With The Stock Flat This Year, Will Q1 Results Drive Home Depot Stock Higher?

Note: Home Depot FY’23 ended on January 28, 2024.

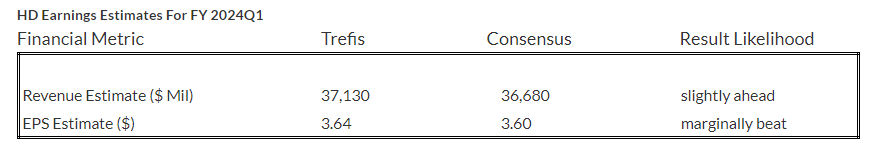

Home Depot (NYSE: HD) is scheduled to report its fiscal first-quarter results on Tuesday, May 14. We expect the company’s stock to likely trade higher with its revenues and earnings beating the market expectations marginally. The company’s stock has been flat since the beginning of this year due to falling lumber prices and softening demand. Consumer spending has shifted more to services instead of goods, along with pressure in certain big-ticket discretionary categories. Looking ahead, Home Depot expects comparable sales to decline approximately 1.0% in FY’24. The home improvement retailer expects to open approximately 12 new stores this year. A gross margin of approximately 33.9% is anticipated for 2024 and an operating margin of approximately 14.1%. Despite a weak home refurnishing market and commodity deflation challenges, HD generated $16.4 billion free cash flow for the full year 2023, a notable 42.9% year-over-year (y-o-y) growth. It is also worth mentioning that HD, with more than 2300 locations, generates more sales from professional contractors than its rival Lowe’s does, and that diversity is a big win for the company in the long term.

HD stock has shown strong gains of 30% from levels of $265 in early January 2021 to around $346 now, vs. an increase of about 40% for the S&P 500 over this roughly 3-year period. However, the increase in HD stock has been far from consistent. Returns for the stock were 56% in 2021, -24% in 2022, and 10% in 2023. In comparison, returns for the S&P 500 have been 27% in 2021, -19% in 2022, and 24% in 2023 – indicating that HD underperformed the S&P in 2022 and 2023.

In fact, consistently beating the S&P 500 – in good times and bad – has been difficult over recent years for individual stocks; for heavyweights in the Consumer Discretionary sector including AMZN, TSLA, and TM, and even for the megacap stars GOOG, MSFT, and AAPL. In contrast, the Trefis High Quality (HQ) Portfolio, with a collection of 30 stocks, has outperformed the S&P 500 each year over the same period. Why is that? As a group, HQ Portfolio stocks provided better returns with less risk versus the benchmark index; less of a roller-coaster ride as evident in HQ Portfolio performance metrics. Given the current uncertain macroeconomic environment with high oil prices and elevated interest rates, could HD face a similar situation as it did in 2022 and 2023 and underperform the S&P over the next 12 months – or will it see a strong jump?

Our forecast indicates that Home Depot’s valuation is $376 per share, which is almost 9% higher than the current market price. Look at our interactive dashboard analysis on Home Depot’s Earnings Preview: What To Expect in Q1? for more details.

- Why Home Depot Stock May Be Worth the Premium Over Lowe’s?

- Is Home Depot Stock A Buy After Q4 Earnings?

- What’s Next For Home Depot Stock After An Upbeat Q3?

- With The Stock Almost Flat This Year, Will Q2 Results Drive Home Depot’s Stock Higher?

- Down 8% This Year Will Home Depot Stock Rebound After Its Q3?

- Home Depot Stock To See Little Movement Past Q2

(1) Revenues expected to come in ahead of consensus estimates

Trefis estimates Home Depot’s Q1 2024 revenues to be around $37.1 Bil, slightly above the consensus estimate. In Q4, Home Depot’s revenues fell 3% y-o-y to $34.8 billion. The retailer’s comparable sales decreased 3.5% during the quarter. To break it down further, customer transactions were down 1.7% during the quarter to $372 million and the average ticket of customers was 1.3% lower to $88.87 for the quarter. In addition, sales per retail square foot dropped 3.6% y-o-y to $550.50. We now forecast Home Depot Revenues to be $142.1 billion for the full year 2024, down 7% y-o-y.

2) EPS to likely to beat consensus estimates slightly

Home Depot’s Q1 2024 earnings per share (EPS) is expected to be $3.64 per Trefis analysis, marginally higher than the consensus estimate. The company reported EPS of $2.82 in Q4 2023 compared to $3.30 a year ago.

(3) Stock price estimate higher than the current market price

Going by our Home Depot Valuation, with an EPS estimate of around $14.16 and a P/E multiple of 26.5x in fiscal 2024, this translates into a price of 376, which is around 9% higher than the current market price.

It is helpful to see how its peers stack up. HD Peers shows how Home Depot compares against peers on metrics that matter. You will find other useful comparisons for companies across industries at Peer Comparisons.

| Returns | May 2024 MTD [1] |

2024 YTD [1] |

2017-24 Total [2] |

| HD Return | 4% | 0% | 158% |

| S&P 500 Return | 4% | 9% | 133% |

| Trefis Reinforced Value Portfolio | 4% | 4% | 639% |

[1] Returns as of 5/12/2024

[2] Cumulative total returns since the end of 2016

Invest with Trefis Market-Beating Portfolios

See all Trefis Price Estimates