What Is Thomson Reuters’ Fair Value?

Thomson Reuters (NYSE:TRI) recently entered into an agreement to sell a 55% stake in its Financial and Risk Division (the segment accounting for more than 50% of its revenues) in order to focus on other segments and accelerate growth. The company will use part of the proceeds of this sale to reduce its debt and use a significant portion of the sale proceeds to return capital to its shareholders. This transaction is broadly being viewed as accretive for the company’s shareholders, as a leaner structure with lower debt and a smaller equity base is likely to generate a higher return on capital, with the company focusing on its higher-growth segments.

In this note, we follow a step-by-step approach to arrive at a valuation estimate for Thomson Reuters following the completion of the deal. Our interactive dashboard on Thomson Reuters’ valuation analyzes its key value drivers, and you can change any of these metrics to arrive at your own estimate for Thomson Reuters’ valuation.

As a first step, we estimate the company’s revenues over the next two years. For details on Thomson Reuters’ revenue growth and key revenue drivers, please refer to our dashboard Analyzing Revenue Growth For Thomson Reuters.

The next step is to forecast the EBITDA margin and calculate the company’s EBITDA for 2019.

For the Legal segment, the EBITDA margin in Q2 2018 fell to 36.4% due to product and marketing expenses as the company launched its new Westlaw Edge product. We expect a slight decline in the segment’s margins going forward. For the other two segments, we do not expect a significant change in margins for 2018 and 2019. The company-wide EBITDA margin is likely to decline between 2018 and 2019, as the lower-margin Reuters and News segment generates higher revenues, leading to a lower average margin. Further, as the company restructures itself, operating expenses in the next two years are likely to be higher.

Once the EBITDA estimate is calculated, we make other adjustments to arrive at the company’s net income forecast. Thomson Reuters will have significant other income in the form of dividends and a share of profits from the Financial and Risk segment. We forecast this number to be around $250 million in 2019. We have estimated this number as 45% of $555 million (lower than the income from this segment of $770 estimated for 2018).For 2019, when the transaction is complete, we have a conservative net income estimate since the division will likely have seen substantial changes and near-term operating expenses could be higher.

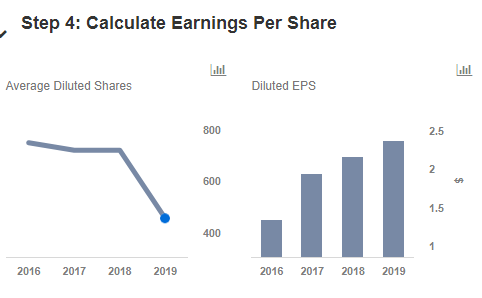

The final two steps are to calculate the earnings per share (EPS) and the PE (price to earnings) multiple to arrive at a stock price estimate. The company plans to return around $9-11 billion back to its shareholders after the divestiture, and we expect this to bring down the average shares outstanding to around 457 million in 2019, compared to a 720 million figure in 2018. We expect the company to command a PE multiple of around 25x in 2019. For a comparative analysis for PE ratios of Thomson Reuters with its peers refer to our dashboard How Does Thomson Reuters Compare With Its Peers?

Based on these estimates, Thomson Reuters fair value could be around $60, which is substantially ahead of the current market price of $42.

- What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.