What’s Happening With TripAdvisor’s Stock?

TripAdvisor’s stock (NASDAQ: TRIP), currently at around $33 has climbed more than 75% since November as vaccine efficacy data and approvals rolled out. In addition, the Presidential elections and better-than-expected Q3 results added to this surge. The company’s stock is now about 11% higher than the levels seen since the beginning of 2020. And, we believe that all the good news appears to be factored into the company’s stock price so far. The travel sector was severely hit in 2020, and consequently, TripAdvisor’s revenues have declined drastically by 60% y-o-y, so far in fiscal 2020. That said, the online travel booking site could also see a very strong upside once the Covid-19 fear abates. This is based on the company’s cash balance of $446 million and another $1 billion in liquidity, providing all the cash needed to safeguard from the current downturn. With roughly half of its expenses coming from sales and marketing, TripAdvisor has high variable costs, making it easier for the company to conserve cash and survive the crisis, including a tough 2020 holiday period and likely limited gains in travel demand in the first half of 2021.

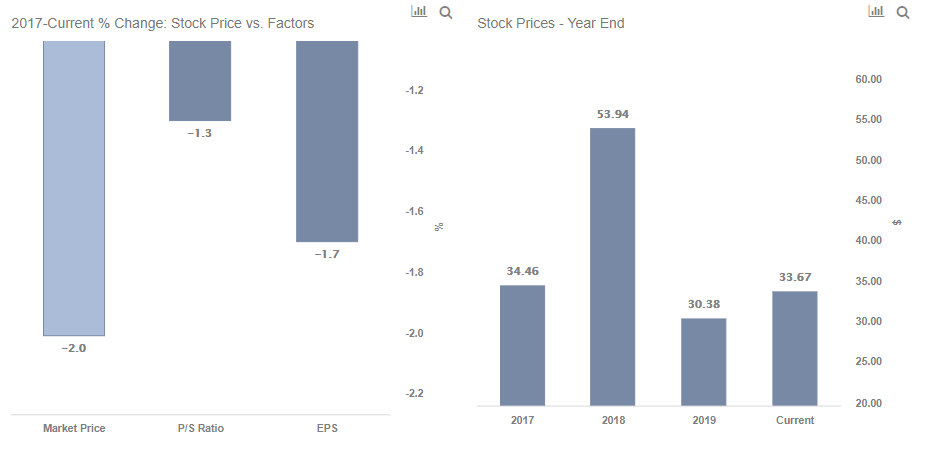

TripAdvisor stock has largely underperformed the broader markets between fiscal 2017 and now. The company’s stock is around 2% lower than it was at the end of fiscal 2017, compared to 44% growth in the S&P. Our dashboard, What Factors Drove 2% Decline in TripAdvisor’s Stock Between Fiscal 2018 and Now? provides the key numbers behind our thinking, and we explain more below.

- Why Has Tripadvisor Stock Slumped 35% This Year?

- Gaining 20% This Year, Will Tripadvisor Stock Rally Further After Q1 Results?

- Up 26% Already This Year, What Is Next For Tripadvisor Stock?

- Up 21% Since 2023, How Will Tripadvisor Stock Trend Post Q4 Results?

- Down 18% This Year, How Will Tripadvisor Stock Trend Following Q3 Results?

- What’s Next For Tripadvisor Stock?

TripAdvisor’s stock declined 12% from around $34 in 2017 to around $30 in 2019. During this period, TripAdvisor’s revenues were largely flat due to declining Hotel business (which accounts for more than half of its sales). A crucial factor in the drop in the company’s stock price was the markets re-valuing the company at a lower P/S multiple from 3.1 in 2017 to 2.7 in 2019. It should be noted that the company’s P/S is up to about 3.0x now, and we believe it will likely hover around the current levels in the near term.

The company’s Hotel revenues were largely hit by lower click-based advertising revenues on TripAdvisor-branded websites. The company is also facing aggressive competition from Google as it is pushing its own hotel products in search results. TripAdvisor’s non-Hotel segment (Experiences and Dining) has been driving the growth in the company’s revenues for the past few years.

How Is Coronavirus Impacting TripAdvisor’s Stock?

In Q3, TripAdvisor saw demand rebound, but the numbers were still far below 2019 levels. The company’s revenue grew nearly 150% from only $59 million in Q2 2020 to $151 million in Q3 2020. But the revenues were still down 65% from year-ago quarter levels. It is also worth mentioning that monthly unique users on TripAdvisor websites grew from only 33% in April to 74% in September of the prior year’s comparable periods. Traffic trends on its websites improved since the onset of the pandemic, suggesting that consumers are rather interested to travel now but are hesitant to book their plans. The company is planning to roll out a direct-to-consumer subscription service, TripAdvisor Plus, that will offer consumers discounts on hotels and travel attractions – which could likely help the company in recovery post-Covid.

Vaccines will obviously change the course of the pandemic, and travel may pick up later in the year. But with Europe extending its lockdowns to limit the Covid-19 spread, travel demand could really struggle in the next few months. The coming quarters will certainly be difficult for TripAdvisor as the travel industry won’t recover until the vaccine is available at scale.

While TripAdvisor stock may have moved in the last few months, 2020 has created many pricing discontinuities which can offer attractive trading opportunities. For example, you’ll be surprised how counter-intuitive the stock valuation is for Amazon vs Etsy. Another example is Apple vs Microsoft.

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams