Will Manulife’s Q4 Core Earnings Again Beat Street Estimates?

Manulife Financial (NYSE: MFC) is expected to release its fourth quarter and full year results on Wednesday, February 13 after the market closes. Manulife provides insurance and insurance-based wealth accumulation products in Asia, Canada, and the United States. This year, the company introduced Global Wealth and Asset Management as a separate reporting segment, which provides fee-based wealth solutions to retail and institutional customers.

Our interactive dashboard on Manulife’s Performance in 2018 outlines the company’s recent performance, as well as our key drivers and forecasts for the company. You can modify any of our forecasts to gauge the impact of changes on the company’s valuation, and see all of our Financial Services data here. Below we analyze key trends in core earnings and assets under management across geographies over the past three quarters.

U.S. Is The Strongest Contributor To Core Earnings

- Manulife Financial Stock Has A 40% Upside

- Is Manulife Financial Stock Oversold At $14?

- Manulife’s Revenues Very Likely Jumped 2x In 2019, But There’s More Here Than Meets The Eye

- Is Manulife’s Volatile Investment Income A Cause For Concern?

- Can Prudential’s International Premiums Contribute 30% To Its Top Line By 2021?

- Strong Core Earnings Growth Drives A Beat For Manulife

Core earnings is a non-GAAP measure which ignores income and expenses that lie outside normal business operations. The company has been reporting strong results over the previous three quarters, with core EPS consistently beating street estimates. As you can see in the chart below, core earnings have been following a consistent upward trend across geographies. The United States is the strongest contributor, followed by Asia and Canada. Demand for insurance products and the launch of Manulife Par are expected to boost the top line in Asia and Canada, respectively.

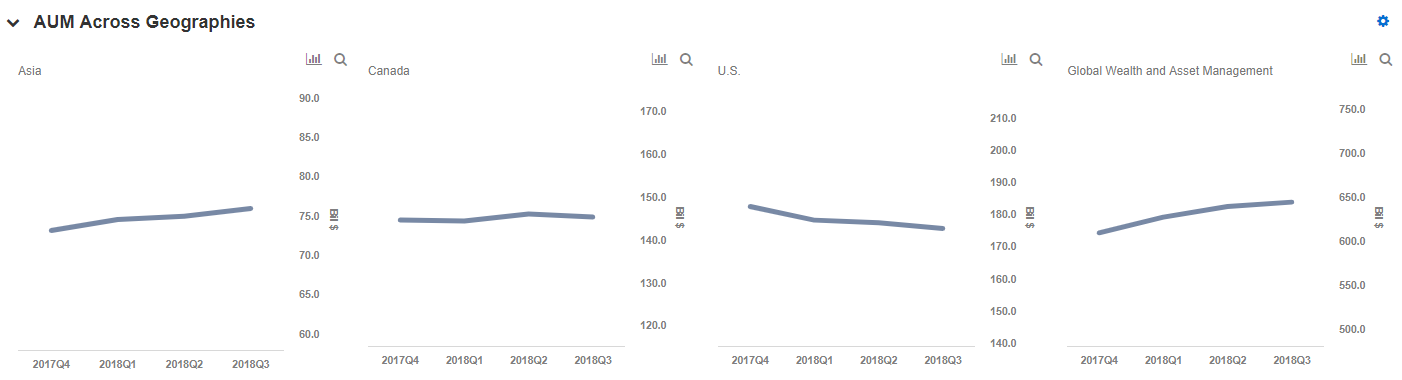

Half Of Manulife’s AUM Managed By Global Wealth And Asset Management

A consistent increase in assets under management for Manulife has been observed over the last three quarters. Favorable investment performance and positive net flows have led to an increase in AUM. In the third quarter, assets under management and administration exceeded $1.1 trillion. Investment income and net customer cash flows contributed $54 billion and $16 billion to the increase, respectively.

Manulife’s focus on optimizing its investment portfolio and aggressively managing costs has enabled it to consistently beat street estimates.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

More Trefis Research

Like our charts? Explore example interactive dashboards and create your own