McDonald’s Growth Momentum Continues, Reports Strong Q3 2018 Results

McDonald’s (NYSE:MCD) reported another strong quarter beating consensus expectations, with revenues coming in at $5.37 billion and earnings at $2.10 per share. Global comparable sales increased by 4.2% (versus +3.7% expected), reflecting positive results across all of its business segments. While guest counts grew in most of the top international markets, the metric continued to remain poor in the U.S. Despite this, the burger giant was able to report a comps increase of 2.4% in the country, driven by higher average check drove sales, due to favorable product mix shifts, menu pricing increase, and digital and delivery initiatives implemented by the company. While the burger giant has been faced with declining revenue in recent quarters, this has been a consequence of the refranchising of its restaurants that the company has been undertaking for a couple of years. The company’s long-term goal is for 95% of McDonald’s restaurants to be owned by franchisees, and at the end of FY 2017, this figure stood at 92%. This strategy has resulted in cutting costs for the burger giant, and has led to an improvement in margins, and consequently, the earnings.

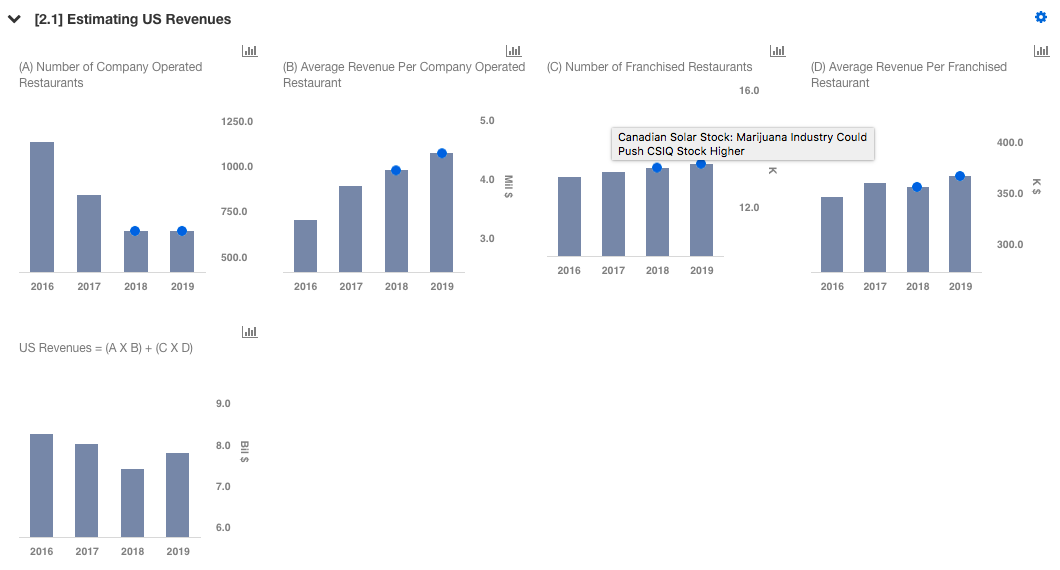

We have a $185 price estimate for McDonald’s, which is higher than the current market price. The charts have been made using our new, interactive platform. The various driver assumptions can be modified by clicking here for our interactive dashboard on McDonald’s Performance In Q3 2018 And Estimating Its Fair Price, to gauge their impact on the revenue, earnings, and price per share metric.

- Looking Beyond The Golden Arches: Drop McDonald’s Stock, Pick This Conglomerate?

- Down 14% YTD, What Lies Ahead For McDonald’s Stock Following Q2 Earnings?

- Down 12% This Year, What’s Happening With McDonald’s Stock?

- Dropping 8% Year To Date, Will McDonald’s Stock Recover Post Q1 Results?

- What To Expect From McDonald’s Q4 After Stock Up 13% Since 2023?

- After A 14% Top-Line Growth In Q2 Will McDonald’s Stock Deliver Another Strong Quarter?

Factors That May Impact Future Performance

1. Refranchising Restaurants: As mentioned earlier, this strategy has been plaguing the revenues of the company for a number of quarters, although it has had a positive impact on the earnings. Another benefit of the franchise model is that the company can take advantage of the significant real estate portfolio it has built up over the years, and collect rent and royalty income in the years to come.

2. Value Meals: McDonald’s began 2018 by launching its $1, $2, $3 menu aimed toward its value-conscious customers. Earlier a similar program was discontinued in 2014 since it impacted margins adversely. However, this time around McDonald’s is confident that other cost efficiencies (around marketing and lower fixed costs due to higher traffic) will ensure that margins do not decline due to this value platform. A higher number of items per order for $1, $2, $3 Dollar Menu transactions can help to drive the comparable sales growth for the company. Moreover, the company also introduced two for $4 breakfast in mid-March, which makes MCD more competitive in the breakfast daypart, to help arrest its market share decline and ease the soft morning sales.

3. Technology Initiatives: McDonald’s is revamping its stores to create “Experience Of The Future” (EOTF) restaurants which will have self-serve kiosks and table service. The company’s mobile ordering and payment system continues to expand (in 20,000 restaurants currently) and McDonald’s is also effectively using the data captured via this platform for personalized marketing and customizations. MCD has also introduced delivery in 11,500 restaurants, through its partnership with UberEats. CFO Kevin Ozan has stated that the delivery check size is generally one-and-a-half to two times the in-store check. In a number of its top markets, delivery has increased to form roughly 10% of the total sales. Consequently, an effective use of technology is another key growth factor for McDonald’s in 2018, as it can drive the average check higher.

4. New Launches: McDonald’s earlier launched its fresh beef burgers in select markets in the U.S. to a good response, and completed its national roll-out in Q2. CEO Steve Easterbrook noted that in the pilot markets of Dallas, “90% of customers who tried the burgers said they’d buy them again.” These premium items helped to drive the average check size higher. The company has also launched its premium burgers in other countries, such as Gourmet Creations in Australia and Mighty Angus in Canada. Increased sales of these products can help to increase the average revenue per consumer.

5. Challenging U.S. Company-Operated Stores Margin: The margins in the U.S. company-operated restaurants remained pressured in the third quarter as a result of the conversion to the EOTF format, labor cost, and commodity pressures. Moreover, a decline in the guest count in the region has also resulted in reduced labor productivity. This pressure is expected to dissipate in mid-2019. Meanwhile, although pricing increased 2% in the country in Q3, commodity costs ramped up nearly 3%, wiping out any possible margin benefit. These costs are expected to ease slightly in the fourth quarter.

6. Reduced Tax Rate: As a result of the reduction in the corporate tax rate from 35% to 21%, MCD’s effective tax rate is expected to be between 24% and 26% for FY 2018 (versus 25%-27% expected earlier). When compared with the almost 40% rate the company had to pay in FY 2017, this should result in an enormous boost to the company’s earnings.

See Our Complete Analysis For McDonald’s

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.