Down 25% This Year Will Under Armour Stock Rebound After Its Q2?

Note: Under Armour’s FY’23 ended on March 31, 2023.

Under Armour (NYSE: UA), a sports equipment company that manufactures footwear, sports, and casual apparel, is scheduled to report its fiscal second-quarter results on Wednesday, November 8. We expect Under Armour stock to trade higher post-fiscal Q2 2024 results with revenues and earnings likely beating consensus. The company’s stock traded lower this year as the company’s growth slowed down due to a heavily promotional market in the North American retail segment. Outside of the retail issue in North America where sales are forecast to dip 3% to 4% this fiscal year, Under Amour is seeing a booming business. The Europe, Middle East, Africa, and Asia Pacific regions expect double-digit sales growth rates for FY’24. The company is guiding to improving margins for FY’24, but the number will be below the 50.3% levels of FY’21. The company goal is only for gross margins to rally 25 to 75 basis points from the 44.9% level of FY’23. It is likely that the UA stock price will rise as the new CEO gets inventory levels under control in the second half of the year and turns around the North American market. Innovations continue to drive the company’s growth, and it’s just a matter of time before these products take center stage.

UA stock has suffered a sharp decline of 55% from levels of $15 in early January 2021 to current levels, vs. an increase of about 15% for the S&P 500 over this roughly 3-year period. Notably, UA stock has underperformed the broader market in each of the last 3 years. Returns for the stock were 21% in 2021, -51% in 2022, and -24% in 2023 (YTD). In comparison, returns for the S&P 500 have been 27% in 2021, -19% in 2022, and 14% in 2023 (YTD) – indicating that UA underperformed the S&P in 2021, 2022, and 2023. In fact, consistently beating the S&P 500 – in good times and bad – has been difficult over recent years for individual stocks; for heavyweights in the Consumer Discretionary sector including AMZN, TSLA, and TM, and even for the megacap stars GOOG, MSFT, and AAPL. In contrast, the Trefis High Quality (HQ) Portfolio, with a collection of 30 stocks, has outperformed the S&P 500 each year over the same period. Why is that? As a group, HQ Portfolio stocks provided better returns with less risk versus the benchmark index; less of a roller-coaster ride as evident in HQ Portfolio performance metrics. Given the current uncertain macroeconomic environment with high oil prices and elevated interest rates, could UA face a similar situation as it did in 2021, 2022, and 2023 and underperform the S&P over the next 12 months – or will it see a recovery?

Our forecast indicates that Under Armour’s valuation is $8 per share, which is 20% higher than the current market price. Look at our interactive dashboard analysis on Under Armour‘s Earnings Preview: What To Expect in Q2? for more details.

- Under Armour Stock Drop Looks Sharp, But How Deep Can It Go?

- What’s Next For Under Armour Stock?

- Down 20% This Year, Will Under Armour’s Stock Recover Following Q4 Results?

- Under Armour Stock Down 24% This Year, What’s Next?

- Under Armour Stock Up 28% Over Last Month, What’s Next?

- What To Watch For In Under Armour’s Stock Post Q1?

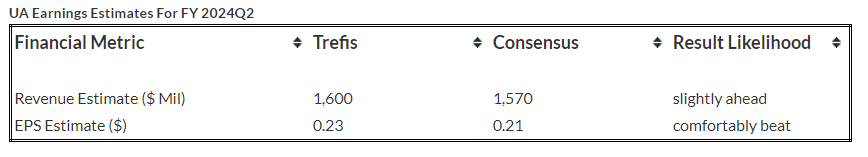

(1) Revenues & Earnings Expected to Beat Consensus Estimates

Trefis estimates UA’s Q2 2024 revenues and EPS to be around $1.6 Bil and 23 cents, both higher than the consensus estimate. In Q1, the company’s revenues fell 2% year-over-year (y-o-y) to $1.32 billion. Under Armour reported a small profit in the first quarter (ended June) with gross margins still under pressure. The biggest issue remains the high inventory levels in the apparel retail sector. Under Armour ended the quarter with inventory at $1.3 billion, up 38% from prior year levels in Q1, though in line with expectations due to leaner inventories in FY 2023. Under Armour’s gross margins were around 50% after the Covid hit, but inventory pressures in the industry have driven margins down to 46.1% for the most recent quarter.

(2) Stock Price Estimate Higher than the Current Market Price

Going by our Under Armour’s Valuation, with an earnings per share (EPS) estimate of around 52 cents and a P/E multiple of 15.6x in fiscal 2024, this translates into a price of $8, which is almost 20% higher than the current market price. We forecast Under Armour’s Revenues to be $6.1 billion for fiscal 2024, up 3% y-o-y.

It is helpful to see how its peers stack up. Under Armour Peers shows how UA’s stock compares against peers on metrics that matter. You will find other useful comparisons for companies across industries at Peer Comparisons.

| Returns | Nov 2023 MTD [1] |

2023 YTD [1] |

2017-23 Total [2] |

| UA Return | 4% | -25% | -74% |

| S&P 500 Return | 4% | 14% | 95% |

| Trefis Reinforced Value Portfolio | 4% | 22% | 525% |

[1] Month-to-date and year-to-date as of 11/7/2023

[2] Cumulative total returns since the end of 2016

Invest with Trefis Market-Beating Portfolios