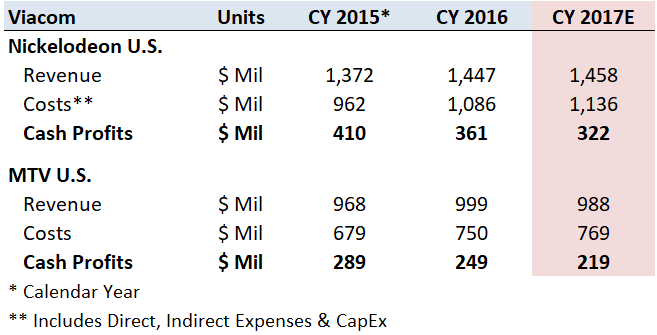

Why Nickelodeon Is 50% More Valuable To Viacom Than MTV

- Nickelodeon has a higher household penetration rate of U.S. pay TV households than MTV. While Nickelodeon is still the leading cable channel among kids in the age group of 2-11 with several hit shows such as Teenage Mutant Ninja Turtles and Sponge Bob Square Pants under its banner, MTV has struggled to keep its younger audience tuned in for continued periods, as its ratings have declined since 2011. MTV’s penetration among U.S. pay-TV households has come down from around 87% in 2011 to 80% in 2016, whereas Nickelodeon’s U.S. penetration among U.S. pay-TV households has gone from 88% in 2011 to 81.3% in 2016. This overall declining trend in the U.S. household penetration in both the networks is due to the growth in alternate viewing platforms such as Netflix (NASDAQ:NFLX), whose penetration has almost tripled during the same time.

- Nickelodeon is able to charge higher retransmission fees than MTV. Nickelodeon U.S. currently has a subscriber base of close to 91 million and it charges an estimated monthly retransmission fee of $0.64. This translates into annual subscription revenue of $708 million. On the other hand, MTV U.S. currently has a subscriber base of close to 90 million and it charges an estimated monthly fees of $0.45. In fact, Nickelodeon should be able to maintain its subscription pricing due to higher ratings and less competition compared to other mainstream channels, with the only noticeable competitors being the Disney Channel and Cartoon Network. Meanwhile, MTV faces more competition than ever from other entertainment options for young adults, including social media, internet videos, and over-the-top (OTT) streaming platforms.

- Nickelodeon also generates significantly more advertising revenues, because of its ratings advantage. Nickelodeon finished 2016 as the number-one kids’ network for the year and as basic cable’s top entertainment network. According to Nielsen Media Research, Nickelodeon was number one in 2-11 age group, 31% ahead of Disney Channel and 75% ahead of Cartoon Network. During the same year, MTV’s total viewership declined 2% year-over-year (y-o-y) to 569,000, whereas Nick Jr. viewership grew 43% y-o-y to 594,000. [1]

Have more questions on Viacom? Please refer to our complete analysis for Viacom

See More at Trefis | View Interactive Institutional Research (Powered by Trefis) Get Trefis Technology

- Ranking 2016’s Winners and Losers, Indiewire, Dec 2016 [↩]