Down 18% This Year, How Will Tripadvisor Stock Trend Following Q3 Results?

Tripadvisor (NASDAQ: TRIP), an online travel company providing booking for hotel reservations, transportation, lodging, travel experiences, and restaurants, is scheduled to announce its fiscal third-quarter results on Tuesday, November 7. We expect Tripadvisor’s stock to likely trade higher due to revenue and earnings beating consensus estimates marginally. TRIP experienced a recovery in travel demand and strong growth in gross bookings from pre-Covid levels in 2022. However, the company’s rising costs have been impacting the company’s profitability as also seen in the fiscal first half of 2023. However, Tripadvisor’s Viator segment (the world’s largest online marketplace for tours, activities, and attractions) appears to be growing rapidly and is now making up a significant portion of total revenue. Additionally, the company appears to have ample liquidity with $1.1 billion in cash on the balance sheet, and about $345 million and $500 million in long-term debt maturities in 2026 and 2028, respectively.

TRIP stock has suffered a sharp decline of 50% from levels of $30 in early January 2021 to around $15 now, vs. an increase of about 15% for the S&P 500 over this roughly 3-year period. Notably, TRIP stock has underperformed the broader market in each of the last 3 years. Returns for the stock were -5% in 2021, -34% in 2022, and -18% in 2023 (YTD). In comparison, returns for the S&P 500 have been 27% in 2021, -19% in 2022, and 13% in 2023 (YTD) – indicating that TRIP underperformed the S&P in 2021, 2022, and 2023. In fact, consistently beating the S&P 500 – in good times and bad – has been difficult over recent years for individual stocks; for heavyweights in the Information Technology sector including AAPL, MSFT, and NVDA, and even for the megacap stars GOOG, TSLA, and AMZN. In contrast, the Trefis High Quality (HQ) Portfolio, with a collection of 30 stocks, has outperformed the S&P 500 each year over the same period. Why is that? As a group, HQ Portfolio stocks provided better returns with less risk versus the benchmark index; less of a roller-coaster ride as evident in HQ Portfolio performance metrics. Given the current uncertain macroeconomic environment with high oil prices and elevated interest rates, could TRIP face a similar situation as it did in 2021, 2022, and 2023 and underperform the S&P over the next 12 months – or will it see a recovery?

Our forecast indicates that Tripadvisor’s valuation is at $18 per share, which is 23% higher than the current market price. Look at our interactive dashboard analysis on Tripadvisor Earnings Preview: What To Expect in Q3? for more details.

- Why Has Tripadvisor Stock Slumped 35% This Year?

- Gaining 20% This Year, Will Tripadvisor Stock Rally Further After Q1 Results?

- Up 26% Already This Year, What Is Next For Tripadvisor Stock?

- Up 21% Since 2023, How Will Tripadvisor Stock Trend Post Q4 Results?

- What’s Next For Tripadvisor Stock?

- Will Tripadvisor Stock See Gains Post Q2?

(1) Revenues expected to come ahead of consensus estimates

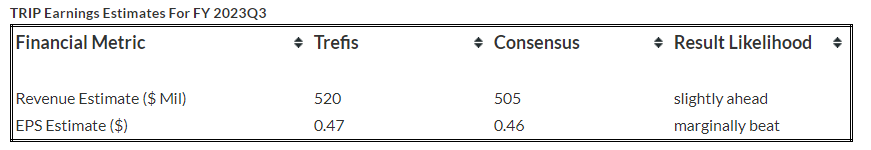

Trefis estimates Tripadvisor’s Q3 2023 revenues to be around $520 Mil, slightly ahead of the consensus estimate. The company’s Q2 revenues rose 18% year-over-year (y-o-y) to $494 million, and narrowly beat market expectations. However, revenue at the TripAdvisor core brand increased just 2% to $279 million. Viator, on the other hand, saw top-line growth of 59% y-o-y to $216 million. Management also talked up its new generative artificial intelligence (AI) planning tool, which is now in beta, taking advantage of the latest technology. For the full year 2023, we expect Tripadvisor revenues to rise 16% y-o-y to $1.7 billion.

(2) EPS likely to marginally beat consensus estimates

Tripadvisor’s Q3 2023 earnings per share (EPS) is expected to come in at 47 cents as per Trefis analysis, slightly beating the consensus estimate. Despite a higher revenue base, the business wasn’t able to profit from it. The company said selling and marketing costs ballooned 24% from the prior year while an increase in headcount to support growth also weighed on profitability. In Q2, the company earned 34 cents (down from 37 cents a year ago) in adjusted EPS. The company spent aggressively on marketing and technology development, especially in the Viator and core Tripadvisor platforms.

(3) Stock price estimate higher than current market price

Going by our Tripadvisor’s Valuation, with an EPS estimate of around $1.04 and a P/E multiple of around 17.0x in fiscal 2023, this translates into a price of $18, which is almost 23% higher than the current market price.

It is helpful to see how its peers stack up. TRIP Peers shows how Tripadvisor’s stock compares against peers on metrics that matter. You will find other useful comparisons for companies across industries at Peer Comparisons.

| Returns | Nov 2023 MTD [1] |

2023 YTD [1] |

2017-23 Total [2] |

| TRIP Return | -1% | -18% | -68% |

| S&P 500 Return | 3% | 12% | 93% |

| Trefis Reinforced Value Portfolio | 3% | 21% | 520% |

[1] Month-to-date and year-to-date as of 11/3/2023

[2] Cumulative total returns since the end of 2016

Invest with Trefis Market-Beating Portfolios