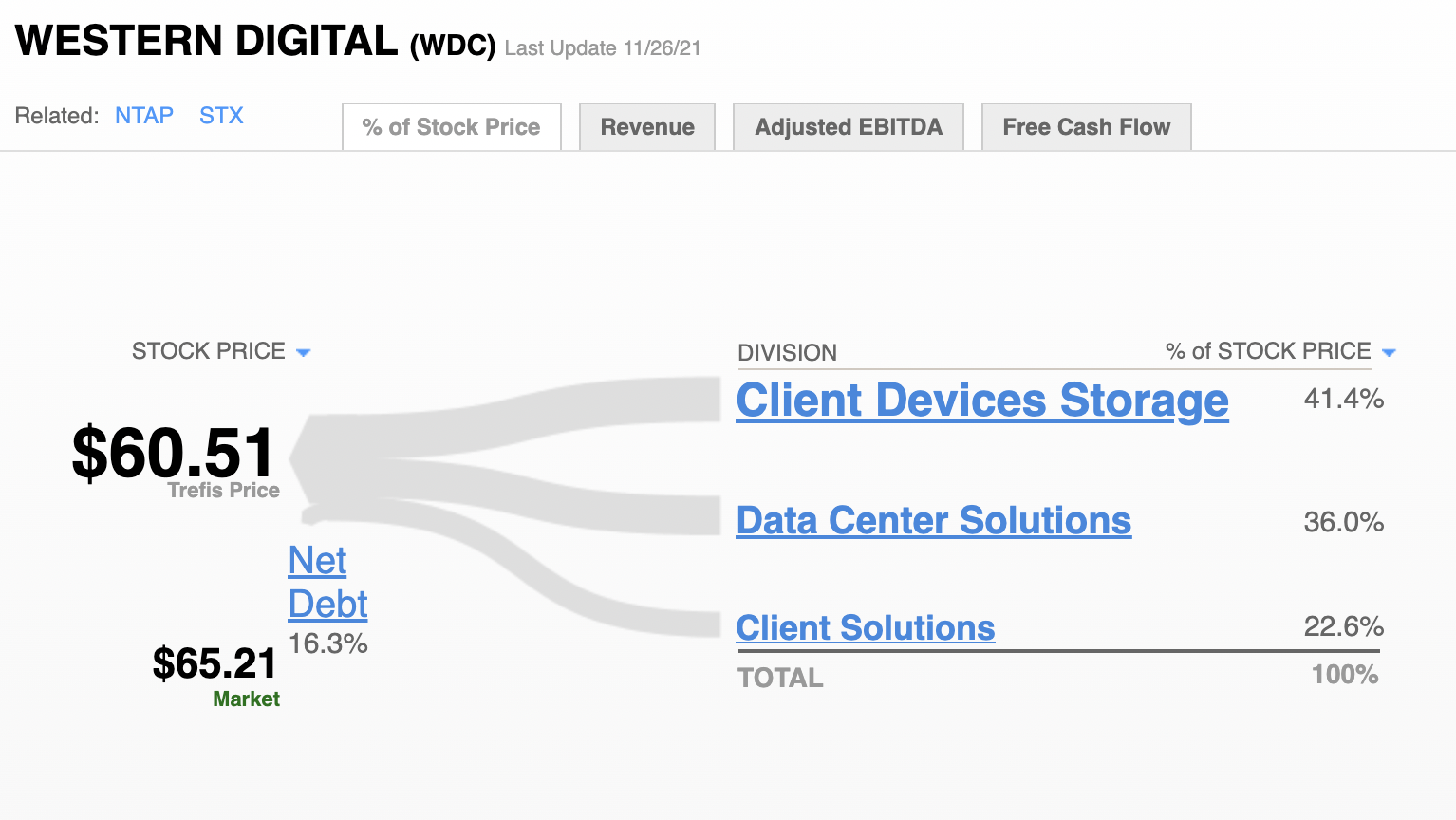

We think the projected growth in WDC’s revenue is fully priced into the stock. We value WDC at about $60 per share, about 7% below the current market price.

See Our Complete Analysis For Western Digital

What if you’re looking for a more balanced portfolio instead? Here’s a high-quality portfolio that’s beaten the market consistently since the end of 2016.