Here’s How “High Growth Markets” Are Likely To Drive McDonald’s Valuation In the Future

Ever since its “turnaround” program starting showing results, McDonald’s (NYSE:MCD) stock price has been on an upward trend. In the last one year, the company’s stock price increased by nearly 40% on the back of strong comparable sales and the company’s refranchising initiative which is improving its profitability. Our price estimate for McDonald’s stands at $157 which is 6% below its current market price.

According to our estimates McDonald’s “High Growth Markets” segment, which includes China, is likely to be a key driver of the company’s growth and valuation in the future. In the nine months ended September 2017 the company’s operating income from this segment increased 21% (excluding the gain from the sale of its China and Hong Kong business) driven by strong performance and the impact of refranchising. With a strong partner now in place in China we believe higher growth can improve margins from this division further, driving the company’s stock price.

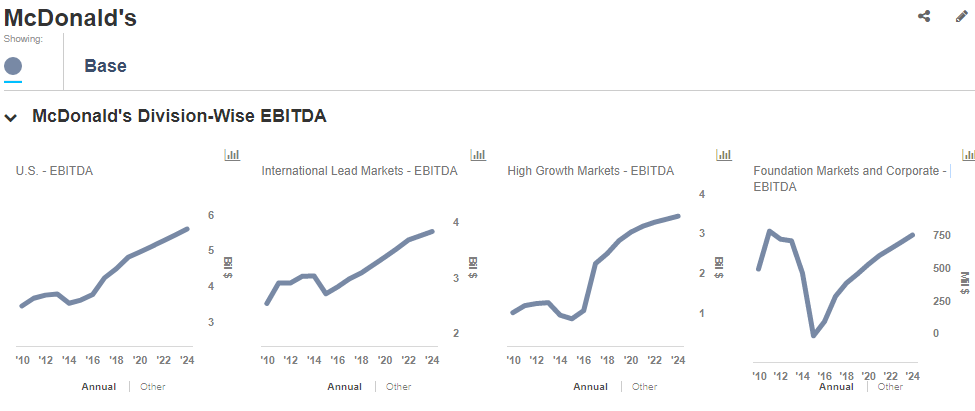

The charts below summarize McDonald’s region-wise growth in EBITDA (earnings before interest, tax, depreciation and amortization) and EBITDA Margin:

- Looking Beyond The Golden Arches: Drop McDonald’s Stock, Pick This Conglomerate?

- Down 14% YTD, What Lies Ahead For McDonald’s Stock Following Q2 Earnings?

- Down 12% This Year, What’s Happening With McDonald’s Stock?

- Dropping 8% Year To Date, Will McDonald’s Stock Recover Post Q1 Results?

- What To Expect From McDonald’s Q4 After Stock Up 13% Since 2023?

- After A 14% Top-Line Growth In Q2 Will McDonald’s Stock Deliver Another Strong Quarter?

Click here to modify these charts and try out our new “Dashboard.”

We expect the margins of the “High Growth Markets” segment to increase significantly over our forecast period, as growth in China picks up. Similarly, we expect the EBITDA (earnings before interest, tax, depreciation and amortization) from this division to reach nearly $3.5 billion by the end of our forecast period, nearly equal to the EBITDA expected of the International Lead Markets Division.

McDonald’s plans to add 2,000 new restaurants in China by 2022 to drive double digit sales growth. With new partners now operating the franchisees in the region, higher growth is likely in the coming years. Similarly other countries in this segment such as Russia are likely to drive growth for the company. The “High Growth Markets” division is a key driver of McDonald’s valuation and its ability to grow sales and restaurants in China, Russia, and similar markets will be a key factor in driving its stock price in the future.

See More at Trefis | View Interactive Institutional Research (Powered by Trefis)