How Has Rite Aid Performed In FY 2018?

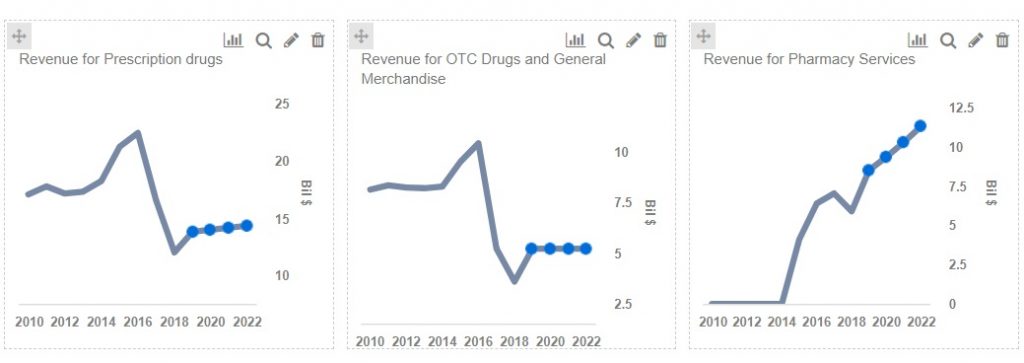

Rite Aid‘s (NYSE: RAD) share price has been a reflection of its weak performance in FY 2018 that was further worsened by its poor pharmacy reimbursement. FY 2018 has been a slow year for Rite Aid as its top line dipped by 6.1% to $21.5 billion compared to revenues of $22.9 billion in the prior year. Its Retail Pharmacy Segment revenues decreased 5.6% to $15.8 billion y-o-y, whereas the Revenues in the Pharmacy Services Segment saw a decrease of 7.8% compared to the prior year to $5.9 billion. During 2018, the company relocated 20 stores, remodeled 179 stores, expanded 3 stores, opened 3 stores, sold 1,651 stores to WBA, and closed 57 stores.

Our interactive dashboard here outlines the key takeaways from Rite Aid’s performance in FY 2018.

- Rite Aid Stock Could Move Higher From $10

- Key Takeaways and Trends From Rite Aid’s Q2 FY’19 Earnings

- What Are The Chances Of Rite Aid’s Recovery From Its Current Slump?

- Why Is Rite Aid’s Stock Performing So Poorly?

- Walgreens And Rite Aid Deal Is Back On Track And Both The Companies Are Expected To Gain

- Walgreens, Rite Aid Earnings And The End Of The Merger

Segment-wise performance

- Retail Pharmacy Segment – Revenues were $15.8 billion, decreasing 5.6 % compared to the prior year period, primarily as a result of the extra week in the prior year and a decline in same store sales. Same store sales for the year decreased 2.9 percent, consisting of a 3.9 percent decrease in pharmacy sales and a 0.8 percent decrease in front end sales.

- Pharmacy Services Segment – Revenues were $5.9 billion, decreased 7.8% compared to the prior year, which was due to a decline in commercial business and to the change in the composition of Medicare Part D. Pharmacy sales included an approximate 187 basis point negative impact from new generic introductions. The number of prescriptions filled in same stores, adjusted to 30-day equivalents, decreased 1.8 percent over the prior year due in part to their exclusion from certain pharmacy networks that Rite Aid participated in, in the prior year. Also, prescription sales from continuing operations accounted for 65.9 percent of total drugstore sales.

Outlook for 2019 –

Rite Aid one of the nation’s leading drugstore chains with 2,548 stores in 19 states. The company expects its net revenue to be between $21.7 billion and $22.1 billion in fiscal 2019, with same store sales expected to range from an increase of 0.0 % to an increase of 1.0% over fiscal 2018. Adjusted EPS is expected to be between $0.02 and $0.06. This performance will be driven by the anticipated benefits from generic drug purchasing efficiencies, a reimbursement rate environment that will be somewhat more stable than fiscal 2018, TSA fees under the agreement with WBA, and other initiatives will grow sales and drive operational efficiencies. The pending transaction with Albertsons will also favorably impact the top line in the coming period.

Rite Aid Merger with Albertsons –

As announced on February 20, 2018, Rite Aid and Albertsons entered into a definitive agreement under which Albertsons will merge with Rite Aid. The merger is expected to close early in the second half of calendar year 2018, subject to the approval of Rite Aid’s shareholders, regulatory approvals, and other customary closing conditions as HSR Waiting Period for Albertsons Companies, Inc. (“Albertsons”). Once completed this will be a unique combination of grocery and pharmacy that will be well positioned to deliver a differentiated experience in 2018 and beyond.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.