What Is L Brand’s Fundamental Value Based On Expected 2019 Results?

L Brands (NYSE: LB) has seen decent growth in its top-line and steady profits the past several years. During the latest quarter, net sales of the company rose to $2.77 billion, compared with $2.61 billion a year ago, up 6% from the prior-year quarter, with adjusted earnings per share at $0.30. This growth has been driven by growth across its Bath and Body Works segment, a well-positioned customer strategy, international diversification, and rising online sales. L Brands has been continuously revamping business by improving the store experience, localizing assortments, and enhancing direct business. These measures have facilitated it to generate incremental sales and increase store transactions through higher conversion rates. A sustained focus on cost containment, inventory management, merchandise, and speed-to-market initiatives has kept L Brands afloat in a competitive environment. Also, L Brands is seeing very strong momentum in online sales growth with online revenue for VS and Bath & Body Works going up.

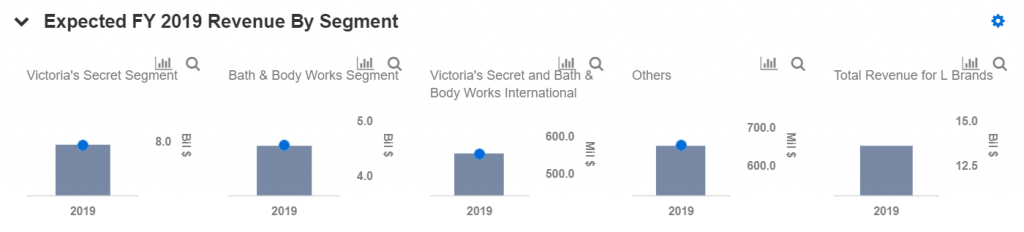

These 4 segments are expected to continue to drive future revenue and profitability growth for the company, in line with the guidance provided by the company, where the VS segment will continue to be the major contributor to its top line growth. The company is focused on improving performance in the Victoria’s Secret business, staying close to its customer, improving the customer experience in stores and online, and improving assortments in compelling new product launches with steadier footing in FY2019.

We have summarized our forecasts in an interactive model L Brands’ Fundamental Value Based On Expected FY ’19 Results. You can modify assumptions such as changes in expected segment revenue or EBITDA margins to see how they impact the company’s value. The image below shows one of the key steps in identifying L Brands valuation sensitivity to changes in its segment revenues. We detail how changes in revenue or segment EBITDA margin impacts total EBITDA, which then impacts value (assuming a constant PE multiple).

The Company is more focused than ever on execution, ongoing improvements in top-line growth, and continuing actions to expand margins, and accelerating their strengths to create more value for their consumers, customers, colleagues, and shareholders. The company plans to grow their business through continuous improvement and sustain their profitability. All these factors, coupled with strong sales momentum, will enable L Brands Inc to continue to grow its top line in 2019 and beyond. If you have a different view, you can modify various inputs to see how changing inputs impacts the company’s valuation. You can share the links to scenarios created on our platform.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.