Another One Bites The Dust In The Apparel Retail Industry

True Religion became the latest casualty in the hard-hit retail industry, as it filed for bankruptcy, and intends to close at least 27 of its 140 stores in the US. The company has also requested permission to cancel 29 leases, and has a deal in place to reduce its debt load by $350 million, to $140 million. More than 300 retailers have filed for bankruptcy this year, according to data from BankruptcyData.com, a rise of 31% from last year. While most of these are small stores, there are some big names in the list, including Gymboree, Payless ShoeSource, Rue21, RadioShack, Wet Seal, and The Limited. For the latest bankruptcy, two main factors can be held accountable. These have been highlighted below.

Rise Of The Athleisure Trend

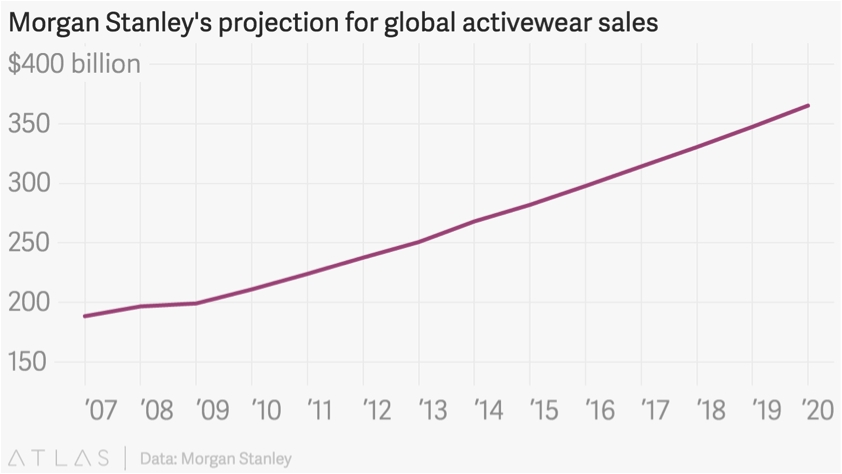

Activewear or the ‘Athleisure’ trend has become so popular, it has carved out a niche for itself in the clothing industry. It has been the lone star in a waning apparel industry, with an estimated market size of $45.9 billion in the US alone, according to research firm NPD Group. While the apparel sales, as a whole, increased 3% year-on-year in 2016, the rise in activewear sales was a whopping 11%. Morgan Stanley has predicted a growth to $83 billion by 2020, stealing the market share from non-athletic apparel. The graph below charts the rise of the trend globally, with sales climbing from $197 billion in 2007 to over $350 billion by 2020.

The main driver for the growth of this segment has been the millennial consumers who love to spend on fitness and experiences, why is why this segment has seen such phenomenal growth recently. As per a Harris poll, 72% of millennials prefer to spend their money on experiences, rather than material things. As athleisure clothing is typically worn for an experience, more often an outdoor experience, such as working out or hiking, they are more likely to spend their money on it. Acceptance of casual dressing at the work place has also been a factor spurring its growth.

However, for True Religion, the brand stayed true to its denim roots. As activewear has converted into more of an everyday wear, brands that did not move along with this trend of stretchy jeans have suffered. True Religion did not incorporate stretch fabrics, as was adopted by many others in the same field. Moreover, they stuck to their t-shirts with loud logos, another trend not favored by millennials.

Growth Of Online Shopping

Online retail sales in the US have grown at a rapid pace over the past several years, thanks to growing internet usage in the country. Internet penetration in the US has gone up from 44% in 2000 to 88.5% currently. Furthermore, facilitated by the convenience of constant access, 92% of teens today go online daily, including 24% who are online constantly, according to a study conducted by Pew Research Center.

The smartphone usage will only increase in the future, and this will likely result in a steady rise in online sales. This is evidenced by research which predicts online apparel sales in the US to increase its revenue from $63 billion in 2015 to $100 billion by 2019. This segment is considered as the most popular e-commerce category in the US, accounting for 17.2% of total e-retail sales in 2015. The US apparel industry is gradually shifting towards omni-channel retailing, which refers to providing a seamless shopping experience across stores and the online channel. This is becoming an inevitable move for US apparel retailers.

In the face of the realization that millennials don’t want to go to malls, many mall-based retailers have announced several rounds of store closures in recent times. Retail analyst Jan Rogers Kniffen told CNBC in May of last year that he predicts 400 of the 1,100 enclosed malls in the US will close in the coming years, and only 250 of the remaining will thrive. The US has 23.5 square feet of retail space per capita, in comparison to 16.4 square feet in Canada and 11.1 square feet in Australia — the next two countries with the highest retail space per capita, according to a Morningstar report from October. Given this statistic, he further noted that the footprint is poised to decline “pretty fast.”

True Religion has also been a victim of this move towards the online channel. Traditional retailers have faltered, while digital companies, such as Amazon, have soared. Like many other retailers, the company did not jump on this digital bandwagon, and instead relied on its core customer base to continue shopping there. While the company has, in the past, worked hard to cut down its costs, through store closures and layoffs, this move has not been enough. In a statement, CEO John Ermatinger stated the company’s intentions to invest in order to grow its digital footprint, as a part of its restructuring plans. A focus on the online channel may be the last resort for the company to stay afloat.

- What’s Next For Gap Stock?

- What’s Next For Gap’s Stock?

- Mind The Gap: Underwhelming Q2 Earnings Likely For The Apparel Retailer

- With The Stock Almost Flat This Year, Will Q1 Results Drive Gap’s Stock Higher?

- Gap Stock Almost Flat This Year, What’s Next?

- Does Gap Stock Have More Room To Run After Rising 67% This Year?

Have more questions about the retail industry? See the links below: