Restaurant Brands International: Three Factors That Can Decide The Stock’s Fate

Can Q3 results provide Restaurant Brands International the necessary momentum, which can drive the stock price?

Restaurant Brands International (NYSE:QSR) is scheduled to report its third quarter earnings report for the fiscal 2015 on October 27. [1] Riding high on its accelerated expansion strategy for both the brands, Burger King and Tim Hortons, the company is expecting yet another solid quarter. The market is speculating for the company to report an EPS of $0.29 for the quarter on $1.05 billion in revenues. [2]

The company’s stock, however, has not reflected the positive growth that the company has been showing over the past two quarters. Since the onset of this year, the stock has been struggling in the range $38-$42. Perhaps investors are waiting for a big result, with some positive guidance. In the Q3 results, investors will have their eyes on three things: comparable sales, restaurant development growth, and guidance.

- Down 10% This Year, What’s Next For Restaurant Brands Stock?

- Down 8% YTD, Will Restaurant Brands Stock Recover Following Q2 Results?

- Restaurant Brands Stock Down 13% This Year, What’s Next?

- Down 6% YTD, Will Restaurant Brands Stock Gain Following Q1 Results?

- Will Q4 Results Help Extend The 20% Gain In Restaurant Brands’ Stock Since Early 2023?

- After A 9% Top-Line Growth In Q2 Will Restaurant Brands Stock Deliver Another Strong Quarter?

Trefis has a $42 price estimate for Restaurant Brands International, which is roughly 12% above the current market price.

See Our Complete Analysis For Restaurant Brands International

It’s All About Comparable Sales

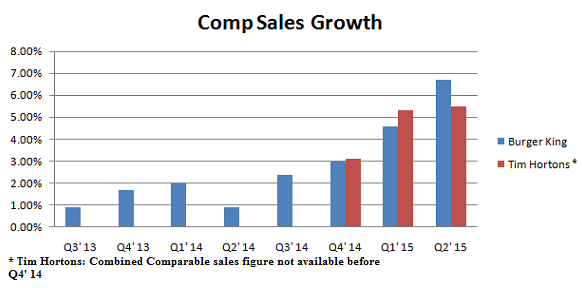

One of the most important metrics for a restaurant company is its comparable sales growth. Both the brands, Burger King and Tim Hortons, have been posting positive comparable sales growth figures over the last 8 quarters.

After the merger of the two brands, their comparable sales growth have increased, as is clear from the chart above. Burger King, with its strength in the breakfast market, has been posting robust system-wide sales growth since the onset of this year. In Q2, the burger brand posted a massive 11.6% year-over-year (y-o-y) increase in its system-wide sales. (Read: Restaurant Brands International: Innovative menu options and strong new store development drives Q2 growth) Furthermore, new menu additions every quarter has been delivering the required growth, attracting more customers.

On the other hand, Tim Hortons’ system-wide sales grew 8.4% y-o-y in Q2 2015, driven by innovative menu items in both the food and beverage segments, especially Dark Roast coffee and the Crispy Chicken Sandwich. Compared to pro forma second quarter 2014 figures, Tim Hortons’ adjusted EBIDTA grew roughly 23% on an organic basis. Tim Hortons has always been consistent in introducing new innovative menu options to cater to the needs of customers in every season year round. (Ref: 3)

Strong comparable sales growth in the third quarter might provide a good platform for the company to post excellent fiscal year results. According to Trefis estimates, Burger King net revenues might grow by 5.8% y-o-y in the fiscal 2015.

RBI Net Restaurant Development: Right On Track

During the last two earnings calls, the company has been stressing restaurant growth in high potential markets, more than any other thing. With an accelerated pace of development, the company has been keeping its investors pleased. Since the start of this year, Burger King has added 156 net new restaurants, including those in new markets, such as South Africa, Poland, Italy, and India. [3] The company thinks of India as its next big market for the brand. Furthermore, Burger King plans on expanding its presence in Southern and Eastern Europe. On the other hand, Tim Hortons added net 105 new restaurants in the year 2015, and plans to further accelerate this development.

Recently, the company signed an offer letter with Qualium Investissement, a leading private equity firm in France, and the owner of Quick Group, for the acquisition of the Quick hamburger fast food chain. [4] This deal aims at expanding Burger King’s presence in one of the lucrative markets in Europe. Currently, there are 25 Burger King Restaurants in France, and they posted roughly €100 million revenues in 2014. With the proposed acquisition, the company aims at converting the Quick restaurants in France to Burger King Restaurants. This will make Restaurant Brands International the second largest quick service restaurant in France, behind McDonald’s, which has more than 1,300 restaurants in the country. (Read: Burger King steps up restaurant growth in France) The impact of the change in number of Burger King’s franchised restaurants on the company’s valuation can be analyzed below:

Additionally, earlier this month, the company announced its expansion plans for Tim Hortons brand in the Cincinnati area. [5]

Guidance Needs To be Strong

One thing that every restaurant operator in the industry, especially those chains that have big future plans and strong brand appeal, should keep in mind is its guidance for the coming quarters. Although, Restaurant Brands International has been providing positive guidance every quarter, it has not been enough to consistently please the investors. Restaurant Brands International has been posting strong top-line growth and solid restaurant development with future plans of tapping into some of the biggest and lucrative markets. Investors would be, no doubt, expecting better guidance for the fourth quarter and fiscal year 2015. Should the company manage to post robust growth in all sectors we can expect them to update the full year guidance positively, too.

A combination of all of the above three factors will determine the fate of QSR’s stock in the coming quarter.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

Notes:- Restaurant Brands International Inc. to report third quarter 2015 results on October 27, 2015 [↩]

- Restaurant Brands International, Yahoo finance, analyst estimates [↩]

- Restaurant Brands International, Q2 2015 earnings call transcript [↩]

- Burger King France shareholders announce the proposed acquisition of Quick Group; will become the second largest QSR chain in France [↩]

- Restaurant Brands International Inc. announces accelerated expansion plans of Tim Hortons in the Cincinnati area [↩]