Forecast Of The Day: Lululemon’s Direct To Consumer Revenue

What?

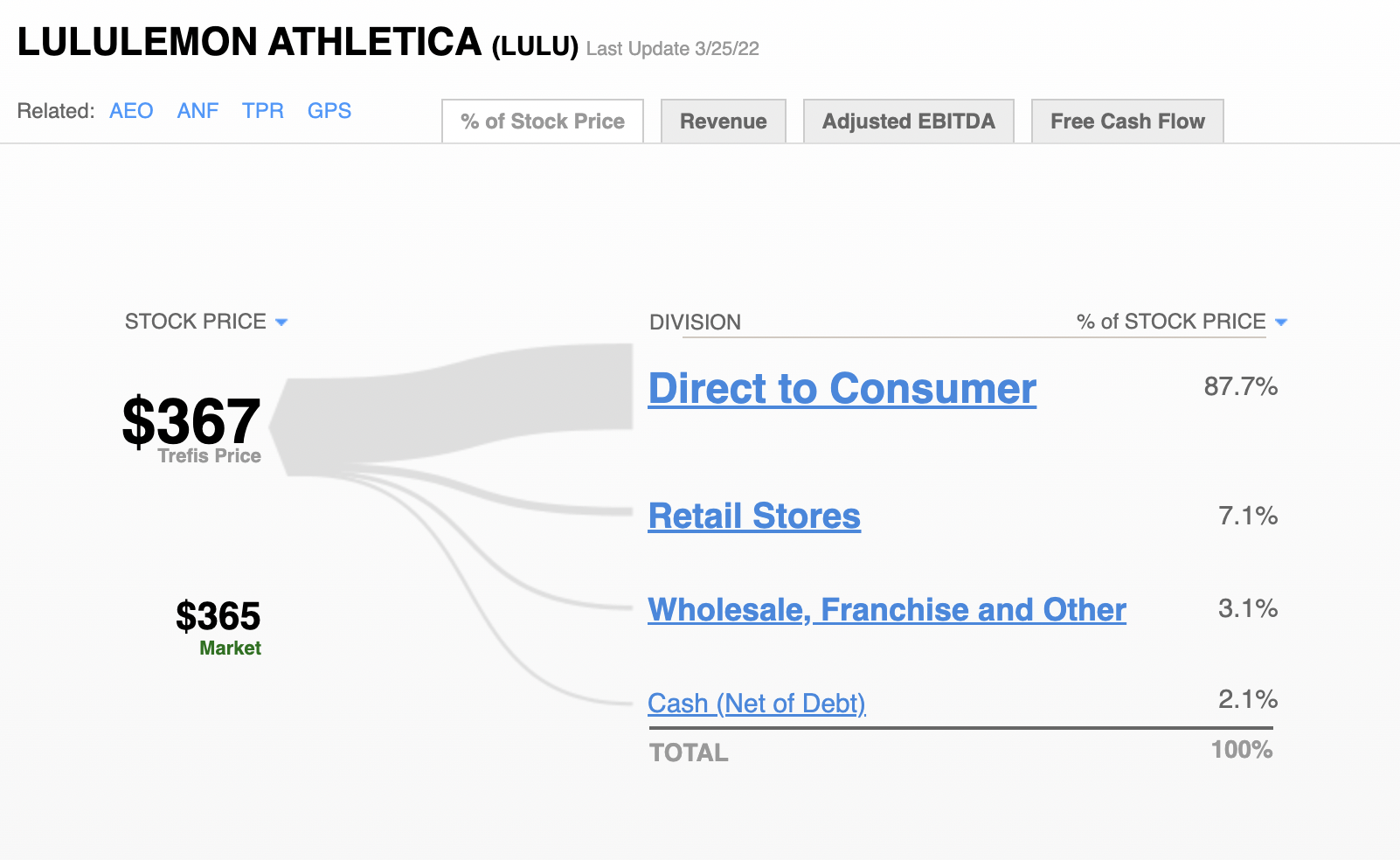

Lululemon’s Direct To Consumer Revenue has soared from $1.1 billion in 2019 to $2.9 billion in 2021. Trefis expects the metric to grow to over $4.3 billion by 2023.

Why?

- EBAY Stock vs. LULU Stock

- Lululemon Stock Down 22% This Year, What’s Next?

- After A 40% Fall This Year Is Lululemon Stock A Better Pick Over Electronic Arts?

- What’s Next For Lululemon Stock After 38% Fall This Year?

- Lululemon’s Stock Down 34% YTD, What’s Happening?

- Down 9% This Year, What’s Next For Lululemon’s Stock Past Q4 Results?

Lululemon benefited from the demand for comfortable work-from-home clothing through Covid-19. Moreover, customers are increasingly placing orders via e-commerce channels, helping Direct To Customer revenues.

So What?

However, we think the projected growth is largely priced into the stock. We value LULU at $367 per share, roughly in line with the current market price.

See Our Complete Analysis For Lululemon

What if you’re looking for a more balanced portfolio instead? Here’s a high-quality portfolio that’s beaten the market consistently since the end of 2016.

Invest with Trefis Market Beating Portfolios