How The New T-Mobile’s Revenue And Subscriber Metrics Stack Up Versus Rivals

The merger between T-Mobile (NASDAQ:TMUS) and Sprint (NYSE:S) received regulatory approval in late July, with the U.S. Department of Justice (DoJ) ratifying the deal. The two companies expect to close the merger by the end of 2019, creating a stronger rival to market leaders Verizon and AT&T. In this analysis, we take a look at the revenues of the combined entity (The New T-Mobile) and how its subscriber metrics stack up versus rivals.

View our interactive dashboard analysis on How Will The New T-Mobile’s Revenues And Subscriber Metrics Compare Versus Verizon & AT&T?

A Look At The Key Segment Revenues For The New T-Mobile

- Sprint’s Stock Looks Expensive Compared To AT&T After Rising 93% In 2 Months!

- Sprint’s Stock Price Doubled In 15 Days; Is Market Overvaluing Sprint Just Before Its Merger With T-Mobile?

- Where Is Sprint Corp Spending Most Of Its Money?

- Machine Learning Answers: Sprint Stock Is Down 15% Over The Last Quarter, What Are The Chances It’ll Rebound?

- Sprint Valuation: Fairly Priced

- How Does Sprint Make Money?

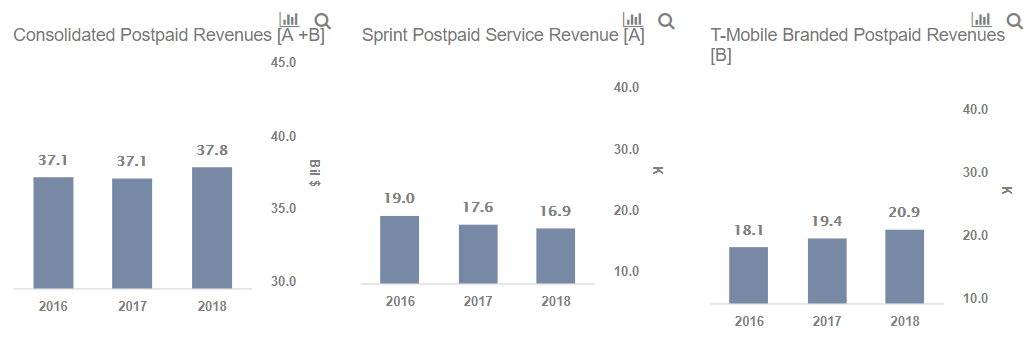

Postpaid Revenues

- Postpaid revenues (including phone and other devices) for the new entity would stand at about $38 billion as of 2018 ($17 billion from Sprint and $21 billion from T-Mobile)

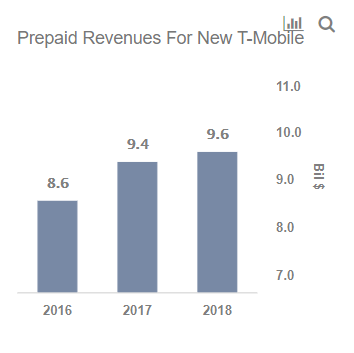

Prepaid Revenues

- As Sprint is expected to sell its prepaid operations as part of the agreement with the U.S. DoJ, we assume that the new entity will only have T-Mobile’s prepaid business, with total revenues standing at $9.6 billion as of 2018.

Equipment Revenues

- Consolidated equipment revenues likely stood at about $20 billion in 2018 (about $10 billion each from Sprint and T-Mobile)

A Look At The Consolidated Revenues And Potential Outlook

- The combined entity would have had revenues of close to about $73 billion in 2018.

- Postpaid will account for a bulk of revenues (52% of total), followed by equipment revenues (28%) and prepaid (13%)

How Will The New T-Mobile’s Revenues Compare With Verizon & AT&T?

- While the New T-Mobile’s revenues (after prepaid business divestment) will be roughly in line with revenues from AT&T’s wireless business, it will be well below Verizon’s wireless revenue.

How Will The New T-Mobile’s Postpaid Base Stack-Up Versus Rivals?

- The new T-Mobile will likely lead AT&T in terms of postpaid subscribers (79 million vs 77 million subscribers in 2018), although it will significantly trail Verizon, which has over 113 million postpaid retail subscribers.

How Will The New T-Mobile’s Prepaid Base Compare With Rivals?

- The company will have a larger prepaid subscriber base than AT&T and Verizon, despite having to divest Sprint’s prepaid business to Dish Networks.

- The New T-Mobile’s prepaid base would stand at 22 million in 2018, compared to 17 million for AT&T and under 5 million for Verizon.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.