Why A Groupon-Yelp Deal Is A Bad Idea

Groupon’s (NASDAQ:GRPN) stock nudged lower over trading yesterday following reports of the company potentially acquiring Yelp (NASDAQ:YELP). Trefis takes a detailed look at whether Groupon should acquire Yelp in an interactive dashboard, parts of which are highlighted below. You can see how key operating metrics for Groupon and Yelp stack up in the dashboard, and also make changes to various inputs to estimate how much a potential deal could cost Groupon. You can also see more Trefis technology company data here.

We think Groupon is unlikely to acquire Yelp because of the following reasons:

- Groupon’s revenues are double that for Yelp, primarily due to the higher average revenue per user (ARPU) that Groupon has. However, both companies have similar EBITDA levels. A potential deal would, hence, be akin to a merger of equals.

- Based on our estimates (detailed further below), we believe that Groupon will need to shell out $3.6 billion to acquire Yelp – a figure that is 2.2x the company’s current market cap of $1.6 billion.

- Considering Groupon’s last reported financials, the company had $596 million in cash and $208 million in debt. Groupon will need to raise most of the money externally to finance this deal – very likely through high-yield debt securities.

- Groupon will likely end up paying 4.4x the amount of anticipated synergies for the acquisition – which makes this a very risky proposition in case it cannot realize these synergies.

- Groupon is currently transforming its business model to convert itself from a deal-centric company to a marketplace. The transformation has taken much longer than was expected.

- Taking the added risk of integrating a similar-sized business at the cost of a highly levered balance sheet to at the same time as it reworks its organic growth plan hardly seems feasible.

Related analysis:

- Is Groupon’s Stock Attractive At $21?

- Does Groupon Have Upside Once Pandemic Subsides?

- Groupon’s Presence AI Acquisition Is A Good Deal If It Didn’t Cost More Than $350 Million

- Groupon’s Q1 Weakness Likely To Remain In Q2, But The Outlook For The Year Isn’t All Bad

- Groupon Q4 Earnings: Key Takeaways

- What To Watch For In Groupon’s Q4 Earnings

Comparing Key Metrics For Yelp vs. Groupon

Yelp’s Revenues are nearly half those of Groupon’s, but by way of users, Yelp leads.

- Yelp’s Revenues were $943 million in 2018, and we expect them to increase to $1.3 billion by 2020

- User base – 2018: 33 million, 2020E: 47.4 million

- ARPU – 2018: $28.6, 2020E: $26.5

- Groupon’s Revenues were $2.6 billion in 2018, and are expected to only grow marginally to $2.75 billion by 2020

- User base – 2018: 49 million, 2020E: 50.3 million

- ARPU – 2018: $53.8, 2020E: $54.8

At the EBITDA per User level, Yelp does marginally better.

- Yelp’s adjusted EBITDA is likely to swell from $183 million in 2018 to $310 million by 2020

- EBITDA/user – 2018: $5.5, 2020E: $6.5

- For Groupon, adjusted EBITDA is likely to witness modest growth from $235 million to $267 million between 2018 and 2020

- EBITDA/user – 2018: $4.8, 2020E: $5.3

Quantifying The Impact Of Gains For Yelp If It Is Acquired By Groupon

If Groupon acquires Yelp, we expect some synergies to materialize from:

- Yelp’s access to a potentially larger user base: With similar sized user bases, we think on an average half of Groupon’s users could be new to Yelp’s platform.

- ARPU improvements: Given Yelp’s expected ARPU is nearly half that of Groupon’s, an acquisition could help Yelp also increase its core business ARPU to Groupon’s expected ARPU of $54.8.

- EBITDA synergies: We suspect that due to the similar unit economics, not much will be achieved at the cost level. However, incremental users could help generate $75 million of synergies at the EBITDA level.

At a more granular level:

- User-level synergies: Yelp’s user base could increase from our current forecast of 47.4 million in 2020 to 73 million if it was acquired by Groupon

- Revenue synergies: Using 73 million in total users with Groupon’s expected ARPU for 2020 would imply revenues of $4 billion for Yelp that year – up from our base-case estimate of $1.3 billion

- EBITDA synergies: Considering the fact that Groupon’s expected EBITDA/user is similar to that of Yelp’s, we expect incremental synergies primarily from an expanded user base

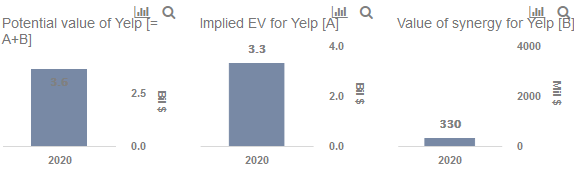

While Yelp’s fair value is closer to 10.5x EV/EBITDA, we estimate Groupon’s intrinsic value is captured at 7.5x. We apply an 11x multiple to the incremental synergy EBITDA to arrive at a maximum potential value of $824 million that can be unlocked by the merger.

- Our 11x EV/EBITDA multiple is a small premium to our estimate of Yelp’s intrinsic value multiple of 10.5x

- 11x is also something that we gave to the synergies if Facebook were to consider acquiring Yelp, where the EBITDA synergies potential was far greater

Since Groupon’s shareholders would be taking on the risk from such a deal, the balance of synergies is likely to tilt towards Groupon. We assume that Yelp’s shareholders are awarded 40% of the incremental gain in value. This works out to roughly $330 million. Taken together with Yelp’s valuation of $3.3 billion according to our estimate, Groupon would potentially pay $3.6 billion for Yelp

Conclusion

- Overall, Groupon would be paying 4.4x ( = acquisition value of $3.6 billion / value of synergies i.e. $824 million) for the synergies from the deal.

- Compared with our analysis of Google acquiring Nutanix (0.63x = $9.3 bil / $14.9 bil)) and Facebook acquiring Yelp (0.47x = 5.8 bil / 12.3 bil), the multiple of synergy paid is quite high and thus the consequent IRR will be fairly low.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs.

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.