What Lies Ahead For Seagate’s Stock Post Q1 Results?

Note: FY’24 ended in June 2024

Seagate stock (NASDAQ: STX), a company specializing in the design, manufacture, and distribution of electronic data storage solutions and products, is scheduled to report its first-quarter results on Tuesday, October 22. We expect STX’s stock to likely see little to no movement with revenue and earnings matching expectations in fiscal Q1. Seagate has seen a 34% rise so far this year – jumping from levels of $85 then to $112 now – vs. an increase of about 22% for the S&P 500 over this period. In comparison, its peer – Western Digital stock (NASDAQ: WDC) – has seen a 29% rise over this period. Both STX and WDC are seeing a recovery in storage demand, amid the AI boom. This resulted in a shift to higher capacity drives and improved pricing.

Seagate is now focused on HAMR products, which could last for a much longer life than that of conventional disks. It is shipping hard disks of 30 TB with the new Heat Assisted Magnetic Recording technology. With the demand expected to pick up for HAMR disks, Seagate is well-positioned to benefit from the same. AI is driving demand for memory and storage to support increased data processing. The company stands to benefit from its mass-capacity drives, given the rising need for enterprises to capture more data. Seagate has also seen its profitability improve lately. Its operating margin fell from 14% in FY 2021 to 1% in FY 2023, but recovered to 6% in FY 2024. Going forward, the company’s operating margin is expected to improve further.

Investors have rewarded STX stock, thanks to the rebound in its storage product sales and the recent expansion of profit margins. However, the increase in STX stock over the last 3-year period has been far from consistent, with annual returns being considerably more volatile than the S&P 500. Returns for the stock were 88% in 2021, -51% in 2022, and 69% in 2023. In contrast, the Trefis High Quality (HQ) Portfolio, with a collection of 30 stocks, is considerably less volatile. And it has outperformed the S&P 500 each year over the same period. Why is that? As a group, HQ Portfolio stocks provided better returns with less risk versus the benchmark index; less of a roller-coaster ride as evident in HQ Portfolio performance metrics. Given the current uncertain macroeconomic environment around rate cuts and multiple wars, could STX face a similar situation as it did in 2022 and underperform the S&P over the next 12 months – or will it see a strong jump?

Our forecast indicates that Seagate’s Valuation is $118 per share, which is almost 6% higher than the current market price. Look at our interactive dashboard analysis on STX’s Earnings Preview: What To Expect in Q1? for more details.

(1) Revenues and Earnings expected to come in line with the consensus estimates

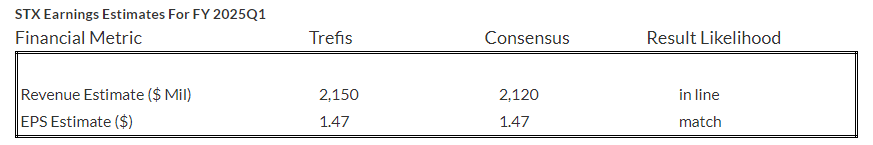

Trefis estimates Seagate’s FQ1 2025 revenues to be $2.2 Bil, matching the market expectations. In Q4 2024, Seagate’s revenue grew 18% y-o-y to $1.9 billion, benefiting from a rebound in cloud demand both in the U.S. and China and resulting in higher exabyte growth. During fiscal year 2024, the company shipped 398 exabytes of HDD storage capacity, compared to 441 exabytes it shipped in the prior year period. However, for Q4, the number of exabytes of HDD storage shipped grew by 15% sequentially. This trend will likely be visible in the coming quarters, with a broader recovery in storage demand, and the company’s focus on HAMR products. We expect Seagate’s revenue to grow 40% y-o-y to $9.2 billion in 2025. STX’s FQ1 2025 earnings per share (EPS) is expected to come in at $1.47 per Trefis analysis, also in line with the consensus estimate.

(2) Stock price estimate similar to the current market price

We estimate Seagate’s Valuation to be $118 per share, reflecting over 5% upside from current levels of around $112. The company’s P/S ratio has been in a wide range of 1.2x to 3.3x in the past three years. This can be attributed to a significant 37% fall in sales in fiscal 2023 and another 11% in fiscal 2024 (fiscal ends in June), owing to lower volume and price erosion amid a significant decline in storage demand. Our forecast of $118 is based on a 16.9x price-to-earnings multiple and adjusted earnings of $6.95 per share in FY 2025.

It is helpful to see how Seagate’s peers fare on metrics that matter. You will find other valuable comparisons for companies across industries at Peer Comparisons.

While investors have their fingers crossed for a soft landing for the U.S. economy, how bad can things get if there is another recession? Our dashboard How Low Can Stocks Go During A Market Crash captures how key stocks fared during and after the last six market crashes.

| Returns | Oct 2024 MTD [1] |

2024 YTD [1] |

2017-24 Total [2] |

| STX Return | 2% | 34% | 317% |

| S&P 500 Return | 1% | 22% | 161% |

| Trefis Reinforced Value Portfolio | 3% | 18% | 789% |

[1] Returns as of 10/21/2024

[2] Cumulative total returns since the end of 2016

Invest with Trefis Market-Beating Portfolios

See all Trefis Price Estimates