Key Takeaways and Trends from Revlon’s Q3 Earnings Release

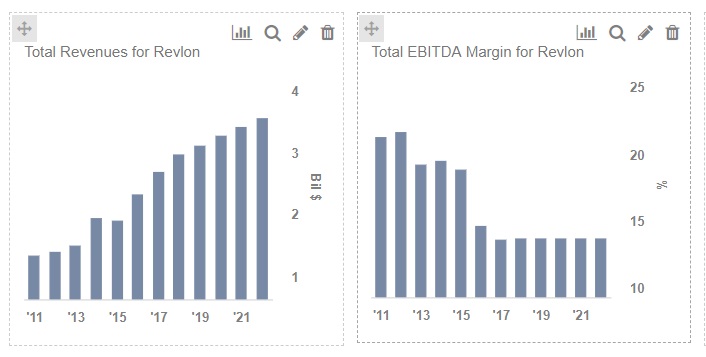

Revlon (NYSE: REV) reported its Q3 earnings recently, where its top line posted a slightly decline of 1.7% in net sales to $655.4 million, compared to $666.5 million during the prior-year period. On a constant currency basis, net sales were slightly positive y-o-y driven by strong growth in the Revlon segment in North America and growth in the Elizabeth Arden segment. Revlon’s performance has been a reflection of their continuous effort toward strengthening their business strategy and putting forth efforts to stabilize their business operations. We are seeing strong growth prospectives in their strategic focus areas as they continue to work toward building momentum across their businesses. Revlon has also announced their 2018 Optimization Program, which is expected to deliver in the range of approximately $125 million to $150 million of annualized cost reductions by the end of 2019.

Revlon’s Elizabeth Arden segment brand has performed well in Q3 driven by new launches and a strong digital presence. Its net sales rose 16.5% to $122.1 Mn, primarily driven by higher net sales of Elizabeth Arden skin care products, including Ceramide and Prevage, principally in international markets. Revlon is on track to attain integration synergies of $190 million by 2020 in restructuring and related charges in connection with implementing actions under the Elizabeth Arden Integration Program in Q3.

With the initiatives adapted by Revlon’s top management for a brand makeover, the company is positive that the new changes will now steer Revlon towards the path of growth in Q4 and beyond. Please refer to our dashboard on Revlon’s Q3 Earnings.

- Key Takeaways and Trends from Revlon’s Q4 Earnings Release

- What Was The Most Important Revenue Driver For Revlon Over The Last 3 Years?

- What Is the Fundamental Value of Revlon Based On Expected 2019 Results?

- How Will Revlon Perform In Q3 2018 Earnings

- What Are Revlon’s Key Sources Of Revenue?

- Key Takeaways and Trends From Revlon’s Q2 FY’18 Earnings

Key trends from Revlon’s Third quarter 2018 earnings are outlined below:

Segment-wise performance in Q3 – Effective January 1, 2018, Revlon began to operate under four global brand teams reporting its results under four new segments: Revlon, Elizabeth Arden, Portfolio brands, and Fragrances.

Net sales for the Revlon segment decreased by 2% y-o-y to $258.3 million, driven by a downturn in the net sales of Revlon color cosmetics and Revlon ColorSilk hair color due to the impact of service level disruptions at the Company’s Oxford, N.C. manufacturing facility with a slight growth in the North America market. Elizabeth Arden net sales, on the other hand, increased by 4.9% on a y-o-y basis to $122.1 million compared to the prior-year period, driven by an increase in net sales of Elizabeth Arden branded skin care products internationally.

Professional segment net sales decreased by 8.7% y-o-y in Q3 to $145.4 million due to weakness in net sales of American Crew men’s grooming products and Cutex nail care. Whereas the Fragrances segment net sales decreased by 15% to $94.8 million y-o-y, driven by a decline in the mass retail channel and the prestige channels.

Decline in International Markets – Total International Sales of the company saw a y-o-y decrease of 2.5% in Q3 driven by a decline in sales of Revlon, Portfolio, and Fragrance segments. On the other hand, Elizabeth Arden segment’s International net sales of $81.1 Million in the Q2 of 2018 increased by 23.0% compared to the prior-year period, primarily driven by higher net sales of skin care products within the EMEA and Asia regions.

Digital Initiatives – Revlon is getting more aggressive in digital and e-commerce initiatives by setting up a new team of digital professionals, realizing the importance of digital progress and social media in a brand’s reach and popularity among its clientele. Along with increasing ad investments, the company is also shifting most of its campaigns to the digital platform. Recently, Revlon collaborated with a leading digital consultancy, Sapient Razorfish, to create a stronger digital presence. These factors are positively working in its favor as an increasing number of customers are buying beauty products online.

Outlook for fiscal 2018 –Revlon is expected to reap stronger results in Q4 and beyond from the Elizabeth Arden integration and thus post healthier results in the coming quarters.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.