Business Transformation Continues To Weigh On Groupon’s Q3 Results

Groupon’s (NASDAQ:GRPN) stock saw another 10% fall following the company’s Q3 earnings release on November 7. The sustained decline in volumes has tested investors’ patience for a turnaround, as the market is still waiting for management’s business transformation to show material results.

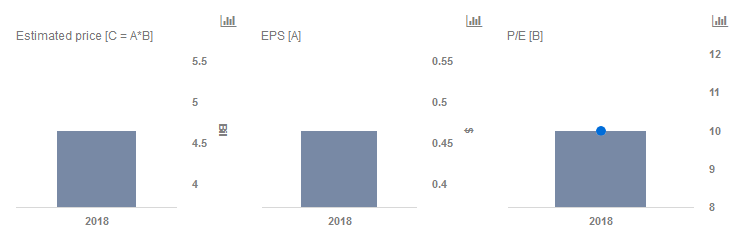

We are maintaining our price estimate of $5 per share for Groupon, which is now significantly ahead of the current market price. Our interactive dashboard on Groupon’s Price Estimate outlines our forecasts and estimates for the company. You can modify any of the key drivers to visualize the impact of changes on its valuation.

- Is Groupon’s Stock Attractive At $21?

- Does Groupon Have Upside Once Pandemic Subsides?

- Why A Groupon-Yelp Deal Is A Bad Idea

- Groupon’s Presence AI Acquisition Is A Good Deal If It Didn’t Cost More Than $350 Million

- Groupon’s Q1 Weakness Likely To Remain In Q2, But The Outlook For The Year Isn’t All Bad

- Groupon Q4 Earnings: Key Takeaways

While Groupon’s management’s strategy appears to be consistent, revenues have continued to decline.

- Global active customers saw a second straight quarter of declines, reaching 48.8 million at the end of September.

- Q3 revenues declined to $593 millon (-6.6% y-o-y), while YTD revenues declined to $1.8 billon (-6.8% y-o-y)

- Global TTM Gross Profit / Active Customer continued to increase and reached $27.51 vs $27.27 in Q2.

- SG&A (excluding IBM litigation) declined by $14 million (or 7% y-o-y)

Groupon stated that the results were negatively impacted by challenges in email and free traffic channels in North America. However, management seems pleased with the momentum in its business initiatives.

The company reiterated its vision to transition from its voucher business to a marketplace. To this end, Groupon has been investing in acquiring customers and merchants that fit in the high-frequency, low-margin paradigm of a marketplace. The company believes that the voucher business sees four to five transactions a year, versus four to five transactions a month for the marketplace business. However, this has also meant the loss of voucher-only customers. Given that Groupon is still best known as a discount coupon company, the transition has been creating some significant financial headwinds. Groupon can thus be seen in the context of a 10-year-old brand transforming its business model, which is certainly a challenge, but we believe Groupon will see some substantial upside if it’s able to pull it off.

Do not agree with our forecast? Create your own price forecast for the Groupon by changing the base inputs (blue dots) on our interactive dashboard.

Like our charts? Explore example interactive dashboards and create your own.