Is Verizon Stock Fairly Valued?

Verizon (NYSE:VZ) has been performing relatively well in recent quarters, driven by its stronger postpaid phone subscriber additions. In this analysis, we take a look at the outlook for the company over the next two years and some of the trends impacting Verizon’s valuation.

View our interactive dashboard analysis Verizon Valuation: Expensive or Cheap?

Step 1: Estimate Postpaid Wireless Revenues

- Net adds could trend higher in FY’19 and FY’20, driven by the company’s mix-and-match plans and the rollout of commercial 5G services.

- ARPU could also trend slightly higher.

- Is Verizon’s Acquisition Of Frontier A Good Idea?

- Can Verizon Stock Gain 50% To $59 As 5G Buildout Winds Down?

- With Mid-Band 5G Gaining Momentum, What To Expect From Verizon’s Q1 Results?

- Up 8% Year To Date As 5G Gains Traction, What’s Next For Verizon Stock?

- Up 25% Over The Last Three Months, Will Verizon See Further Gains Following Q4 Results?

- Down 50% From Covid Highs, Will Verizon Stock Recover Post Q3 Results?

Step 2: Estimate Total Wireless Revenue

- We expect total wireless revenues to rise, driven by the postpaid business, although prepaid is likely to under-perform due to the mounting competition.

- Handset revenues could also trend slightly lower going forward, due to a saturated smartphone market.

Step 3: Estimate Total Wireline Revenues

- We expect wireline revenues to trend lower in the long run, due to a decline in traditional voice and data communication services, although this could be partially offset by higher demand for IP-based services.

Step 4: Estimating Total Revenue

- We estimate that Verizon’s total revenues will grow to about $133 billion, driven by higher wireless revenues.

Step 5: Estimating Net Income

- While Verizon’s net margins increased in 2018, partly due to the U.S. tax reforms, we expect adjusted net margins to stand at 14% levels going forward.

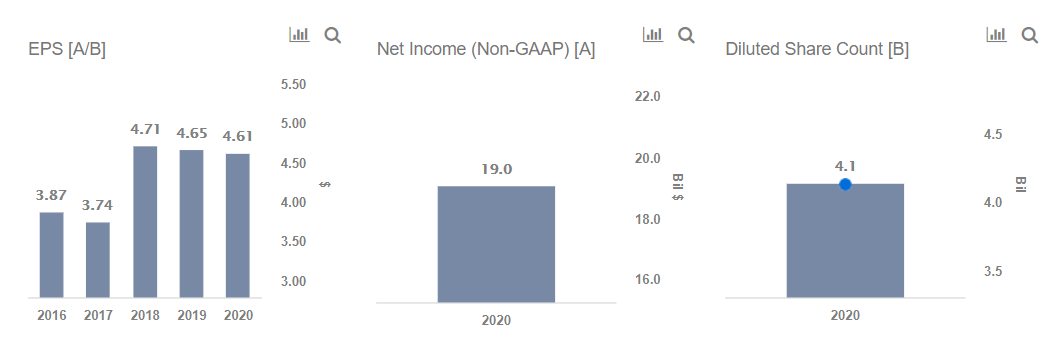

Step 6: Estimating EPS

- We expect EPS to stand at about $4.60 in 2020.

Step 7: Arriving At Price Estimate

- We are valuing Verizon at 12x projected 2020 earnings

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.