What Do Falling Oil Prices Have To Do With Cigarette Prices In Saudi Arabia?

Saudi Arabia is slated to impose hefty taxes on tobacco products, sugary soft drinks, and energy drinks in the quarter starting in April. A 100% tax will be placed on cigarettes and energy drinks, as well as a 50% tax on soft drinks. These taxes were first proposed by the Gulf Cooperation Council (GCC) in 2015, but Saudi Arabia only recently signed an agreement to put them into effect. The kingdom is also the first GCC member to announce a specific timeline for the implementation of the taxes. In addition to these taxes, the new budget has called for a number of other significant changes, including a 5% value-added tax to be applied on certain goods, stemming from the collapse in oil prices.

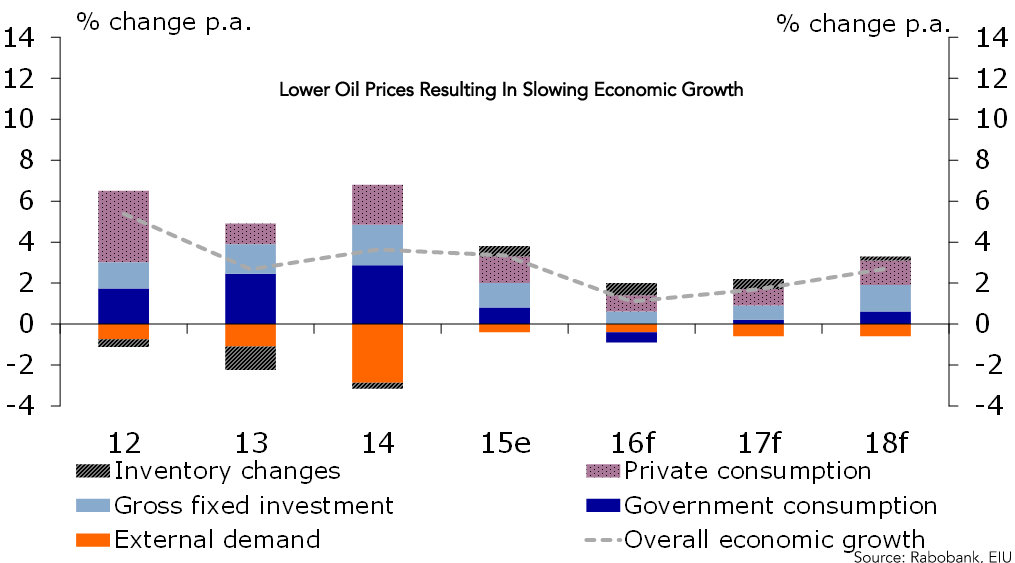

Oil Price Fall Wreaking Havoc On Saudi Arabia

Saudi Arabia is the largest oil exporter in the world, and is the biggest economy in the Arab region. However, its coffers have taken a hit amid the oil price free-fall, with the price per barrel dropping from $115 in mid-2014 to the early $50s range currently. Prices dipped to the mid-$20s range in January 2016, hitting 12-year lows. As a consequence of the low oil prices, Saudi Arabia posted record high budget deficits of $98 billion in 2015, with an expected $87 billion deficit forecast for 2016. This forced the kingdom to announce its ambitious agenda, called Vision 2020, aimed at reducing its high dependence on oil by changing the way it generates its income.

This plan focuses on three major areas. First, in order to increase its current investment income, and to diversify its national wealth, the kingdom would hold a first international bond sale, raising $17.5 billion. An IPO of a small part of Saudi-Aramco, the giant oil conglomerate, is also set to be held. Second, austerity measures were also implemented, such as reducing fuel, water, and electricity subsidies, and salary cuts for government employees. Third, the plan seeks to enhance the generation of non-oil revenues. This is to be done by raising the fees and tariffs on public services, and the introduction of the value added tax. It is this third measure that involves the implementation of the tax on tobacco products.

Tax Hikes To Cause Cigarette Volume Growth To Slow Down

Saudi Arabia has one of the world’s highest rates of smokers, as 14% of its teenagers and 7% of the women smoke. Low cigarette prices in the region have contributed to the increasing number of smokers, especially among teenagers and those in the low income category. The kingdom has been one of the fastest growing tobacco markets recently, and is expected to grow at a CAGR of 4.5% over the period 2014 to 2019.

However, with the imposition of taxes on cigarettes, the unit prices are expected to increase. This would prompt a number of smokers to either quit, or reduce their intake, causing a slowdown in the volume growth. While the cigarette prices would still be low, as compared to those in other countries, the move is also a step towards combating the unhealthy habit. As the VAT will be imposed on the import cost, it would not result in the doubling of the present price of cigarettes.

The rise in prices may also result in a shift to economy brands, since tobacco will become less affordable to middle and low income consumers. Philip Morris International (NYSE:PM) is the market leader in the country, in terms of retail volume, followed by British American Tobacco. These companies would need to ensure the availability of their brands at different price points, in order to meet the changing needs and preferences of the consumers.

See Our Complete Analysis For Philip Morris International

Have more questions on Philip Morris? See the links below:

- iQOS’ Impressive Growth Story Continues In The Fourth Quarter For Philip Morris

- Can iQOS Continue Its Tremendous Momentum For Philip Morris In Its Fourth Quarter?

- How Is Philip Morris Working Towards A Smoke-Free Future?

- How Will A Ban On Foreign Tobacco Investment In India Affect Philip Morris?

- EU Comes Up With A Plan To Prevent Illicit Cigarette Trade

- Is Japan The New Battleground For Tobacco Firms?

- Forecasting An End Of Cigarettes, Philip Morris Launches iQOS In The UK

- BAT’s Possible Acquisition Of Reynolds To Shake Up The Tobacco Industry

- Philip Morris Q3 2016: Flat Earnings Driven By Shipment Volume Decline

- Will Philip Morris Beat Expectations This Earnings Season?

- What Factors Will Ensure Growth For Philip Morris In Asia?

- Philip Morris Disappoints Investors With Its Dividend Hike

- What Are The Risks Associated With Holding Philip Morris’ Stock?

- Can iQOS Be A Key Growth Driver For Philip Morris In The Future?

- Philip Morris Q2 2016 Earnings: Currency Headwinds Leave The Company Flat

- How Will Philip Morris Perform In Q2 2016?

- Which Is A Better Dividend Bet – Altria Or Philip Morris?

- What Is The State Of The Illicit Cigarette Market In The European Union?

- How Will The Brexit Impact Philip Morris?

- What Effect Will The Plain Packaging Ruling In Canada Have On Philip Morris?

- What Effect Will A Tobacco Tax Hike Have In New Zealand?

- How Will Philip Morris Perform In 2016?

- Why Has Philip Morris’ Price Risen ~17% This Year Despite An Earnings Miss?

- Philip Morris Misses Q1 Revenue And EPS Estimates

- Will Philip Morris Beat Expectations This Earnings Season?

- How Did Philip Morris Perform In Russia, Given The Currency Headwinds And Excise Tax Rise?

- How Has Philip Morris Fared In Comparison To Its Peers?

- How Will Philip Morris’ Revenue And EBITDA Change In The Next 3 Years?

- Philip Morris: Year 2015 In Review

- What is Philip Morris’ Fundamental Value Based On Expected 2016 Results?

- What is Philip Morris’ Revenue And EBITDA Breakdown?

- What’s Behind The 70% Rise In Philip Morris Stock?

- Higher HTU Sales To Drive Philip Morris’ Q2?

- With 10% Gains This Year 3M Stock Appears To Be A Better Pick Over Philip Morris

- Is Philip Morris Stock A Better Pick Over Union Pacific?

- IQOS Helps Philip Morris Navigate Well In Q1

- Should You Pick Philip Morris Stock After 7% Fall This Year And Q4 Miss?

Notes:

2) Figures mentioned are approximate values to help our readers remember the key concepts more

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research