With Robust AI Prospects Is IBM A Better Pick Over Merck Stock Within The Dow Index?

We believe that the computing behemoth IBM (NYSE: IBM) is currently a better pick over the pharmaceuticals giant Merck (NYSE: MRK). The decision to invest often comes down to finding the best stocks within the scope of certain characteristics that suit an investment style. In this case, although these companies are from different sectors, they share a similar revenue base of around $61 billion and both are part of the Dow 30 Index. Although Merck has seen a better revenue growth, IBM is more profitable. There is more to the comparison, and in the sections below, we discuss why we think IBM will outperform Merck in the next three years. We compare a slew of factors, such as historical revenue growth, returns, and valuation.

1. Merck Stock Has Outperformed IBM In The Last Three Years

MRK stock has seen strong gains of 65% from levels of $80 in early January 2021 to around $130 now, vs. an increase of about 40% for IBM stock over this period. In comparison, the S&P 500 is up 45% over this roughly three-year period. However, the increase in MRK and IBM has been far from consistent. Returns for MRK stock were -6% in 2021, 45% in 2022, and -2% in 2023. IBM is one of a handful of stocks that have increased their value in each of the last three years, but that still wasn’t enough for it to consistently beat the market. Returns for the stock were 6% in 2021, 5% in 2022, and 16% in 2023. In comparison, returns for the S&P 500 have been 27%, -19%, and 24% over these years, respectively — indicating that both MRK and IBM underperformed the S&P in 2021 and 2023.

In fact, consistently beating the S&P 500 — in good times and bad — has been difficult over recent years for individual stocks; for heavyweights in the Health Care sector including UNH and JNJ, and even for the megacap stars GOOG, TSLA, and MSFT. In contrast, the Trefis High Quality (HQ) Portfolio, with a collection of 30 stocks, has outperformed the S&P 500 each year over the same period. Why is that? As a group, HQ Portfolio stocks provided better returns with less risk versus the benchmark index; less of a roller-coaster ride, as evident in HQ Portfolio performance metrics.

Given the current uncertain macroeconomic environment with high oil prices and elevated interest rates, could MRK and IBM face a similar situation as they did in 2021 and 2023 and underperform the S&P over the next 12 months — or will they see a strong jump? Although we think both stocks have limited upside, we think IBM will fare better than MRK.

2. Merck’s Revenue Growth Is Better

Merck has seen its revenue rise at an average annual rate of 13.5% from $41.5 billion in 2020 to $60.1 billion in 2023. On the other hand, IBM’s average revenue growth rate of 3.9% from $55.2 billion to $61.9 billion over this period has been comparatively slower.

Merck’s revenue growth has been driven by the success of Keytruda over the recent years. Keytruda has seen its label expand from Non-Small Cell Lung Cancer to Melanoma, Head & Neck, Cervical, Renal, and many more indications, resulting in a stellar 74% surge in sales to $25 billion in 2023, versus $14 billion in 2020. We think Keytruda will peak at around $32 billion in annual sales and decline thereafter with biosimilars entering the market. Currently, Samsung Bioepis, Amgen, Sandoz, and others are working on development of Keytruda’s biosimilars.

Note that Keytruda accounted for 42% of total Merck’s sales in 2023 and its loss of market exclusivity will result in a meaningful decline in sales, and it will be challenging for Merck to bridge this gap. As such, Merck has been looking at inorganic growth, with acquisitions of Acceleron Pharma in 2021, Prometheus Biosciences in 2023, and Harpoon Therapeutics this year.

Other than Keytruda, Merck’s HPV vaccine – Gardasil – has been gaining market share and has seen its sales rise 126% to $8.9 billion in 2023, compared to $3.9 billion in 2020. Similar to Keytruda, Gardasil will also lose market exclusivity in the U.S. in 2028. However, the decline in Gardasil sales is expected to be less profound and hurting for Merck as opposed to Keytruda.

IBM’s revenue growth is being led by its software products, driven by higher sales of Red Hat products and Data & AI solutions. Red Hat, which was acquired in 2019, has been a key growth driver for IBM, given its large portfolio of open-source technology, its hybrid cloud platform, and its large developer community. IBM’s consulting business has also been doing well, despite a tough market for IT spending. Although AI hasn’t really been a big revenue driver for IBM, this trend is expected to change. IBM has been looking to capitalize on the rising demand for AI in the enterprise space. Last year, it introduced Watsonx, its core platform that enables enterprise clients to train, tune, validate, and deploy customized AI models for their businesses. IBM has said that client demand for AI solutions has been accelerating, with its book of business for Watsonx and generative AI seeing strong growth lately. Look at Watsonx Can Help IBM Stock Gain Lost Ground for more details.

3. IBM Is More Profitable

Merck’s operating margin fell from 13.4% in 2020 to 4.9% in 2023, while IBM’s operating margin expanded from 8.4% to 15.2% over this period. However, the 2023 margin decline for Merck can be attributed to a $10 billion charge recorded in Q2’23 for the Prometheus acquisition. IBM has been focused on cutting costs, indicating that it would reduce costs in 2024 by $3 billion, up from its prior estimate of $2 billion via headcount reduction and greater automation. Looking at the last twelve-month period, IBM’s operating margin of 15% fares much better than 8% for Merck.

Looking at financial risk, both companies are comparable. Merck’s 10% debt as a percentage of equity is much lower than 39% for IBM. However, its 5% cash as a percentage of assets is lower than 14% for IBM, implying that Merck has a better debt position, but IBM has more cash cushion.

4. The Net of It All

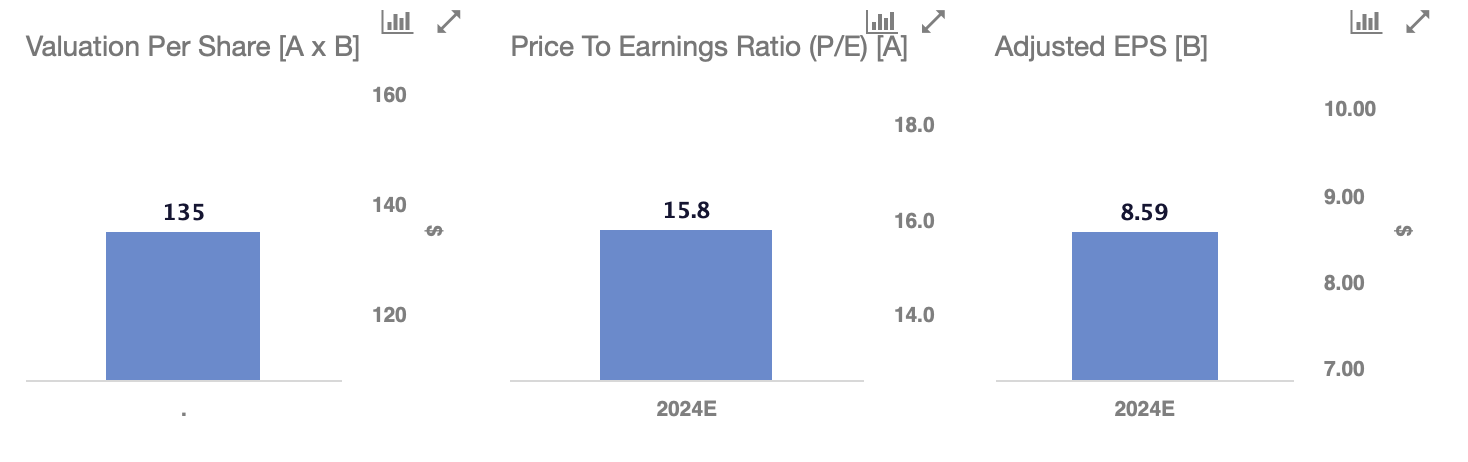

We see that IBM is more profitable and has more cash cushion, while Merck has seen better revenue growth and has a better debt position. Now, looking at prospects, we believe IBM is the better choice of the two, given its better prospects. We estimate Merck’s Valuation to be $135 per share, close to its current market price of $130. At its current levels, MRK stock is trading at 15x forward expected earnings of $8.59 on a per share and adjusted basis. The 15x figure is slightly higher than the 13x average seen over the past few years, excluding 2023. This is because the 2023 EPS of $1.51 was much lower due to a $17.1 billion R&D charge related to the Prometheus and Imago acquisitions and upfront payments for collaboration agreements with Kelun-Biotech and Daiichi Sankyo.

In comparison, at its current levels of around $174, IBM stock trades at close to 19x expected 2024 earnings of $9.25 per share. This compares with the 15x average P/E multiple for IBM seen over the last three years.

Overall, we think IBM is likely to offer better returns than Merck in the next three years. Although IBM’s growth rates have been lackluster, we think the rise in valuation multiple seems justified, given that IBM is focusing on core areas such as cloud computing, AI, and automation after divesting its legacy business. IBM is also making mid-size acquisitions to bolster its portfolio of higher-margin software products. It’s likely that Merck may continue to see better revenue growth in the near term due to continued market share gains for Keytruda. However, its stock may still see a downward adjustment to its valuation multiple, as investors account for Keytruda’s loss of market exclusivity in 2028.

While IBM may outperform MRK in the next three years, it is helpful to see how Merck’s Peers fare on metrics that matter. You will find other valuable comparisons for companies across industries at Peer Comparisons.

| Returns | Jun 2024 MTD [1] |

2024 YTD [1] |

2017-24 Total [2] |

| MRK Return | 3% | 19% | 120% |

| IBM Return | 4% | 6% | 5% |

| S&P 500 Return | 4% | 15% | 144% |

| Trefis Reinforced Value Portfolio | 2% | 7% | 658% |

[1] Returns as of 6/21/2024

[2] Cumulative total returns since the end of 2016

Invest with Trefis Market-Beating Portfolios

See all Trefis Price Estimates