AMD Stock Up 5x More Than Nvidia- Make Sense To You?

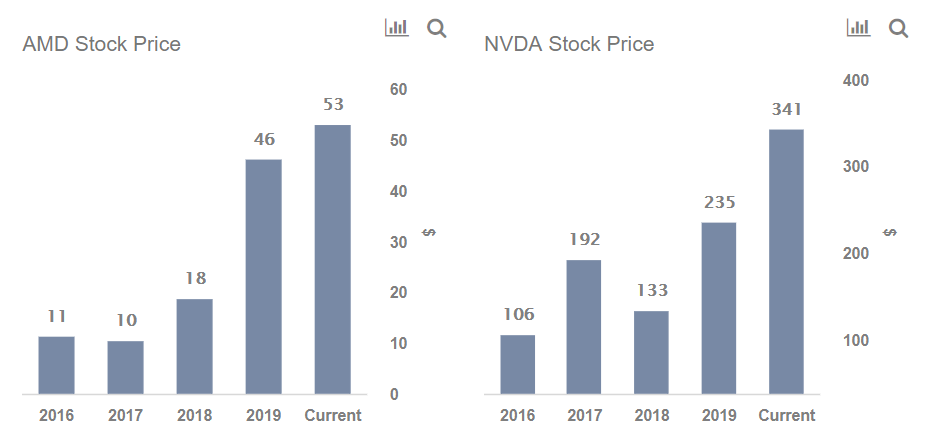

The stock price for Nvidia (NASDAQ: NVDA) is up roughly 78% since the beginning of 2018. In comparison, Advanced Micro Devices (NASDAQ :AMD) has seen its stock grow by a staggering 430% during the same period. The difference in the stock price growth makes sense when we look at the net margin growth for AMD, which went from -11.5% in 2017 to 5.2% in 2019. In comparison, Nvidia saw its margins rise from 24.1% in 2017 to 35.3% in 2019, but dropped back to around 25.6% for FY ’20, on the back of a slight drop in revenue combined with a rise in R&D expenses, owing to its data center business.

Even then, Nvidia’s revenue growth since 2017, came in at 70% compared to around 50% for AMD, and its margins stand at 5x that of AMD (25.6% vs 5.2%). Does that make sense? We don’t think it does, and we believe Nvidia is a good investment at the moment compared to AMD, as investors seek to ride the rally in technology stocks, especially gaming and cloud storage, in the current Covid-19 crisis. Companies such as Nvidia and AMD stand to benefit in the current crisis, as the demand for gaming platforms and devices is on the rise, given that more people are staying indoors. Our dashboard, Nvidia vs. AMD: Does The Stock Price Movement Make Sense?, has the underlying numbers.

Nvidia Has Witnessed Strong Top Line Growth, And Further Stands To Benefit More Than AMD In The Current Crisis

Let’s look at both companies a little more closely. AMD is a GPU manufacturer, whose Ryzen and Radeon processors have helped AMD’s revenue jump 1.5x in a span of 2 years. Furthermore, the company saw its net margins grow from -11.5% in 2017 to 5.2% in 2019, owing to a rise in the selling price of its products. Also, AMD reported strong numbers for Q1 ’20 in late April, with revenue coming in at $1.79 billion vs $1.27 billion in Q1 ’19, and net income coming in at $162 million vs $16 million.

Nvidia, too, is a fast growing gaming company in the GPU segment, and the data center segment, which has been seeing surging demand of late. Nvidia’s revenue grew 1.58x between FY’17 and FY’20. Further, revenue rose sharply in Q1 ’21, coming in at $3.08 billion vs $2.22 billion, up 38% Y-o-Y. Net income more than doubled from $394 million to $917 million over the same period, as operating expenses didn’t grow in proportion to revenue. This growth is expected to continue further, as demand for Nvidia’s high margin data center business has been rising over the past few months, and is expected to rise further going forward.

We believe Nvidia’s business looks quite attractive compared to AMD, especially at current valuations. Nvidia trades at a 74.3x P/E multiple, compared to AMD’s stock trading at 170.1x. Both companies have seen a steady rise in P/E Multiple with AMD’s P/E rising from 54x in 2018 to 170x, and Nvidia’s P/E rising from 20x to 74x over the same period.

Looking for more technology stocks insights? See how Qualcomm could bounce back from the Covid-19 crisis in our interactive dashboard, 20% Gain Possible For Qualcomm Stock Post-Covid? In 2008 It Lost 18.7% And Then Gained 40.0%

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams