The U.S. Netflix Story: Evolving Competition Threatens Growth

Will the rising competition in the U.S. crush Netflix (NASDAQ:NFLX) or will the company maintain its lead and continue to be the preferred choice for streaming customers? There is no easy answer to this question. However, our research suggests that while Amazon (NASDAQ:AMZN) and Comcast (NASDAQ:CMCSA) can be Netflix’s biggest challenges, a lot will depend upon the motivation of these companies to continuously improve their content.

Although currently, Netflix is the king when it comes to the content and subscribers, the future is what concerns investors and analysts. The company’s stock has fallen from its mid-2011 peak of close to $300 to less than $60. That’s an 80% decline and can be attributed to the company’s management’s missteps coupled with growing competitive threat. It is imperative that we understand how the competitive scenario has changed for Netflix and where it stands today. We estimate that in bearish cases where the competition stunts Netflix’s growth and the content bidding war leads to further sharp rise in content acquisition costs, our price estimate for Netflix could go down as low as $70.

- After A Solid 2024, What’s In Store For Netflix Stock?

- Up 70% This Year, Is Netflix Stock Worth The Risk?

- Netflix Stock Downside Scenario: $400

- How Netflix Stock Can Climb To $1,000

- Netflix Stock Q3 Preview: Will The Momentum Slow Down?

- Rising Margins, Ad Growth To Drive Netflix’s Q2 Results, But Stock Is Expensive At $670

See our complete analysis for Netflix

Netflix Grew Rapidly Until 2011 & Increased Its Share In The U.S. Movie Rental Market

Netflix began as a by-mail DVD rental company and over time, revolutionized the U.S. movie rental market. Within 3 years of its formation, the company came up with the concept of subscription service. Netflix’s edge lied in the additional convenience that it offered to its customers. Instead of having to drive down to a rental store, the customers could get DVDs right at their homes without having to pay for postage. This proved to be a significant advantage as Netflix grew its subscriber base from 1.5 million in 2003 to close to 12.3 million in 2009. [1]

In 2009, the explosive growth began and Netflix expanded its base from 12.3 million to 24.4 million subscribers within the span of two years. [1] The reason was a significant push into streaming, which was initially added as a free add-on service for DVD subscribers and later became Netflix’s mainstream offering. In essence, Netflix has changed from a by-mail DVD rental company to an online streaming service provider. In the process, it increased its revenues from just $270 million in 2003 to close to $3.12 billion in 2011. [1]

As Netflix grew, it not only leveraged the U.S. movie rental market growth, it also stimulated it. The company took advantage of the fact that the customers were starting to prefer renting over buying DVDs due to the accompanying cost saving. Netflix further fueled this trend by making it convenient for customers to rent by delivering DVDs directly to their homes. The total movie rental market in the U.S. grew from $9.4 billion in 2006 to more than $9.8 billion in 2009, and has continued its growth since then. [2] This implies an annual average growth rate of 1.5% which is appears to be quite low given how Netflix has grown. The truth is that a significant part of Netflix’s expansion resulted in cannibalization of sales of traditional rental stores. In fact between 2006 and 2011, Netflix’s revenues grew at an average annual rate of more than 25%. Furthermore, between 2006 and 2009, Netflix’s share in the U.S. movie rental market increased from 11% to 17%. [3] We believe that this share would have reached somewhere around 25% by the end of 2011.

In addition to the convenience of providing DVDs to customers’ homes, introduction of online streaming played a huge role in Netflix’s growth between 2009 and 2011. In fact, adding online streaming titles accelerated Netflix’s growth, and the company nearly doubled its subscriber base during to the two-year period following 2009. Today, DVDs have taken a backseat and Netflix has become a mainstream online video streaming service provider.

However, 2011 Changed Everything

In beginning of 2011, Netflix seemed unstoppable and the accelerating subscriber additions demonstrated high customer demand for the company’s services. The company misunderstood the reason behind its success and daftly hit customers with a sudden 60% price increase for hybrid subscribers (DVD+Streaming) without explaining the rationale behind this decision. Netflix did not have content that would make it indispensable, and instead, customers were partly sticking around due to its low subscription price compared to the content it offered.

The decision not only put the brakes on expansion, it also led to subscriber losses for the first time in many years. The situation was further exacerbated when Netflix announced that it re-branding its DVD business to Qwikster. Netflix reversed this decision later. The subscriber backlash and resulting smaller customer base sent the stock price plummeting. We note that the subscriber losses were primarily concentrated among DVD customers.

Even though the management’s missteps were the primary reason behind the decline in Netflix’s stock price, there is no denying that this was also the period when the competitive threat strengthened in the U.S. The competitors utilized this window of opportunity to bolster their advances and several new competitors with deep pockets emerged. From being a leader with virtually no credible competition, Netflix now faces threat from giants such as Amazon, Dish Network (NASDAQ:DISH), Comcast, Verizon (NYSE:VZ) and others. Let’s take a look at how this competitive scenario has changed.

Netflix Still Has Lead But Competitive Scenario Is Changing

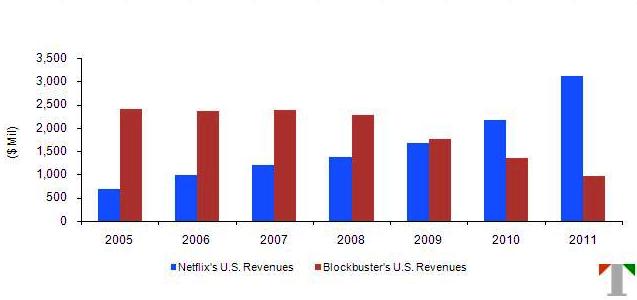

There was a time when Netflix virtually had no competitor strong enough to challenge its progress. As the company rapidly gained subscribers, it literally put its main competitor Blockbuster out of the business. Blockbuster was still primarily operating on traditional store-based rental model and its presence in by-mail DVD rental business was small. While Netflix’s U.S. revenues grew from $682 million in 2005 to $3122 million in 2011, Blockbusters’s U.S. revenues declined from $2400 million to just $970 million during the same period. [4]

As of today, Blockbuster still continues to close its under-performing stores under its new parent company Dish Network. Even though it has its own launched streaming service, the subscriber base is still quite small in comparison to Netflix. If we look at other competitors, we find that Netflix still has significant lead in terms of subscriber base and content. Hulu had around 1.5 million paying subscribers at the end of 2011 and its current subscriber count stands at over 2 million. [5] Hulu’s total revenues of $420 million in 2011 pale in comparison to Netflix’s. [6] Even though Redbox is growing fast, its 2011 revenues of $1.56 billion are still less than half of that of Netflix, and Redbox doesn’t have a streaming service yet. [7] Streaming is where the future growth lies. Amazon has done reasonably well in this area but is still behind Netflix in terms of subscriber base and content. Additionally Comcast’s Xfinity Streampix has just begun its journey.

Even though Netflix still has advantage over its competitors in terms of subscriber base, content quantity and quality, device reach and brand image, the potential strength of the competitors and their intentions are a cause of worry to investors. Let’s explore the strengths of these main competitors below and gauge the level of competition they pose to Netflix.

Amazon Is One Of The Biggest Competitive Threats

Facts: Amazon started offering streaming as a part of its Amazon Prime service which was originally aimed at providing free shipping of merchandise to subscribers. Although in the beginning of 2011 there were talks around Amazon planning to start a stand-alone streaming service, the company’s management hasn’t really taken any step in this direction and still offers streaming as a part of its Amazon Prime service. According to Bloomberg, Amazon prime had between 3 to 5 million subscribers around Oct 2011 and was planning to increase this count to 7 to 10 million subscriber by the end of 2012 or mid of of 2013. [8]

As far as content is concerned, Amazon had over 22,000 titles in its streaming library in August 2012, representing 70% growth in 2012 alone. [9] The company further signed a deal with Epix in September to add 3000 more titles to its library, bringing its total to 25,000. [10] Amazon’s device reach isn’t bad either and subscribers can watch the content on TVs, Blu-ray players, Kindle Fire, PS 3, Xbox 360 and iPad.

Synthesis: It appears that Amazon Prime’s subscriber base is sufficiently large to cause concern for Netflix. In addition to this, its streaming library seems to be growing at a fast pace and seems sufficient enough to attract customers. Amazon’s growing subscriber base and streaming catalog can not be ignored by Netflix, and presents the highest competitive threat in the U.S. streaming market.

However, we have our doubts regarding Amazon’s motivation of continuously improving its streaming content. The fact that Amazon is unwilling to separate streaming as a stand-alone service indicates that primary motive of Amazon is to promote its online sales by encouraging customers to subscribe to its Amazon Prime service. This is the right strategy after all Amazon’s core business is online retailing. Nevertheless this could also mean that Amazon may not put enough effort in improving its streaming catalog, and keep it just good enough to lure customers who would like to take advantage of free shipping along with some add-on video entertainment.

However, the fact remains that Amazon has deep pockets and the ability to spend heavily on the content if it intends to do so. This is the company’s significant advantage over Netflix. Additionally, it possess a huge base of loyal customers making it easy to market its streaming service.

Comcast Can Prove Immensely Dangerous

Comcast launched its Xfinity Streampix offering in Feb 2012, allowing its subscribers to complement their existing pay-TV packages with additional streaming service. The service is priced at $4.99 per month, $3 less than what Netflix charges, and is therefore very competitively priced. Comcast stated during its Q2 2012 earnings announcement that it had doubled the titles available for streaming Streampix since its launch.

Although the company has not disclosed any other metrics related to this service, it is safe to assume that it is trying hard to improve the streaming content. After all, the streaming service is a part of its broader strategy to hook subscribers in order to turn around its pay-TV subscriber losses. Comcast has deep pockets just like Amazon, but lags behind in terms of content and device reach given its relatively recent start in the subscription streaming arena. However unlike Amazon, Comcast may be more motivated to improve its content since it is charging separately for streaming. This implies that customers will only subscribe if they find the content worth it. Comcast can leverage its established relationships with the media companies to gain content rights and will aim to catch up with Netflix soon.

Dish Network Is Dangerous But Its Commitment To Blockbuster Streaming Is In Doubt

Dish Network offers sling DVR technology to its subscribers, allowing them remotely access their pay-TV programming. Adding Blockbuster streaming is an excellent compliment to this, thus giving the subscribers true flexibility in what they want to watch, when they want to watch it and from where they want to watch it. Blockbuster streaming service was launched in late 2011 and has helped Dish in improving its subscriber trends.

In fact immediately after the launch, Dish registered two consecutive quarters of subscriber growth which was a big improvement given how the company has performed over the last two years. The advantage to Dish is Blockbuster’s existing brand, spending capability to get the streaming content, existing relationships with the content owners and the motivation to improve subscriber trends. Dish has priced its service at $10 per month, allowing its subscribers to gain access to streaming as well as by-mail DVD rental service. This turns out to be cheaper than what Netflix charges.

However, Dish’s commitment to making Blockbuster a serious competitor to Netflix and a viable streaming services seems to be under doubt as evident from the management’s recent interview with Bloomberg. [11] This has resulted from the delay in regulatory approval that would have allowed Dish to use its acquired satellite spectrum for terrestrial data communication. This delay has led to failure of Dish’s original plans to sell mobile devices that would have utilized the spectrum for Blockbuster streaming. Nevertheless we believe that Dish will still leverage Blockbuster and push it as much as it can.

Future Bearish Scenarios For Netflix

Our current price estimate for Netflix stands at $96, implying a premium of about 50% to the market price. However, depending upon how competition evolves, our estimates might turn out to be too bullish. We estimate that Netflix’s subscriber base will reach 40 million by the end of our forecast period (by 2019). However, if competition evolves strongly and this subscriber base stabilizes at around 30 million, our price estimate would fall to $80. In a more bearish case where the stunted subscriber growth is accompanied by a further rise in the content costs as competitors bid prices up, our price estimate can fall to $70. This assumes that Netflix’s overall content costs will increase to 60% of its revenues.

Understand How a Company’s Products Impact its Stock Price at Trefis

- Netflix’s SEC Filings [↩] [↩] [↩]

- Blockbuster’s SEC Filings [↩]

- Calculated based on market data and Netflix’s reported revenues [↩]

- SEC Filings [↩]

- Hulu Plus subscription hits 2 million, accelerates revenue, GigaOm, Apr 17 2012 [↩]

- Hulu’s 2011 Revenue Grew 60 Percent To $420M, Will Invest $500M In Content This Year, TechCrunch, Jan 12 2012 [↩]

- Coinstar’s SEC Filings [↩]

- Amazon Is Said to Have Fewer Prime Members Than Estimated, Bloomberg, Feb 15 2012 [↩]

- Amazon Prime Crosses Big Milestone: More Items Are Now Shipped with Prime Free Two-Day Shipping Than with Free Super Saver Shipping, Amazon Press Release, Aug 27 2012 [↩]

- Amazon and Epix strike movie deal; Netflix shares drop, Reuters, Sept 4 2012 [↩]

- Blockbuster Hits Rewind on Plan to Return as Netflix Killer,Bloomberg, Oct 6 [↩]