How Are Eli Lilly’s Profit Margins Trending?

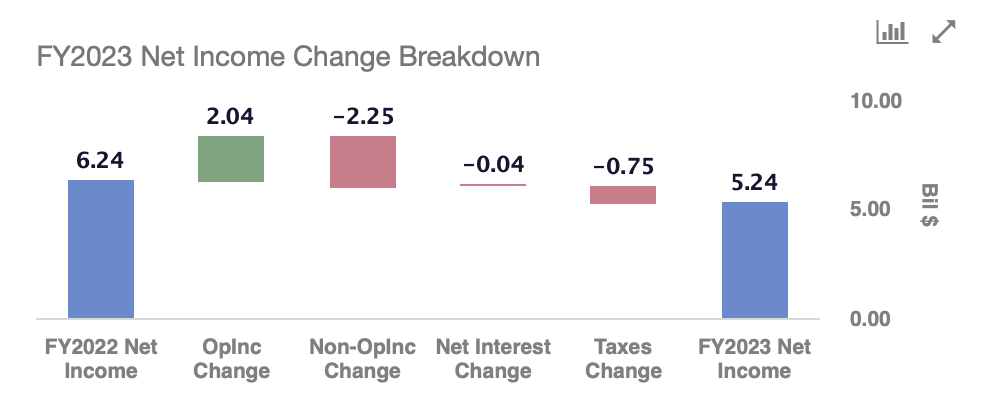

Eli Lilly (NYSE: LLY) saw its net income decline by $1 billion or 16% y-o-y to $5.2 billion in 2023. This can primarily be attributed to higher acquired in-process research and development expenses (IPR&D). In this note, we discuss Eli Lilly’s margin profile along with its stock performance, over the last three years. Our dashboard – What Drove Net Income Change For Eli Lilly – has more details.

Firstly, let us look at Eli Lilly’s stock performance. LLY stock has seen extremely strong gains of 345% from levels of $170 in early January 2021 to around $760 now, vs. an increase of about 40% for the S&P 500 over this roughly three-year period. Admirably, LLY stock has outperformed the broader market in each of the last 3 years. Returns for the stock were 64% in 2021, 32% in 2022, and 59% in 2023. In comparison, returns for the S&P 500 have been 27% in 2021, -19% in 2022, and 24% in 2023.

In fact, consistently beating the S&P 500 — in good times and bad — has been difficult over recent years for individual stocks; for other heavyweights in the Health Care sector, including UNH, JNJ, and MRK, and even for the megacap stars GOOG, TSLA, and MSFT. In contrast, the Trefis High Quality (HQ) Portfolio, with a collection of 30 stocks, has outperformed the S&P 500 each year over the same period. Why is that? As a group, HQ Portfolio stocks provided better returns with less risk versus the benchmark index; less of a roller-coaster ride, as evident in HQ Portfolio performance metrics.

Given the current uncertain macroeconomic environment with high oil prices and elevated interest rates, could LLY see a strong jump? Eli Lilly’s valuation is largely dependent on future pipeline potential rather than its current earnings, and despite its large move, the $860 average of analysts’ price estimates is over 10% above its current market price of around $760.

Eli Lilly Has Seen Its Gross And Operating Margins Expand In Recent Years

Eli Lilly’s gross profit rose from $19 billion in 2020 to $27 billion in 2023. Its gross profit margin expanded from 77.7% to 79.2% over this period. Similarly, Eli Lilly also saw its operating margin expand from 28.9% in 2020 to 31.6% in 2023, and 32.9% for the last twelve months period. Although the company increased its investments in research and development, with total R&D expenses rising 53% between 2020 and 2023, it cut its SG&A costs. The latter rose only 18% over the same period. The 36% rise in SG&A and R&D expenses combined was still lower than the 39% revenue growth over this period.

Net Income Margin Has Contracted In Recent Years

Despite expansion of gross and operating margins, the company saw its net income decline from $6.2 billion in 2020 to $5.2 billion in 2023. This can be attributed to the company’s non-operating expenses, primarily IPR&D. We consider IPR&D as a non-operating expense. It rose from $660 million or 2.7% of revenue in 2020 to $3.8 billion or 11.1% of revenue in 2023. The 2023 IPR&D expenses were associated with acquisitions of DICE, Versanis, Emergence Therapeutics, and Mablink Biosciences.

On an adjusted basis, net income margin has contracted from 25.2% in 2020 to 16.7% in 2023. This resulted in earnings falling from $6.78 to $6.32 on a per share and adjusted basis and over the same period. However, the company’s outlook for 2024 is solid. The top-line is expected to be in the range of $42.4 billion and $43.6 billion in 2024, reflecting a 26% y-o-y growth at the mid-point of the range. Eli Lilly’s revenue growth is expected to be driven by its diabetes drug – Mounjaro – and its weight-loss drug – Zepbound.

The company expects its SG&A to rise at a slower pace than revenues and R&D to rise at a higher pace than SG&A. It expects its adjusted earnings per share to be in the range of $13.50 and $14.00, implying a stellar 2.2x y-o-y rise at the mid-point of the provided range.

Eli Lilly has not included any IPR&D charges in its current guidance. Overall, with the bottom-line expected to double in 2024, the net income margin is expected to see a sharp jump this year. It should also be able to continue to expand its operating margin with disciplined SG&A expenditures. A better margin profile will also bode well for its stock.

While LLY stock may see higher levels, it is helpful to see how Eli Lilly peers fare on metrics that matter. You will find other valuable comparisons for companies across industries at Peer Comparisons.

| Returns | May 2024 MTD [1] |

2024 YTD [1] |

2017-24 Total [2] |

| LLY Return | -3% | 30% | 930% |

| S&P 500 Return | 4% | 9% | 133% |

| Trefis Reinforced Value Portfolio | 4% | 4% | 636% |

[1] Returns as of 5/14/2024

[2] Cumulative total returns since the end of 2016

Invest with Trefis Market-Beating Portfolios

See all Trefis Price Estimates