How Does Travelzoo Make Money?

Travelzoo (NASDAQ: TZOO) is a global Internet media company, which publishes travel and leisure deals to more than 28 million subscribers worldwide. The company’s Travel business, which makes revenues by listing fees paid by travel businesses (hotels, airlines, travel companies) to advertise their offers, is expected to contribute $95 million to Travelzoo’s 2019 revenues, making up 84% of the company’s $114 million in revenues for 2019. The Local Deals and Entertainment segment constitutes around 16% of the total revenues, which includes fees paid by entertainment and local businesses to advertise on Travelzoo.

Travel revenues remained flat and Local revenues have declined in the Asia Pacific region since the last 2 years. Going forward, Travelzoo plans to continue investing as well as increasing its marketing spend in the Asia-Pacific region. To that end, the company has launched a project called Asia-Pacific 2020. Under the project, the company will assemble a team of experienced executives from Travelzoo’s key functions in Europe and North America with strong knowledge of its business. In addition, Travelzoo believes that there is a significant opportunity to grow its member base, which it plans to achieve by investing in marketing and strategic partnerships. We expect this strategy to reap strong results for the company and drive value in the near term.

We have created an interactive dashboard on Travelzoo Revenues: How Does It Make Money?, where we discuss Travelzoo’s business model, followed by sections that review past performance and 2020 expectations for the company’s revenue drivers, and competitive comparisons with TripAdvisor and Booking Holdings.

- Why Did Travelzoo’s Stock Grow Despite Only Modest Revenue Growth?

- Could Travelzoo’s Stock Rise By 50% Post COVID-19 Crisis?

- Why Has Travelzoo’s Stock Price See-Sawed So Much Since Early 2018?

- Can Travelzoo End Fiscal 2018 On a Strong Note?

- What Is TripAdvisor’s Revenue And EBITDA Breakdown?

- What Will Travelzoo’s Revenue Growth Look Like Through Fiscal 2019?

Travelzoo’s Total Revenue declined 3% from $114 million in 2016 to almost $111 million in 2018, however it is expected to grow over 5% to around $117 million in 2 years

- Travelzoo has lost $3 million to its revenue over the last two years.

- However, we expect increasing sales from both its Travel and Local Deals divisions to likely add $3 million in revenue over the next two years.

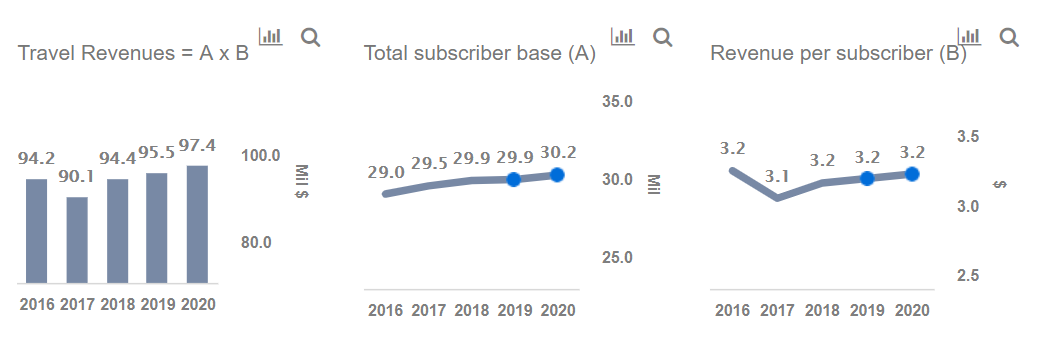

(A) Revenue from Travel to increase 3% (about $3.1 million) in the next two years, with its share of Total Revenue expected to be about 83% by 2020

- Overall, Travel almost remained flat in the last two years at $94.4 million in 2018, driven by a decline in advertising spend in Travelzoo’s Asia-Pacific region. This trend in other geographic regions has also been unpredictable, with revenues swinging considerably from one period to the next.

- We expect revenue to grow by 3% in the next two years, to about $97.4 million in 2020, driven by the company’s initiatives to revive its Asia Pacific region revenues. The company’s management has hired a consulting firm in China to revive its Asia Pacific operations.

- Travel sales contributed 85% of total revenue in 2018. This share is expected to go down to 83% in 2020.

(B) Revenue from Local Deals and Entertainment to increase 17% (adding about $2.9 million) in the next two years, with its share of Total Revenue expected to be about 17% by 2020

- Segment revenue declined from $20.1 million in 2016 to $17 million in 2018, due to a fall in the markets covered under local deals. As a result, vouchers sold declined over this period.

- We expect revenue to grow by about 17% in the next two years, to about $19.8 million in 2020.

- Local Deals and Entertainment sales contributed 15% of total revenue in 2018. This share is expected to go up to 17% by 2020.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.