Shutterfly’s Lifetouch Acquisition Boosts Its Earnings & Is Likely To Drive Its Value In The Long Term

In line with market expectations, Shutterfly (NASDAQ:SFLY) reported a solid financial performance for its June quarter earlier this week driven by the better-than-expected performance from the Lifetouch acquisition. This, coupled with the efficiencies from the consolidation and restructuring program drove the company’s operating margin. We expect the integration of Lifetouch, along with the company’s strategic initiatives to optimize its technology and a strong focus on building its brands to drive its value in the coming quarters.

We have a price estimate of $88 per share for the company, which is higher than its current market price. View our interactive dashboard – Shutterfly’s Outlook For 2018 and modify the key drivers to visualize their impact on its valuation.

- Why Is Apollo Global Management Acquiring Shutterfly?

- Lifetouch Powers Shutterfly’s Q1 Results, And Will Continue To Drive Growth Going Forward

- Lifetouch Acquisition To Continue To Drive Top-Line Growth For Shutterfly In Q1

- Breaking Down Shutterfly’s Key Revenue Drivers

- Lifetouch Acquisition Should Continue To Drive Growth For Shutterfly

- Can Lifetouch Acquisition Drive Shutterfly’s Q4?

Key Highlights of 2Q’18 Results

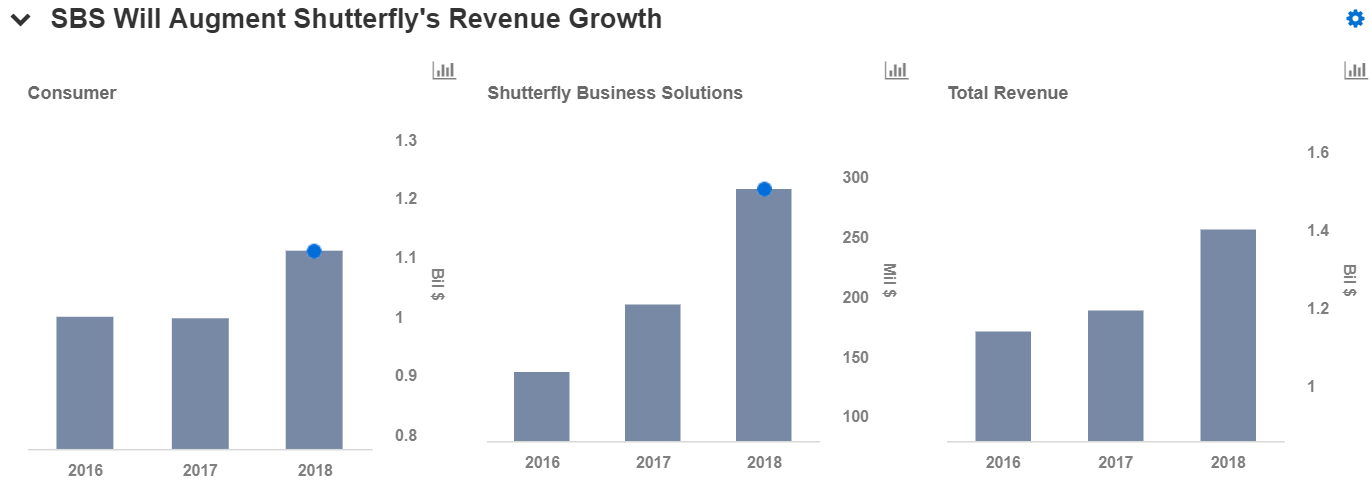

- Shutterfly’s 2Q’18 results exceeded its expectations, with the revenue growing to $477 million driven by strong performance in both the Lifetouch and SBS segments.

- However, the Shutterfly Consumer segment growth was below expectations due to a shift away from free promotions and toward paid higher value purchases. Also, the division suffered due to the loss of revenue from the closure of three of its websites in 2017 – Tiny Prints, Wedding Paper Divas, and MyPublisher.

- Shutterfly’s adjusted EBITDA for the quarter was $84 million driven by Lifetouch’s strong performance, the efficiencies from the consolidation and restructuring program, and continued expense control.

Going Forward

- Shutterfly closed the Lifetouch acquisition in the second quarter, which is expected to drive its value in the coming quarters. Going forward, the company will report three divisions – Shutterfly Consumer, Lifetouch, and Shutterfly Business Solutions, each of them having significant opportunities for the company. Also, the company plans to limit the use of free promotions over time and focus on acquiring customers cost effectively.

- The company is progressing well with the integration of the Lifetouch acquisition, which will enable it to realize notable cost and revenue synergies over time. It aims to leverage Lifetouch’s existing customer base of more than 10 million existing households as well as the 1 million new kindergarten households they add each year. It expects to realize synergies that will contribute $50 million to its 2020 adjusted EBITDA target of $450 million.

- As part of its strategic initiatives, Shutterfly launched eight new personalized gifts and home décor products in the second quarter, including ceramic coasters, pot holders and photo wristlets. It further launched Kids and Pets categories, expanding the range of products it offers. The company plans to double the number of new products launched in 2018 versus 2017, which will drive its value in the long term.

Do not agree with our forecast? Create your own price forecast for Shutterfly by changing the base inputs (blue dots) on our interactive dashboard.