HP Q1: Personal Systems Strength Offset By Weakness In Supplies Revenue

HP Inc. (NYSE:HPQ) reported its fiscal first quarter results on February 27. The company’s Q1 revenues came in at $14.7 billion (+1% y-o-y), lower than consensus estimates. However, non-GAAP EPS of $0.52 was in line with street expectations. Despite a loss of share in its Supplies business, due to competition from online channels, the strength from Personal Systems allowed HP’s management to maintain its guidance of achieving at least $3.7 billion in free cash flow for the year.

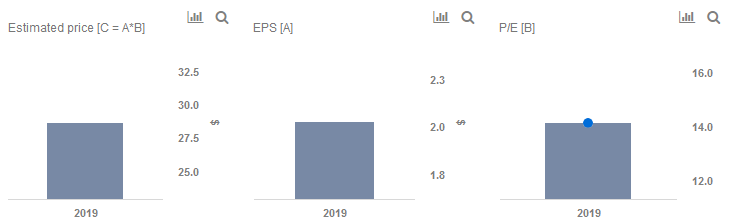

We have a price estimate of $29 per share for HP, which is around 20% higher than the current market price. Our interactive dashboard on HP’s Price Estimate outlines our forecasts and estimates for the company. You can modify any of the key drivers to visualize the impact of changes on its valuation, and see all of our technology company data here.

- HP Stock Outperformed Dell Amid AI-Fueled PC Recovery. Is It The Better Bet?

- Up 5% In A Fortnight, Can HP Inc. Stock Continue Outperforming The Market?

- What’s Next For HP Inc. Stock After Dropping 5% Last Week?

- Buy HP Inc. Stock For 25% Upside?

- Has HP Inc. Stock Peaked At $17?

- Here’s Why Hewlett-Packard’s Stock Could Touch $10

Highlights of the Q1 earnings release are below:

- Personal Systems: Revenue grew to $9.7 billion (+2% y-o-y), with notebook and desktop revenue growth outpacing the corresponding unit growth. CPU supply constraints over the first half of 2019 are expected to ease going into the second half of the year.

- Printing: Revenue declined to $5.1 billion (-1% y-o-y), with hardware units growing while a decline in Supplies revenues was a disappointment. The weakness in Supplies revenues was particularly pronounced in the EMEA region, where Supplies declined 9% y-o-y due to macro uncertainty and online sales eating into HP’s market share. Due to expected weakness through the year, the company’s management expects a $100 million headwind to Supplies revenue.

For 2019, the company’s management did not change its guidance for non-GAAP EPS of $2.12-2.22. HP’s management was forthcoming in acknowledging the challenges with its Supplies business, and also believes that the company is taking the corrects steps to address the market share pressure.

Do not agree with our forecast? Create your own price forecast for HP by changing the base inputs (blue dots) on our interactive dashboard.

Like our charts? Explore example interactive dashboards and create your own.