Down 23% This Year, Will Starbucks’ Stock Recover Following Q3 Results?

[Note: Starbucks’ fiscal year 2023 ended October 1]

Starbucks stock (NASDAQ: SBUX), the world’s leading roaster, marketer, and retailer of specialty coffee worldwide, is scheduled to report its Q3 2024 results on Tuesday, July 30. We expect SBUX stock to likely trade higher with revenues and earnings beating expectations slightly in its third-quarter results. SBUX stock has declined from around $93 to $73 YTD, largely underperforming the broader indices, with the S&P growing about 14% over the same period. In comparison, SBUX’s peer McDonald’s stock (NYSE: MCD) fell 14% so far this year. SBUX’s stock declines can be attributed to investors’ concern about a sharp decline in same-store sales and a significant miss on earnings per share and net revenue expectations in last Q2. The company is now calling for fiscal 2024 revenue growth in the low single-digits, down from its previous range of 7% to 10% y-o-y growth. It should be mentioned that inflationary pressures played a big role in the company’s weak Q2 results. Nevertheless, the coffee business is lucrative as it lends itself to repeat purchases, which puts Starbucks in a strong position. The premium coffee products offered by Starbucks involve no significant technological disruptions, and the industry’s slow pace of progress should help Starbucks make it through the long term. In light of this year’s decline, shares are currently trading at a compelling price-to-earnings ratio of only ~20 (compared to a high 20s historical figure). We believe the coffee company’s stock could see gains based on the fact that it is still growing in the United States and has substantial growth potential in China and beyond.

SBUX stock has faced a notable decline of 25% from levels of $100 in early January 2021 to around $73 now, vs. an increase of about 45% for the S&P 500 over this roughly 3-year period. However, the decrease in SBUX stock has been far from consistent. Returns for the stock were 11% in 2021, -13% in 2022, and -1% in 2023. In comparison, returns for the S&P 500 have been 27% in 2021, -19% in 2022, and 24% in 2023 – indicating that SBUX underperformed the S&P in 2021 and 2023.

In fact, consistently beating the S&P 500 – in good times and bad – has been difficult over recent years for individual stocks; for heavyweights in the Consumer Discretionary sector including AMZN, TSLA, and HD, and even for the megacap stars GOOG, MSFT, and AAPL. In contrast, the Trefis High Quality (HQ) Portfolio, with a collection of 30 stocks, has outperformed the S&P 500 each year over the same period. Why is that? As a group, HQ Portfolio stocks provided better returns with less risk versus the benchmark index; less of a roller-coaster ride as evident in HQ Portfolio performance metrics. Given the current uncertain macroeconomic environment with high oil prices and elevated interest rates, could SBUX face a similar situation as it did in 2021 and 2023 and underperform the S&P over the next 12 months – or will it see a recovery?

- Starbucks’ China Sales Decline Amidst Intensifying Competition

- Starbucks Stock Can 2X Now

- Here’s How Starbucks Stock Could Grow To $190

- Can Starbucks’ Stock Rise 55% To Its Pre-Inflation Shock Highs?

- Down 22% YTD, What Lies Ahead For Starbucks’ Stock?

- Down 9% This Year, What Lies Ahead For Starbucks Stock Following Q2 Earnings?

Our forecast indicates that Starbucks’ valuation is $80 per share, which is almost 9% higher than the current market price. Look at our interactive dashboard analysis on Starbucks Earnings Preview: What To Expect in Fiscal Q3? for more details.

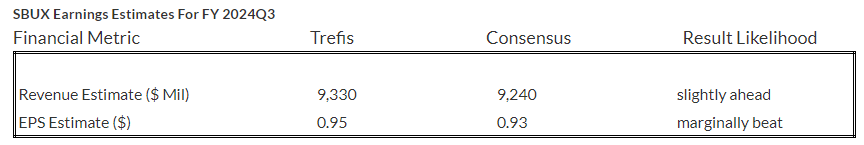

(1) Revenues expected to beat consensus estimates marginally

Trefis estimates Starbucks’ Q3 2024 revenues to be around $9.3 Bil, marginally beating the consensus estimate. The company’s fell 2% y-o-y to $8.6 billion. Its comparable sales for the entire company were down 4.0%, driven by a 6% decline in total transactions, partially offset by a 2% increase in average spending per customer. Rising operating costs of its stores, increased promotional activities, and higher wages were mainly responsible for the rather weak outcome. China saw the worst decline in comparable sales (-11%) in Q2. Since 18% of all SBUX stores are in China, this geography remains a challenge to the company. We forecast Starbucks’ Revenues to be $36.7 billion for the fiscal year 2024, up 2% y-o-y.

2) EPS is also likely to beat the consensus estimates marginally

Starbucks’ Q3 2024 earnings per share (EPS) is expected at 95 cents per Trefis analysis, slightly above the consensus estimate. Starbucks reported fiscal Q2 2024 adjusted EPS of $0.68, well below the consensus of $0.80 (down 7% year-over-year (y-o-y)). In fact, the coffee king’s Q2 operating margin was just 12.8% , down 240 basis point decline y-o-y, well below its ten-year average of 15.1%.

(3) Stock price estimate higher than the current market price

Going by our Starbucks Valuation, with an EPS estimate of around $3.75 and a P/E multiple of 21.4x in fiscal 2024, this translates into a price of $80, which is 9% higher than the current market price.

It is helpful to see how its peers stack up. SBUX Peers shows how Starbucks’ stock compares against peers on metrics that matter. You will find other useful comparisons for companies across industries at Peer Comparisons.

| Returns | Jul 2024 MTD [1] |

2024 YTD [1] |

2017-24 Total [2] |

| SBUX Return | -6% | -23% | 54% |

| S&P 500 Return | -1% | 14% | 142% |

| Trefis Reinforced Value Portfolio | -1% | 6% | 684% |

[1] Returns as of 7/26/2024

[2] Cumulative total returns since the end of 2016

Invest with Trefis Market-Beating Portfolios