What Can We Expect From United Technologies In Q3

United Technologies (NYSE:UTX) is expected to report its earnings on October 23. Earnings are expected to come in 4.2% higher while revenues are expected to rise by 7% y-o-y.

We currently have a price estimate of $174 per share, which is higher than the market price. You can use our interactive dashboard to modify key drivers and visualize the impact on United Technologies price estimate.

- Why Has Gates Industrial Stock Rallied 40% Over The Last 3 Months?

- UTX Outperforms On The Back Of Strong Fourth Quarter Results

- United Technology To See A Mixed Quarter.

- United Technologies Beats 3Q Expectations

- What Will Drive United Tech’s Near Term Growth?

- How Did United Technologies Perform In Q2?

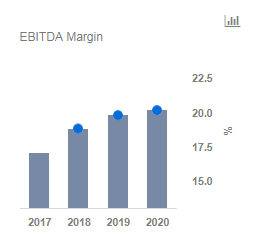

United Technologies, through the quarter, has been working on reducing costs and improving its products. Key segments like Otis are expected to benefit this quarter with orders for new equipment, service transformation, and innovation. Despite robust revenues, there are expected to be issues with one-time charges and Forex. Pratt and Whitney is also expected to add to revenues as throughout the quarter there were orders for new engines from its airline partner. Estimates put the increase at 11% y-o-y in revenues to $4.3 billion, while operating profits are expected to come in at $345 million. The UTC Aerospace system is also expected to drive revenues as the aftermarket business is robust and is expected to add $3.5 billion for the quarter and the increase is expected to come in at 1.7% y-o-y . The UTC Climate Control and Security, similarly added new products; which will be a key driver of revenue growth for the quarter, all of this is expected to help operating margins improve.

Furthermore, the acquisition of Rockwell Collins is expected to close during the quarter. United Technologies is expected to acquire Rockwell Collins for a total of $30 billion. This addition will help United Technologies meet demand and add key products to its aerospace business. The cost synergies of the acquisition are expected to be in the $500 million dollar range and therefore, the acquisition will be key in helping United Technologies improve margins going forward.

In conclusion, with continued robust demand across segments, the accretive addition of Rockwell Collins, and the subsequent cost reduction, will positively drive earnings per share during the quarter. We believe any beat on the bottom line will drive the stock closer to our estimate over time.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.