Will Roche Stock Rebound To Its 2022 Highs of $50?

The stock price of Roche (OTCMKTS: RHHBY) trades at $35 per share, about 33% below its peak level of over $53 seen in April 2022. In contrast, its peer Bristol Myers Squibb stock (NYSE: BMY) saw a 48% decline over this period. RHHBY stock was trading at $42 in early June 2022, just before the Fed started increasing rates, and is now 17% below that level, compared to a substantial 45% gain for the S&P 500 during this period. In this analysis of Roche’s upside post-inflation shock, we capture trends in the company’s stock during the turbulent market conditions seen over 2022. We compare these trends to the stock’s performance during the 2008 recession.

Notably, RHHBY stock has underperformed the broader market in each of the last three years. Returns for the stock were 18% in 2021, -24% in 2022, and -7% in 2023. In comparison, returns for the S&P 500 have been 27% in 2021, -19% in 2022, and 24% in 2023 — indicating that RHHBY underperformed the S&P in 2021, 2022, and 2023. In fact, consistently beating the S&P 500 — in good times and bad — has been difficult over recent years for individual stocks; for heavyweights in the Health Care sector including UNH and JNJ, and even for the megacap stars GOOG, TSLA, and MSFT. In contrast, the Trefis High Quality (HQ) Portfolio, with a collection of 30 stocks, has outperformed the S&P 500 each year over the same period. Why is that? As a group, HQ Portfolio stocks provided better returns with less risk versus the benchmark index; less of a roller-coaster ride, as evident in HQ Portfolio performance metrics.

Given the current uncertain macroeconomic environment with high oil prices and elevated interest rates, could RHHBY face a similar situation as it did in 2021, 2022, and 2023 and underperform the S&P over the next 12 months — or will it see a recovery? From a valuation perspective, we think Roche stock has a little upside. We estimate Roche’s Valuation to be $37 per share, about 6% above its current market price.

Timeline of Inflation Shock So Far:

- 2020 – early 2021: Increase in money supply to cushion the impact of lockdowns led to high demand for goods; producers unable to match up.

- Early 2021: Shipping snarls and worker shortages from the coronavirus pandemic continue to hurt supply.

- April 2021: Inflation rates cross 4% and increase rapidly.

- Early 2022: Energy and food prices spike due to the Russian invasion of Ukraine. Fed begins its rate hike process.

- June 2022: Inflation levels peak at 9% – the highest level in 40 years. The S&P 500 index declined more than 20% from peak levels.

- July – September 2022: Fed hikes interest rates aggressively – resulting in an initial recovery in the S&P 500 followed by another sharp decline.

-

October 2022 – July 2023: Fed continues rate hike process; improving market sentiments helps S&P500 recoup some of its losses.

-

Since August 2023: Fed has kept interest rates unchanged to quell fears of a recession, and it is prepared for rate cuts in 2024 and 2025.

In contrast, here’s how RHHBY stock and the broader market performed during the 2007/2008 crisis.

Timeline of 2007-08 Crisis

- 10/1/2007: Approximate pre-crisis peak in S&P 500 index

- 9/1/2008 – 10/1/2008: Accelerated market decline corresponding to Lehman bankruptcy filing (9/15/08)

- 3/1/2009: Approximate bottoming out of S&P 500 index

- 12/31/2009: Initial recovery to levels before accelerated decline (around 9/1/2008)

Roche and S&P 500 Performance During 2007-08 Crisis

RHHBY stock declined from $22 in September 2007 (pre-crisis peak) to around $13 in March 2009, as the markets bottomed out, implying it lost 41% of its pre-crisis value. It recovered to $22 in early 2010, reflecting a 69% rise between March 2009 and January 2010. The S&P 500 Index saw a decline of 51%, falling from levels of 1,540 in September 2007 to 757 in March 2009. It then rallied 48% between March 2009 and January 2010 to reach levels of 1,124.

Roche’s Fundamentals And Financial Position

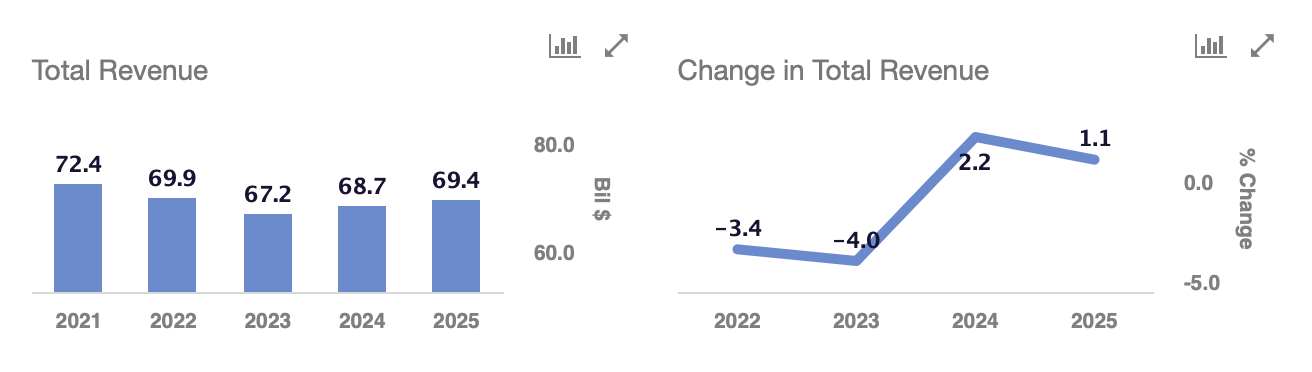

Roche’s revenue has declined 7.2% from $72.4 billion in 2021 to $67.2 billion in 2023. This can primarily be attributed to lower demand for its Covid-19 testing. Excluding the Covid-19 products, Roche has benefited from the continued uptick of its relatively new drugs, including Perjeta, Kadcyla, Alecensa, Tecentriq, Hemlibra, Vabysmo, and Ocrevus. These drugs are expected to be the key growth drivers for Roche as it battles with biosimilar competition for its previously top-selling drugs – Avastin, Herceptin, and Rituxan – which have seen their combined sales fall a significant 41% to $5.4 billion in 2023, compared to $9.1 billion in 2021. The sales of these three drugs combined peaked at $21 billion in 2018.

Roche also saw its adjusted net income margin contract by 120 bps to 24.7% over this period. Its bottom line stood at $2.58 on an adjusted basis in 2023, versus $2.72 in 2021.

Roche’s total debt increased marginally from $34.3 billion in 2021 to $34.8 billion in 2023, while its cash decreased from $14.3 billion to $12.5 billion over the same period. The company’s debt is around 15% of the company’s equity and its cash is around 12% of its assets, implying a good financial position.

Conclusion

The potential upside could be over 50% if the stock recovers from $35 currently to its pre-shock levels of $53. With the Fed’s efforts to tame runaway inflation rates helping market sentiments, we think RHHBY stock will likely see higher levels over time. The move in Roche stock will be driven by the developments around its pipeline, which includes an experimental weight-loss drug – CT-388 – which showed positive early-stage trial results. While we think that Roche’s pharmaceuticals business may see tepid growth in the near term, its diagnostics business will likely see a rebound. A blood test to support an earlier diagnosis of Alzheimer’s was designated as a breakthrough device by the U.S. FDA earlier this year.

| Returns | Jun 2024 MTD [1] |

2024 YTD [1] |

2017-24 Total [2] |

| RHHBY Return | 9% | -3% | 23% |

| S&P 500 Return | 4% | 15% | 144% |

| Trefis Reinforced Value Portfolio | 2% | 7% | 658% |

[1] Returns as of 6/21/2024

[2] Cumulative total returns since the end of 2016

Invest with Trefis Market-Beating Portfolios

See all Trefis Price Estimates