Can Target Keep Beating Expectations In Q3?

Target (NYSE: TGT) is scheduled to announce its fiscal third quarter results on Wednesday, November 15. The company had a better-than-expected first half of fiscal 2017, with the company beating earnings per share estimates and revenue estimates in both quarters. In the first six months of 2017, the company’s revenue came in flat at $32.4 billion, primarily due to growth in digital comparable sales, which offset a decline in comparable store sales. Notably, Target’s digital sales accounted for 4.3% of total sales, compared to 3.4% in the corresponding period last year. Target also posted diluted earnings of $2.44 per share, up 11% y-o-y. Among product categories, household essentials accounted for 25% of the first-half net sales.

Our $59 price estimate for Target’s stock is slightly below the current market price.

Target’s stock is down more than 20% this year, as the company is looking to overhaul its business model. In fact, the retailer plans to invest close to $2 billion this year during this phase, which includes the expansion of small-format stores, revamping existing stores, supply chain improvements, increased promotions (estimated investment of $7 billion over the next 3 years), and lower everyday pricing.

- Shifting Targets: Are These Two Stocks A Better Bet Than TGT?

- Why Did Target Stock Jump 10%?

- With The Stock Almost Flat This Year, Will Q2 Results Drive Target’s Stock Higher?

- Is Amazon Stock A Better Retail Pick Over Target?

- Gaining 12% Year To Date, Will Q1 Results Drive Target’s Stock Higher?

- TGT Stock Up 21% YTD, What’s Next?

Target has been investing in e-commerce initiatives in response to pressure on comparable sales growth due to declining traffic at brick and mortar stores since last year, driven by small declines in both traffic and average transaction amounts. However, Target’s store comparable sales grew positive in the second quarter, which reflected the retailer’s strategy of investing in the stores to grow its traffic. On the other hand, Target was also able to grow its digital comparable sales in the second quarter, largely due to the company’s e-commerce efforts, such as next-day shipping and the consolidation of Target’s app. Going forward, Target’s upcoming initiatives in this transition could lead to some near-term margin pressure given the significant investments they may entail.

In the third quarter, the company expects to generate both GAAP EPS from continuing operations and adjusted EPS in the range of $0.75 to $0.95. Reuters’ compiled analyst estimates forecast revenues of $16.6 billion and earnings of 85 cents per share in Q3.

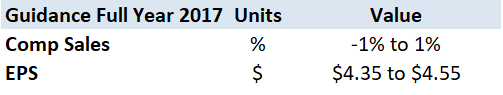

For the full year 2017, Target raised its adjusted EPS guidance to range between $4.35 to $4.55, up 11% from its prior guidance range. The company also expects its comparable sales to be in the range of -1% to 1%. In addition, the company also expects its capital expenditures to be in the $2 billion to $2.5 billion range.

See our complete analysis for Target

See More at Trefis | View Interactive Institutional Research (Powered by Trefis)