Why Is Home Depot Concentrating On Interconnected Retail?

The home improvement industry in the US is massive, with Home Depot (NYSE:HD), one of the biggest players in this space, garnering close to $100 billion in sales. Furthermore, the relatively decent operating margin for the company, 14.9% in the first nine months of 2017, may make this sector attractive to e-commerce companies, such as Amazon, that make-do with single-digit margins. In order to keep such companies at bay, Home Depot has undertaken a number of steps, and invested a considerable amount of money, to seamlessly integrate and cohere its different channels. Its investment has been mostly focused on upgrading its e-commerce offerings in terms of an improved distribution system, better supply chain management, and fully integrating its web and in-store inventory. It has also been named as one of the world’s most innovative companies in 2017 by Fast Company. This recognition comes in light of the fact that Home Depot generated an estimated $90 billion in revenues in 2016 without opening any new stores in the previous three years.

We have a $172 price estimate for Home Depot, which is below the current market price. The chart below has been made using our new, interactive platform.

HD’s Sizeable Investments Paying Off

- What’s Next For Home Depot Stock After An Upbeat Q3?

- With The Stock Almost Flat This Year, Will Q2 Results Drive Home Depot’s Stock Higher?

- With The Stock Flat This Year, Will Q1 Results Drive Home Depot Stock Higher?

- Down 8% This Year Will Home Depot Stock Rebound After Its Q3?

- Home Depot Stock To See Little Movement Past Q2

- Why Homebuilder Stocks Are Soaring This Year

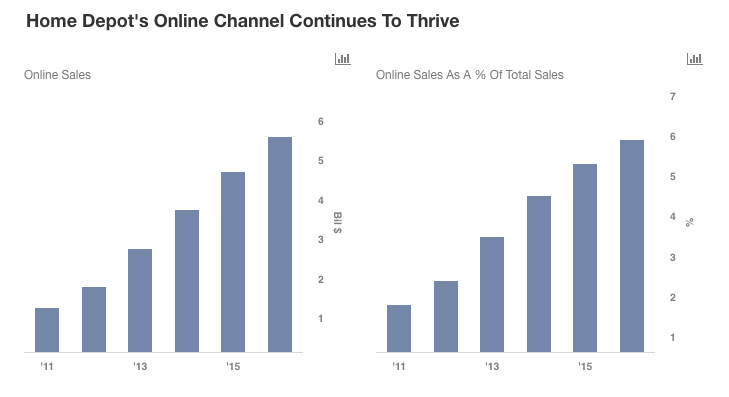

Home Depot’s integrated retail strategy, which seamlessly connects online and offline channels, is making its stores more efficient, leading to higher revenues and profitability. The company has also observed improved customer satisfaction scores as it continues to invest in this initiative. The company has stated that 60% of all its sales, whether in-store or online, are influenced by a digital visit. Moreover, the company’s online traffic is set to cross 1.8 billion visits this year. HD’s online revenues have increased by approximately $1 billion in each of the last four years, with the online penetration reaching 6.4%, nearly double that of its nearest traditional competitor. The online channel has also been one of the driving factors behind the impressive growth rates the company has seen, contributing to 20% of HD’s growth over the past few years.

Given the fact that customers today are more digitally engaged, and want more convenience and simplicity, the focus on the digital channel is imperative. More than 50% of Home Depot’s marketing spend is now digital, such as on Google search, Spotify, and Pandora, with the balance expended on TV, radio, and print. Moreover, the company has made significant investments to improve the online experience for its customers. For example, its new expedited online checkout process has cut down the average checkout time of customers by 20%. The online channel also gives customers access to over a million products, compared with about 35,000 items in a typical Home Depot store. The company also has a new feature in its app which helps customers to virtually try out products. For instance, if someone wants to buy a piece of furniture, but has no idea how it will look in their home, the app, using the phone’s camera and augmented reality, can place the item in the room, which can be seen on the phone. The app also allows customers to find products more easily in the stores.

Benefits Of An Integrated Channel Strategy

By focusing on an integrated channel strategy, Home Depot has been able to increase revenues per square foot, rather than generating revenues from new square footage. This has ensured that its existing store network is being effectively used to drive revenues. Home Depot has been specifically focused on products that are e-commerce unfriendly and where customers need advice from experienced associates in the store. By integrating its online and offline channels, the company has ensured that customers can come to stores for a demo or advice and then buy the product online. For orders placed online, the customer can pick up the product in store and seek advice at the time of pick up.

An interesting point to note is that 45% of the company’s online orders are picked up by customers at the store, indicating that the company’s integrated retail strategy which allows customers to shop online but pick up from a store is a driving factor of its e-commerce growth. An additional benefit to be derived from this strategy is that while picking up their orders the customers can see offers and other products available in the store. As a result, approximately 20% of the time, the customer ends up buying more than just the original product.

See complete analysis for Home Depot’s stock

Have more questions about Home Depot? See the links below.

- Improving Housing Trends Bode Well For Home Improvement Companies

- How Is Home Depot Keeping Its Stores Relevant Amid A Changing Retail Landscape?

- What Is Home Depot’s Growth Strategy For the Future?

- Hurricanes Boost Home Depot’s Sales But Pressure Margins

Notes: