Key Takeaways and Trends From Rite Aid’s Q2 FY’19 Earnings

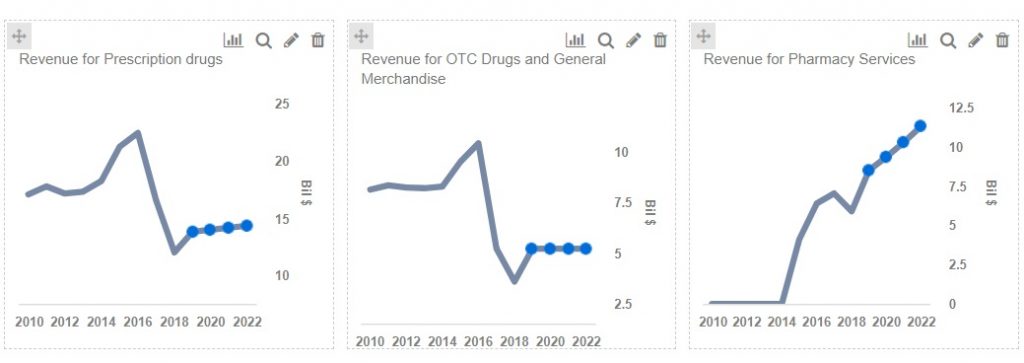

Rite Aid‘s (NYSE: RAD) share price has been a reflection of its weak performance in FY 2018 that was further worsened by its poor pharmacy reimbursement. With a slow FY 2018 Rite Aid’s performance in the recent Q2 2019 was as anticipated, where its top line rose to $5.4 billion compared to revenues of $5.3 billion in the prior year. The major driver for this increase in sales was the growth in its Retail Pharmacy Segment backed by an upward trend in its same stores sales, while its Revenues in the Pharmacy Services Segment also saw a 4.6% growth compared to the prior year. Rite Aid has also recently made changes in its management with overhauling its board of directors a month after it abandoned its merger with grocery chain Albertsons.

On the other hand in Q2, RAD incurred a Net loss of $352.3 Mn from the continuing operations primarily due to a charge of $282.6 million, net of tax, for the impairment of intangible assets, including goodwill, related to their Pharmacy Services Segment. The company remodeled 33 stores, bringing the total number of wellness stores to 1,720, closed 8 stores and opened 1 store, resulting in a total store count of 2,526 at the end of the Q2.

Looking ahead for 2019, the company expects revenues to be between the band of $21.7 billion and $22.1 billion with same-store sales to be flat or increase by 1 percent, adjusted EBITDA in the range of $540 million to $590 million, and capital expenditures to total about $250 million. It is focused on long-term growth initiatives of building significant momentum for the future as they continue to work to meet the evolving needs of their customers and create value for shareholders. Please refer to our dashboard analysis on Takeaways From Rite Aid’s Q2 2019 Earnings.

- Rite Aid Stock Could Move Higher From $10

- How Has Rite Aid Performed In FY 2018?

- What Are The Chances Of Rite Aid’s Recovery From Its Current Slump?

- Why Is Rite Aid’s Stock Performing So Poorly?

- Walgreens And Rite Aid Deal Is Back On Track And Both The Companies Are Expected To Gain

- Walgreens, Rite Aid Earnings And The End Of The Merger

Segment-Wise Performance –

- Retail Pharmacy Segment -Revenue was $3.9 billion and increased 0.2 % compared to the prior year period, primarily as a result of the increase in same store sales partially offset by a reduction in store count.

- Pharmacy Services Segment – Revenues were $1.6 billion,which increased by 4.6% compared to the prior year, driven by an increase in commercial business and increase in the composition of Medicare Part D. Pharmacy sales included an approximate 107 basis point negative impact from new generic introductions. The number of prescriptions filled in same stores, adjusted to 30-day equivalents, increased 1.1% over the prior year due in part to their exclusion from certain pharmacy networks that Rite Aid participated in, in the prior year. Also, prescription sales from continuing operations accounted for 66.4 percent of total drugstore sales.

Rite Aid abandons its merger with grocery chain Albertsons – The $24 Bn deal was abandoned just a year after regulators thwarted Walgreens Boots Alliance’s acquisition of Rite Aid. This deal, announced in February, had faced push-back from a number of retail investors as well as top ten shareholder, Highfields Capital Management.

If the collaborative effort had gone ahead, Rite Aid shareholders would have owned some 30% of the combined entity. The deal was partially intended to increase foot traffic to Albertsons’ in-store pharmacies (which would have been re-branded to Rite Aid) and to increase the likelihood that customers heading to pick up their medication would be tempted to pick up some groceries on their way out. It would have also facilitated Albertsons’ largest investors, including private equity firm Cerberus, to cash out of their investments in the grocery chain. Rite Aid, meanwhile, would have benefited from Albertsons’ digital know-how and financial strength.

Rite Aid overhauls board – Rite Aid plans to overhaul its board of directors a month after it abandoned the planned merger with Albertsons. The company is expected to separate the CEO and chairman position and its shareholders will vote on the proposed changes. Director Bruce Bodaken will become chairman and John Standley will remain CEO. Additionally, Rite Aid nominated three independent directors — Robert E. Knowling Jr., Louis P. Miramontes, and Arun Nayar — to the board. These changes will strengthen and enhance the Board’s governance oversight consistent with the company’s commitment to align its interests with those of its stockholders.

Outlook for full fiscal 2019 – Rite Aid one of the nation’s leading drugstore chains with 2,548 stores in 19 states. The company expects its net revenue to be between $21.7 billion and $22.1 billion in fiscal 2019, with same store sales expected to range from an increase of 0.0 % to an increase of 1.0% over fiscal 2018. Adjusted EPS is expected to be between $0.02 and $0.06. This performance will be driven by the anticipated benefits from generic drug purchasing efficiencies, a reimbursement rate environment that will be somewhat more stable than fiscal 2018, also the above highlighted recent changes in its Board will grow sales and drive operational efficiencies.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own