Tesla Stock Worth $2,000?

Trefis analysis shows Tesla’s (NASDAQ: TSLA) stock could cross $2,000 in 5 years from its current level of $500. Tesla will need to scale annual deliveries from about 300K in 2019 to over 2 million (comparable to luxury car sales by Mercedes, BMW, and Audi) by 2025, with a trajectory to 5 million (comparable to GM and VW) by 2030. It’s a tough ask, but then Tesla did achieve the uphill task of increasing deliveries from 30k in 2015 to 300k in 2019. In addition, for Tesla stock to breach the $2,000-mark, the company will need to meaningfully improve its earnings margins to about 15% while achieving significant revenue growth.

Below we discuss the specifics of Tesla Stock Upside included with our interactive charts to test sensitivity to underlying assumptions. Deeper insights on Tesla revenues and Tesla expenses as well as Tesla P/S multiple are also available separately as context to this analysis. Additionally, we provide a counter analysis to our Tesla upside case in our interactive dashboard for Tesla Stock Downside: $0?

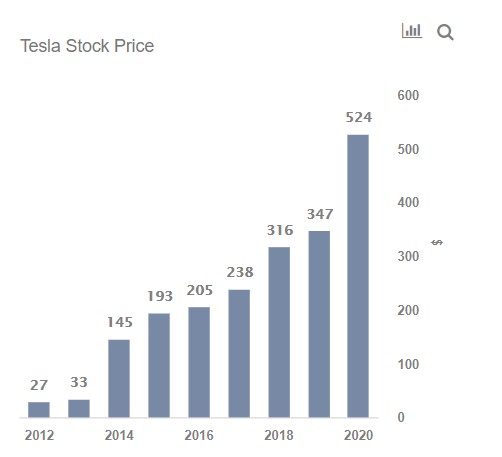

Tesla’s stock price has soared from $27 in Jan 2012 to over $500 in Jan 2020

- This translates into a CAGR of 44% over 8 years. In comparison, the S&P has returned about 12% a year over the same period.

This Is What It Will Take For Tesla’s Stock Price To Swell Beyond $2,000:

#1. Tesla Deliveries: While deliveries are likely to grow to close to 500k units this year, it is possible for deliveries to stand at over 2 million cars by 2025 and 4 million cars by 2030

- We estimate Tesla’s Deliveries to have a CAGR of 58% over 2015-20

- It is possible for delivery growth to stand at over 33% over 2020-25 and 14% over 2025-30

- You can modify the growth rate in the below charts to arrive at your own estimates for 2025 and 2030 figures.

Why it’s possible for Tesla’s Deliveries to jump to 2 million by 2025 and 4 million by 2030:

#1.1 The auto market is sizable and Tesla is gaining ground

- Global automobile sales stood at about 94 million units in 2018 and Mercedes Benz, the largest luxury player delivered 2.4 million cars, with BMW selling 2.1 million cars.

- With the upcoming launch of new models such as the Model Y and Cybertruck, Tesla could go beyond the conventional luxury market as well.

#1.2 Tesla could replicate its U.S. success overseas

- The North American market still accounts for a bulk of Tesla’s sales (~69% in 2018) and the company still has a lot of room to scale up internationally.

- Tesla’s deliveries in its primary market of the U.S. have already surpassed BMW’s car sales in the U.S. in 2019 and it’s possible that the company could replicate this success overseas.

#1.3 Tesla has been efficient in ramping up production capacity

- Tesla has a fairly solid track record of scaling up production. Deliveries rose from about 2k cars in 2012 to 76k in 2016 and 367k in 2019.

- Tesla built-out its Chinese factory in a record 10 months and production is expected scale from a run-rate of 250k cars per year by the end of this year to 500k cars.

- This means that Tesla should be able to build out new capacity and scale-up, as demand for its vehicles increases.

#2. Tesla Revenues: If it does manage to ramp up deliveries as detailed above, Tesla’s Total Revenues could potentially grow from $28 billion in 2020 to $112 billion in 2025 and $212 billion in 2030

- This assumes that Average Selling Prices for Tesla vehicles will fall to levels of ~$53k, with Other Revenues rising to $6 billion by 2025.

#3. Tesla Net Income: The strong revenue growth will need to be accompanied by steady improvement in margins, with Tesla’s Net Margins growing to 13.5% in 2025 and 15% by 2030

- This would translate into a Net Income of $16 billion in 2025 and $33 billion in 2030.

Why it’s possible for Tesla’s Net Margin to swell to 15% by 2030 from its current estimated level of -0.4% in 2019:

#3.1 Tesla’s Net Profit Margins could potentially be higher than rivals such as BMW

- This can be attributed to the company’s increasing automation, improving economies of scale, declining battery costs and higher software content in its vehicles

#4. Tesla Valuation: We believe that Tesla stock could be worth close to $2,000 by 2025 and more than $3,500 by 2030

This assumes a P/E multiple of about 23.5x in 2025 and 20x in 2030 and shares outstanding at 190 million and 200 million for 2025 and 2030

Why a P/E multiple of 23x in 2025?

While the P/E number the market will assign is based on the alternatives available to investors – here is some data we used to arrive at the potential multiple for Tesla. We suggest that you choose for yourselves in our interactive dashboard for Tesla Stock Upside keeping the following in mind:

- Google trades at about 24x, with revenue growth of about 20%-23%, and margins of a little over 20%

- Apple traded at about 16x, with revenue growth averaging less than 5% and margins standing at over 20%

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams