Down 8% YTD, Will Restaurant Brands Stock Recover Following Q2 Results?

Restaurant Brands International is one of the largest fast-food restaurant chains in the world that operates Burger King, Tim Hortons, Popeyes, and, since late 2021, Firehouse Subs. The company is scheduled to report its fiscal second-quarter results on Thursday, August 8. We expect Restaurant Brands International stock (NYSE: QSR) to see little to no movement with revenue beating but earnings missing expectations marginally in the second quarter results. QSR stock has declined from around $78 to $72 year-t0-date, underperforming the broader indices, with the S&P growing about 9% over the same period. In comparison, QSR’s peer Starbucks (NASDAQ: SBUX) stock declined 20% year-to-date to $75. QSR’s stock decline can be attributed to investors’ concern about rising costs and their effects on the company’s bottom line. Tim Horton’s, Popeyes, and Firehouse Subs are far less penetrated internationally than McDonald’s or Burger King. That means more room to open new restaurants and a longer runway for revenue growth. The revenue stream of QSR is directly influenced by the system sales it generates across its brands, which can be increased by growing restaurant sales or by adding as many restaurants as possible. It should be noted that the company’s Q1 net restaurant growth expanded by 3.9% compared to the previous year (contributing to a total count of 31,113 restaurants globally) – despite cost inflation. [The system-wide sales are different from revenues in that they refer to sales for all franchise restaurants, while revenues include supply chain sales, as well as royalty, property, and advertising revenues from the franchises.]

QSR stock has witnessed gains of 15% from levels of $60 in early January 2021 to around $72 now, vs. an increase of about 40% for the S&P 500 over this roughly 3-year period. However, the increase in QSR stock has been far from consistent. Returns for the stock were -1% in 2021, 7% in 2022, and 21% in 2023. In comparison, returns for the S&P 500 have been 27% in 2021, -19% in 2022, and 24% in 2023 – indicating that QSR underperformed the S&P in 2021 and 2023.

In fact, consistently beating the S&P 500 – in good times and bad – has been difficult over recent years for individual stocks; for heavyweights in the Consumer Discretionary sector including AMZN, TSLA, and HD, and even for the megacap stars GOOG, MSFT, and AAPL. In contrast, the Trefis High Quality (HQ) Portfolio, with a collection of 30 stocks, has outperformed the S&P 500 each year over the same period. Why is that? As a group, HQ Portfolio stocks provided better returns with less risk versus the benchmark index; less of a roller-coaster ride as evident in HQ Portfolio performance metrics. Given the current uncertain macroeconomic environment with high oil prices and elevated interest rates, could QSR face a similar situation as it did in 2021 and 2023 and underperform the S&P over the next 12 months – or will it see a strong jump?

Our forecast indicates that Restaurant Brands’ valuation is $73 per share, which is nearly in line with the current market price. Look at our interactive dashboard analysis on Restaurant Brands Earnings Preview: What To Expect in Fiscal Q2? for more details.

- Down 10% This Year, What’s Next For Restaurant Brands Stock?

- Restaurant Brands Stock Down 13% This Year, What’s Next?

- Down 6% YTD, Will Restaurant Brands Stock Gain Following Q1 Results?

- Will Q4 Results Help Extend The 20% Gain In Restaurant Brands’ Stock Since Early 2023?

- After A 9% Top-Line Growth In Q2 Will Restaurant Brands Stock Deliver Another Strong Quarter?

- What To Expect From Restaurant Brands’ Stock Past Q2 Results?

(1) Revenues expected to come in slightly above the consensus estimates

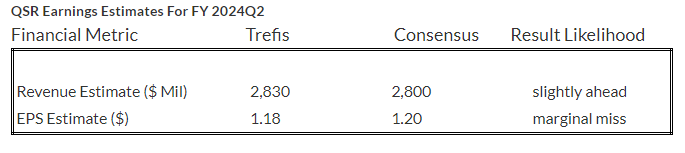

Trefis estimates QSR’s Q2 2024 revenues to be around $2.8 Bil, slightly above the consensus estimate. QSR’s Q1 revenues grew 9% y-o-y to $1.74 billion, fueled by 4.6% growth in consolidated comparable sales – notable growth across major segments including 7.5% at Tim Hortons Canada and 6.2% at Popeyes Louisiana Kitchen U.S. In the first quarter, same-store sales at Burger King grew 3.4%, while Tim Hortons (a coffee chain based out of Canada) comp sales grew 6.9%, and Popeyes (a fried chicken chain) comp sales rose 5.7%, and International segment comps grew 4.2% in Q1. For the full year 2024, we expect QSR’s revenues to grow almost 15% y-o-y to $8 billion.

2) EPS is also likely to miss consensus estimates marginally

QSR’s Q2 2024 earnings per share (EPS) is expected to come in at $1.18 per Trefis analysis, marginally below the consensus estimate. On the bottom line, the company’s earnings grew 18% y-o-y to 72 cents in the first quarter. And, its adjusted EBITDA grew 7% y-o-y to $627 million over the same period.

(3) Stock price estimate in line with the current market price

Going by our QSR’s valuation, with an EPS estimate of around $3.44 and a P/E multiple of 21.1x in fiscal 2024, this translates into a price of $73, which is around the current market price.

It is helpful to see how its peers stack up. QSR Peers shows how Restaurant Brands’ stock compares against peers on metrics that matter. You will find other useful comparisons for companies across industries at Peer Comparisons.

| Returns | Aug 2024 MTD [1] |

2024 YTD [1] |

2017-24 Total [2] |

| QSR Return | 2% | -8% | 50% |

| S&P 500 Return | -6% | 9% | 132% |

| Trefis Reinforced Value Portfolio | -4% | 3% | 662% |

[1] Returns as of 8/7/2024

[2] Cumulative total returns since the end of 2016

Invest with Trefis Market-Beating Portfolios