CarParts.com To Benefit From Shift To E-commerce?

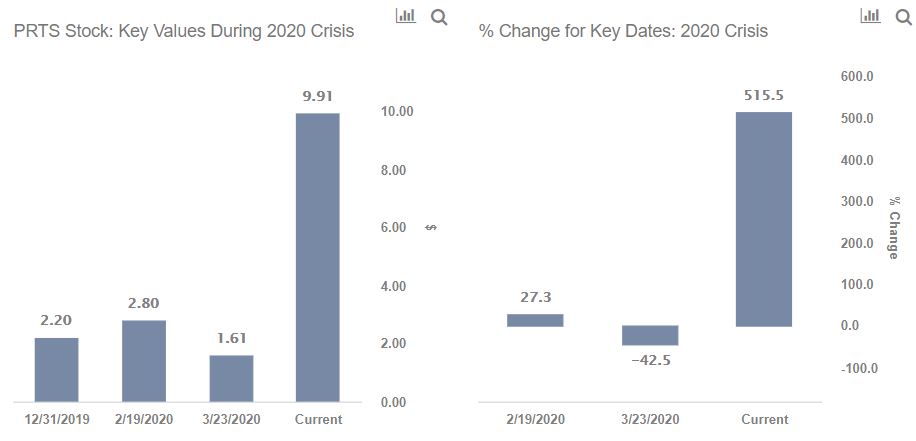

CarParts.com’s stock (formerly U.S. Auto Parts Network) (NASDAQ: PRTS) has rallied around 500% since 23rd March (vs. about 52% for the S&P 500) to its current level near $10. This is after falling to $2 in late March, as a rapid increase in the number of Covid-19 cases outside China spooked investors, and resulted in heightened fears of an imminent global economic downturn. The stock hit an all-time high recently. Are the gains warranted or are investors getting ahead of themselves? We believe that the stock recovery is justified, but the stock has very small upside in the near term. Why is that? One of the reasons for the high recovery was the Fed’s multi-billion dollar stimulus package announced on March 23rd which lifted market sentiments. The stock was boosted during the pandemic as people are shifting to e-commerce for buying car parts as they are averse to traditional in-person buys. In June 2020 the company announced it would open a new 210,000 square foot distribution center in Grand Prairie, Texas which will create a minimum of 150 new jobs and $10 million in economic impact in its first 18 months. We also have a detailed comparison of CarParts.com stock performance during the current crisis with that during the 2008 recession in our dashboard analysis.

How Did CarParts.com Fare During 2008 Downturn?

We see PRTS’s stock declined from levels of around $9 in October 2007 (the pre-crisis peak) to roughly $1 in March 2009 (as the markets bottomed out) – implying that the stock lost as much as 85% of its value from its approximate pre-crisis peak. This marked a drop that was higher than the broader S&P, which fell by about 51%.

Further, PRTS’s stock rose steadily post the 2008 crisis to about $5 in early 2010 – rising by about 300% between March 2009 and January 2010, as against the S&P which bounced back by about 48% over the same period.

In comparison, this year PRTS’s stock lost 43% of its value between 19th February and 23rd March 2020, and has already recovered nearly 515% since then. The S&P in comparison fell by about 34% and rebounded by about 52%.

Is The Recovery Warranted & Can We Expect Further Gains?

The rally across industries over recent months can primarily be attributed to the Fed stimulus which largely quieted investor concerns about the near-term survival of companies. The flattening of Covid cases in the worst hit U.S. and European cities is also giving investors confidence that developed markets have put the worst of the pandemic behind them.

The global spread of coronavirus has led to lockdown in various cities across the globe, which has affected industrial and economic activity. This is likely to adversely affect consumption and consumer spending. As people are currently averse to in-person buying and public transport, there has been an increase in the demand of online car purchase (28% of Total retail sales in Q2 2020). This is expected to lead to higher online demand for car parts which the company is well placed to take advantage of. CarParts.com reported record Revenue at $119 million (up 61% y-o-y) and Gross Profit at $41 million (up 88% y-o-y) for Q2 2020.

Over the coming weeks, we expect continued improvement in demand and subdued growth in the number of new Covid-19 cases in the U.S. to boost market expectations. Following the Fed stimulus — which helped set a floor on fear — the market has been willing to “look through” the current weak period and take a longer-term view, with investors focusing their attention on 2021 results.

So, while CarParts.com seems to have very little upside in the near term, what if you’re looking for a more balanced portfolio instead? Here’s a top quality portfolio to outperform the market, with over 100% return since 2016, versus 55% for the S&P 500. Comprised of companies with strong revenue growth, healthy profits, lots of cash, and low risk. It has outperformed the broader market year after year, consistently.

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams