Southwest Airlines Stock Poised For Strong Gains?

The shares of Southwest Airlines (NYSE: LUV) are trading 30% below pre-Covid levels despite stable passenger numbers at TSA checkpoints, largely due to the anticipation of a near-term decline in air travel demand. However, investors have been optimistic on Hyatt Hotels stock (NYSE: H), a hotel company with a strong domestic presence. This year, Hyatt Hotels stock has gained 14% assisted by a revival in leisure travel and subsequent improvement in system-wide room occupancy rates. While both companies belong to different industries, domestic travel demand is the key macroeconomic factor driving their top line. Given Hyatt’s lower profitability and weaker balance sheet as compared to Southwest Airlines, Trefis believes that Southwest stock is poised for strong gains. Does the optimism in Hyatt stock indicate an upcoming surge in air travel? We compare the historical trends in revenues, margins, and valuation multiple of both companies in an interactive dashboard analysis, Southwest Airlines vs. Hyatt Hotels – parts of which are highlighted below.

- Revenue Growth

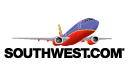

Hyatt’s growth was slightly higher than Southwest before the pandemic, with Hyatt’s revenues expanding at an average rate of 5.5% p.a. from $4.2 billion in 2016 to $5 billion in 2019, versus Southwest Airlines revenues growing at an annual rate of 3.4% from $20 billion in 2016 to $22 billion in 2019. Interestingly, both companies reported 60% revenue contraction in 2020 as the pandemic led to a slump in travel demand.

- The management & franchise business has been key to Hyatt’s growth, resulting in a 20% expansion of the total room portfolio since 2017. The company has been selling its properties to expand the management & franchise business in recent years. Moreover, the acquisition of Apple Leisure Group in the second quarter furthers the company’s asset-light strategy.

- Currently, Hyatt earns 60% of its total revenues from the management & franchise segment and expects to grow the share to 80% by 2024.

- Southwest Airlines primarily earns its revenues from the sale of airline tickets and other ancillary services such as freight & mail. In the past few years, continued capacity growth along with rising ticket prices have been key contributors toward top line expansion.

- Southwest Airlines’ domestic business contributes around 97% of the total revenues due to its strong network and point-to-point business model. For Hyatt, domestic business contributes around 80% of the total revenues.

- Returns (Profits)

- What’s Behind The 10% Fall In Southwest Airlines Stock?

- What’s Next For Southwest Stock After Elliott Management Builds Up A $2 Billion Position?

- How Does The Current Performance of Southwest Airlines Stock Compare With The 2008 Recession?

- What’s Behind The 15% Fall In Southwest Airlines Stock Earlier This Week?

- What’s Next For Southwest Stock After A 20% Rise This Year?

- Gaining 20% In 2023 Will Delta Continue To Outperform Southwest Stock?

Southwest Airlines’ operating profit margin has been consistently higher than Hyatt Hotels.

- In 2019, Hyatt Hotels reported an operating margin and net income margin of 4% and 15%, respectively. The net margin surged due to realization of gains from asset divestitures.

- The company generated $396 million of operating cash on net sales of $5 billion, resulting in the operating cash margin of 8%. Subsequently, invested $369 million in property, plant & equipment and returned $421 million to investors in buybacks from asset sales.

- Whereas, Southwest Airlines reported an operating margin and net income margin of 15% and 11%, respectively. The company generated $4 billion of operating cash on revenues of $22 billion at an 18% operating cash margin. Subsequently, invested $1 billion in property, plant & equipment and returned $2.3 billion to investors in dividends & share repurchases.

- Both companies have been following different shareholder return policies with Hyatt executing buybacks utilizing cash from asset sales and Southwest returning a sizable portion of operating cash to shareholders.

- Notably, the third round of payroll support program requires airlines to suspend dividends and share repurchases until September 2022.

- Risk

From the perspective of financial leverage, Hyatt Hotels is the riskier bet of the two companies.

- Financial leverage coupled with strong top line growth is a boon for investors. However, high interest expenses weigh on the bottom-line if growth stalls.

- In 2020, Hyatt Hotels and Southwest Airlines reported $3 billion and $10 billion of long-term debt, respectively. With $13 billion of cash & short-term investments, Southwest has a strong cash position to overcome any short-term losses without affecting balance sheet strength.

- On the contrary, the $2 billion of cash & short-term investments on Hyatt Hotels’ balance sheet leads to $1 billion of net debt.

While it makes sense that travel demand would rebound and Southwest would benefit, a new risk is that the Omicron variant may put up a roadblock to increased travel, or at least delay the timeline to recovery.

What if you’re looking for a more balanced portfolio instead? Here’s a high-quality portfolio that’s beaten the market consistently since the end of 2016.

| Returns | Dec 2021 MTD [1] |

2021 YTD [1] |

2017-21 Total [2] |

| LUV Return | -17% | -14% | -19% |

| S&P 500 Return | -1% | 24% | 107% |

| Trefis MS Portfolio Return | -2% | 42% | 282% |

[1] Month-to-date and year-to-date as of 12/15/2021

[2] Cumulative total returns since 2017

Invest with Trefis Market-Beating Portfolios

See all Trefis Price Estimates