With Over 10% Gains This Year Is Altria Stock A Better Pick Than Freeport?

We believe that Altria stock (NYSE: MO) is a better pick over Freeport-McMoRan stock (NYSE: FCX), given its better prospects. Although these companies are from different sectors, we compare them because they have a similar market capitalization of $75-$80 billion and a similar revenue base of $20-23 billion. Freeport-McMoRan has seen better revenue growth lately, while Altria is more profitable. Still, investors have assigned a similar valuation multiple of 3.3x revenues for both stocks. In the sections below, we discuss why we believe that Altria will offer better returns than Freeport-McMoRan in the next three years by comparing a slew of factors, such as historical revenue growth, stock returns, and valuation.

1. Freeport-McMoRan’s Stock Has Fared Better

MO stock has witnessed gains of 15% from levels of $40 in early January 2021 to around $45 now, while FCX stock has seen extremely strong gains of 100% from $25 to around $50 over the same period. This compares with an increase of about 40% for the S&P 500 over this roughly three-year period.

However, the increase in MO stock has been far from consistent. Returns for the stock were 16% in 2021, -4% in 2022, and -12% in 2023. Returns for FCX stock were 60%, -9%, and 12% over the same years, respectively. In comparison, returns for the S&P 500 have been 27% in 2021, -19% in 2022, and 24% in 2023 — indicating that MO underperformed the S&P in 2021 and 2023, while FCX underperformed the S&P in 2023.

In fact, consistently beating the S&P 500 — in good times and bad — has been difficult over recent years for individual stocks; for heavyweights in the Consumer Staples sector including WMT, PG, and COST, and even for the megacap stars GOOG, TSLA, and MSFT. In contrast, the Trefis High Quality (HQ) Portfolio, with a collection of 30 stocks, has outperformed the S&P 500 each year over the same period. Why is that? As a group, HQ Portfolio stocks provided better returns with less risk versus the benchmark index; less of a roller-coaster ride, as evident in HQ Portfolio performance metrics.

Given the current uncertain macroeconomic environment with high oil prices and elevated interest rates, could MO and FCX face a similar situation as they did in 2023 and underperform the S&P over the next 12 months — or will they see a strong jump? We think Altria stock will fare better than Freeport-McMoRan in the next three years.

2. Freeport-McMoRan’s Revenue Growth Is Better

Freeport-McMoRan’s revenue growth has been better, with a 20.3% average annual growth rate in the last three years, compared to -2.2% for Altria.

Altria sells its tobacco products in the U.S. markets. Due to supply disruptions, the company’s revenue growth was impacted during the pandemic. Altria also sold its wine business for $1.2 billion in 2021, with an increased focus on smoking and smokeless products. With higher inflation, the company is seeing a decline in cigarette volume lately, a trend expected to continue going forward. For perspective, the volume of smokable products declined 9.6% y-o-y to 86.4 million sticks in 2022, and another 9.8% to 76.3 million sticks in 2023. That said, pricing growth is helping the company offset some of the revenue loss from volume.

For Freeport-McMoRan, revenue growth is driven by higher copper and gold price realizations. Freeport-McMoRan is one of the world’s largest producers of copper. Copper prices have been subdued lately, amid concerns about elevated interest rates. The company reported a 1% decline in the average realized price for copper in 2023, while that for gold was up 10%.

Looking at the last twelve months, Freeport-McMoRan’s 0.3% sales growth fares better than -2.3% for Altria. Our Altria Revenue Comparison and Freeport-McMoRan Revenue Comparison dashboards provide more insight into the companies’ sales.

3. Altria Is More Profitable

Altria’s reported operating margin expanded from 52.1% in 2020 to 56% in 2023. In comparison, Freeport-McMoRan’s operating margin grew from 13.8% to 27.2% over this period. Looking at the last twelve-month period, Altria’s operating margin of 47.4% fares much better than 27.2% for Freeport-McMoRan.

Looking at financial risk, both are comparable. While Altria’s 32% debt as a percentage of equity is higher than 6% for Freeport-McMoRan, its 10% cash as a percentage of assets is marginally higher than 9% for the latter. This implies that Freeport-McMoRan has a better debt position, but Altria has slightly more cash cushion.

4. The Net of It All

We see that Freeport-McMoRan has seen superior revenue growth and has a better debt position. On the other hand, Altria is more profitable and has slightly more cash cushion. Now, looking at prospects, using P/S as a base, due to high fluctuations in P/E and P/EBIT, we believe Altria will offer better returns compared to Freeport-McMoRan over the next three years.

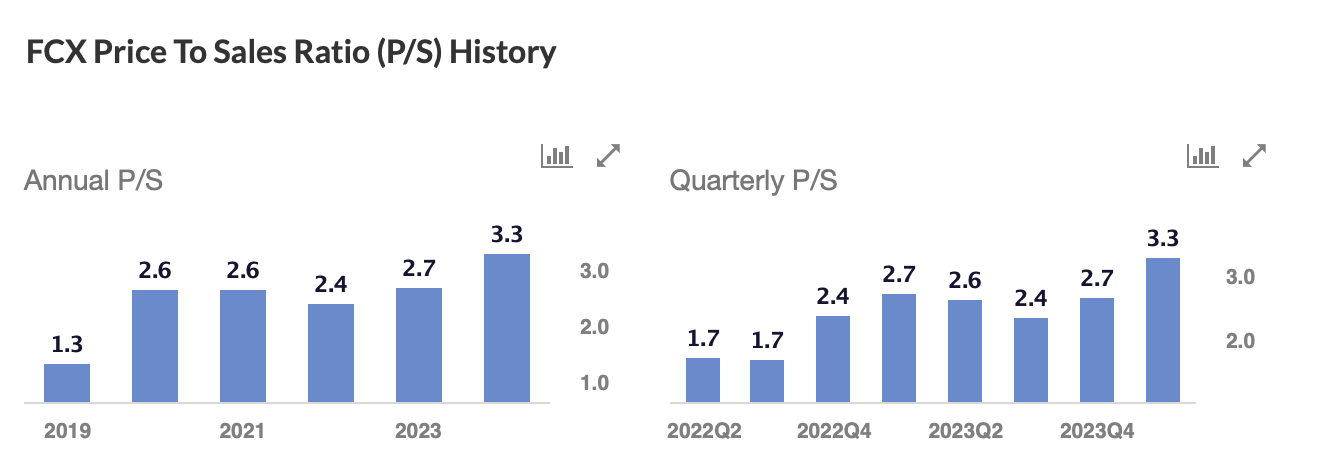

If we compare the current valuation multiples to the historical averages, Altria fares better. Altria stock trades at 3.3x sales, compared to 3.1x average over the last five years, and Freeport-McMoRan stock trades at 3.3x revenues vs. the last five-year average of 2.3x.

While MO may outperform FCX in the next three years, it is helpful to see how Altria’s Peers fare on metrics that matter. You will find other valuable comparisons for companies across industries at Peer Comparisons.

| Returns | May 2024 MTD [1] |

2024 YTD [1] |

2017-24 Total [2] |

| MO Return | 4% | 13% | -33% |

| FCX Return | 5% | 23% | 297% |

| S&P 500 Return | 4% | 10% | 134% |

| Trefis Reinforced Value Portfolio | 5% | 5% | 642% |

[1] Returns as of 5/31/2024

[2] Cumulative total returns since the end of 2016

Invest with Trefis Market-Beating Portfolios

See all Trefis Price Estimates