Health Revolution: Healthy For Some, Unhealthy For Others

The health revolution has taken the U.S. by storm, as is evident from the paradigm shift in two indicative industries, fast food and athletic wear. Not only are people more aware of the detrimental effects that fast food have on their well being over the long term, but also how it diminishes their disposable income. With a profusion of instructive videos and educational material easily accessible via the internet and social media, eating well and being fit has emerged as key new fads.

Following the recession, the private sector has stepped up its spending on consumer healthcare products. The introduction of devices like Apple’s iWatch, Samsung’s Galaxy Gear, and apps like Nike‘s (NYSE:NKE) Nike+ and Under Armour‘s (NYSE:UA) MapMyFitness, can be seen as complementary to fitness and training apparel. In the wake of the Affordable Care Act, consumers are paying a higher share of their medical costs than they did in the past. This has resulted in increasing health consciousness in the society, causing precautionary steps to be taken far in advance to avoid those prohibitive and potentially fatal costs. These trends, in turn, are changing the dynamics of the restaurant and athletic wear industry.

In the following note, we analyze how the “health fad” is transforming the spending pattern within the fast food and atheltic wear segment.

- Don’t Do It? Nike Stock Looks Less Attractive Than These Two Alternatives

- 25% Gains Left For Nike’s Stock?

- Down 13% This Year, Will Nike Stock Recover Following Q4 Results?

- Can Nike Stock Nearly Double To Pre-Inflation Shock Highs Of Over $175?

- Down 19% In Last Twelve Months, Will Nike Stock Gain Following Q3 Results?

- Nike Stock Could Rise 70% If It Recovers To Pre-Inflation Shock Highs

Is the health fad real?

In the recent recent past, there has been a general shifting trend to eat and live healthier in the U.S. With a rising awareness of problems associated with obesity and diabetes, fast food visits have been on a constant decline. Furthermore, soda sales have dropped for ten consecutive years now. People are now more focused on eating well and living a healthy lifestyle. In this respect, gym membership in the U.S. has also seen significant increases, rising from about 41.3 million in 2004 to 55 million in 2015. ((Number of Gym Memberships in the U.S. from 2000-2015, www.statista.com)) Increased gym memberships have led to greater sales of gym equipment and athletic apparel. This has benefited companies like Nike and Under Armour greatly.

Furthermore, the onus of this trend can be quite obviously traced back to the “rise of millennials”. The millennials are now the largest demographic in the U.S., comprising close to 28% of the total population. Companies are scrambling to change their strategies to best accommodate, potentially, the most important demographic at the moment. With the rise of the internet and wide usage of social media platforms, the technologically savvy millennials are more aware of themselves and their bodies.

Emergence of atheleisure

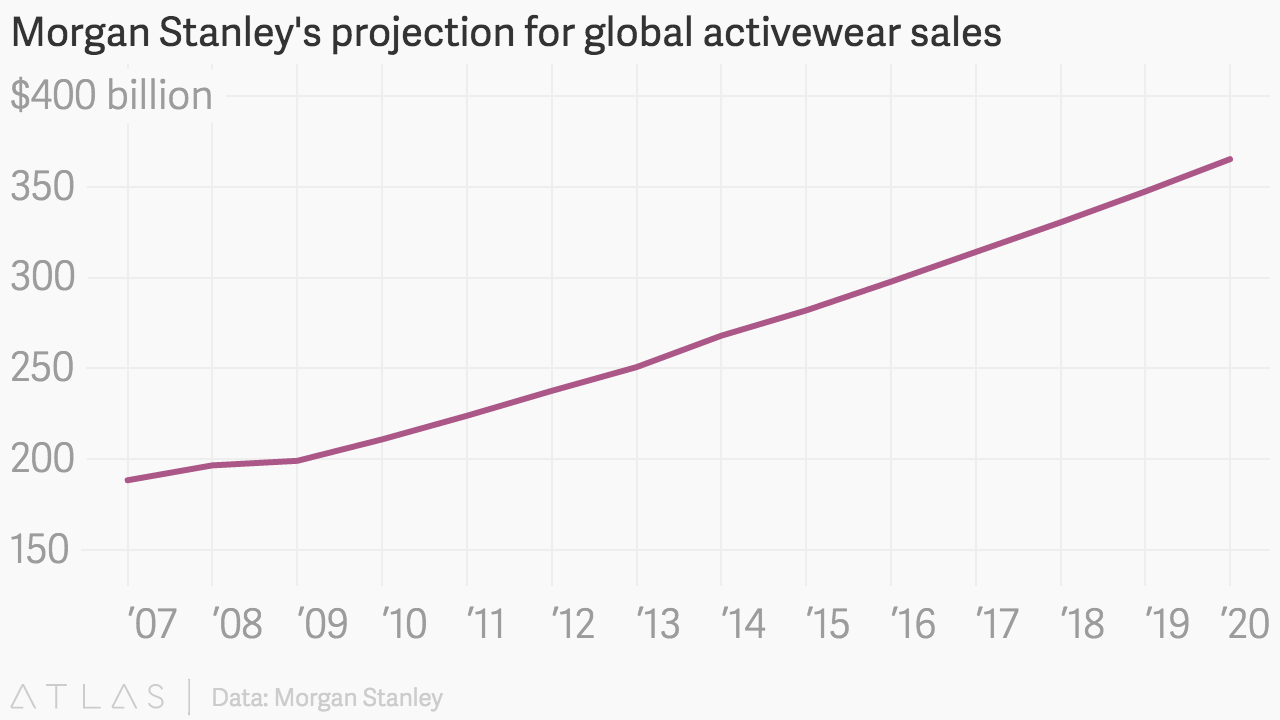

Activewear or the ‘athleisure’ trend has become extensively popular in today’s day and age. It has carved out a niche for itself in the clothing industry. In a waning apparel industry, it has been the lone star, with an estimated market size of close to $44 billion in the U.S. alone, according to research published by the NPD Group. To put this rise into perspective, one must only look at the numbers. While apparel sales, as a whole, increased 2% year on year in 2015, activewear sales grew by a mammoth 16%. Going forward, Morgan Stanley has predicted a growth to $83 billion by 2020, stealing the market share from non-athletic apparel. The graph below charts the rise of the trend globally, with sales climbing from $197 billion in 2007 to over $350 billion by 2020.

Athleisure has helped fill a gap in the market place, where clothing that was functional wasn’t particularly stylish. Such clothing can be worn to the gym, as well as anywhere else. This comfortable standard of clothing has largely been adopted and driven by the millennials. As mentioned previously, their increased health consciousness, and a cultural shift in the workplace, has made it acceptable to wear sneakers and sweatpants in the office. According to Harris poll, 72% of the millennials prefer to spend their money on experiences as opposed to material objects. This has greatly helped propel athleisure, as the clothing style is typically worn for an experience (more often an outdoor experience), such as yoga or hiking.

Even for Gap Inc (NYSE:GPS), its Athleta brand, the company’s foray into athleisure, has been selling well. Strong sales of leggings and sports bras were a bright spot in otherwise dismal sales for the company in 2015.

Given the current health revolution, and the growing popularity of such apparel among the millennial population, it comes as no surprise that athleisure has become a more relevant clothing option than just a few years ago. It is, therefore, highly plausible that within the next few years, athleisure apparel is going to account for a larger portion of the total apparel market.

Declining sales at restaurants

Despite economic recovery being seen in the U.S., the restaurant industry continues to struggle, as sales and traffic remain weak. Since the beginning of 2016, comparable sales and traffic have been deteriorating in every single month, save February. This is despite the improvement in the job market, which is said to be closely linked to consumer spending.

Industry-Wide Decline

Instances such as the outbreak of E.coli at Chipotle Mexican Grill’s (NYSE: CMG) and the meat scandal at McDonald’s (NYSE:MCD) have left people wary of even the quick service restaurants, which until recently were the main contributor of growth in traffic in the restaurant industry.

Even the appeal of cheap prices, which ensured continued sales growth at these restaurants at the time of recession, have been neutralized by the negative publicity around the sup-optimal quality of food served. As of late September, the traffic within the segment has failed to show any meaningful growth in comps. According to NPD, the growth stagnation problem revolves around fewer lunch visits to restaurants this year, as an increasing percentage of the labor force is choosing to work from home, thus skipping the lunchtime restaurant rush. Further, in the face of decline in food at home inflation, consumers are spending less of their disposable income on eating out. This issue is further compounded by the health revolution, which as mentioned earlier, is the new fad. People are more concerned about eating well and healthy food, rich in nutritional value, rather than going after quick, easy and cheap food.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research